The past two years have arguably been the most economically challenging in China’s recent history. Despite this, investors who focus on the most important metric – earnings revisions – may find pockets of opportunity.

The past two years have arguably been the most economically challenging in China’s recent history. Despite this, investors who focus on the most important metric – earnings revisions – may find pockets of opportunity.

June 2022

Introduction

The Chinese economy has been the engine of global growth for the past 30 years. While there has always been a need for investors to be selective when it comes to Chinese equities, there has generally been a positive tailwind of strong growth and innovation to support the stock market.

However, since early 2020, the country has gone through two years of major stress, with multiple headwinds curtailing its growth. These range from the global Covid-19 pandemic to regulatory uncertainty in sectors such as property and tech to, more recently, external headwinds as developed market economies begin to slow.

While we believe that the Chinese economy has touched off the bottom, and that these difficult conditions may ease somewhat, stock investors must learn to cope with a less-than supportive macro environment. In our view, the solution is to focus on the one metric which matters: earnings revisions. Even against a challenging backdrop, there are enough companies with positive revisions which equity investors can use to construct a resilient portfolio, irrespective of whether the Chinese economy continues its recovery.

The Chinese economy has faced possibly its toughest two years since economic reform under Deng Xiaoping.

An Unprecedented Two Years

The Chinese economy has faced possibly its toughest two years since economic reform under Deng Xiaoping.

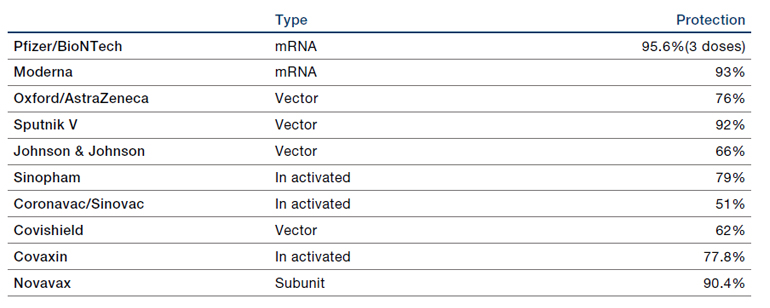

The first and most obvious stress has been the impact of Covid-19. While China’s zero-Covid policy was initially very successful, the Omicron variant has proven much more difficult to contain. Lockdowns have been reimposed across the country, and although Shanghai is slowly removing restrictions, the highly infectious nature of the Omicron variant means there can be no guarantee the worst has passed. Indeed, Shanghai reimposed some restrictions in the wake of 11 new infections discovered on 9 June.1 While some progress is being made, lagging vaccination/booster rates, particularly among the elderly, suggest lockdowns could persist well into the second half of the year. Additionally, there remain questions about the efficacy of China’s homegrown Covid vaccines which may have impeded efforts to return the country to normal (Figure 1).

Figure 1. Sinovac Efficacy Versus Other Covid Vaccines

Source: Mya Care; as of 6 May 2022.

Indeed, of all the deteriorating trends, rising unemployment is the one policymakers are unlikely to tolerate for long, suggesting more forceful intervention is not far away.

These lockdowns have had profound effects on the Chinese economy. GDP growth in the first quarter came in at 4.8%. While this surpassed analyst expectations of 4.4% growth, it is still below the 5.5% target the country has set for 2022. About a fifth of China’s GDP is driven by exports (Figure 2). In April, China’s export growth slowed to 3.9%, the weakest in almost two years, as the Covid-19 curbs halted factory production. Indeed, supply chains have come under particular stress, with many overseas companies unable to access Chinese-made products and components. Loading times at the port of Shanghai, the world’s busiest port, have increased significantly since the start of the year, and now hover around 70 hours, compared with between 20 to 30 hours pre-pandemic2. The scale of the slowdown can be seen from the number of riders of Chinese subway systems of the ten largest cities, with seven out of the ten well below February levels (Figure 3). This dampened economic outlook is also being reflected in the country’s unemployment numbers: the urban unemployment rate rose from around 4.9% in September 2021 to 6.1% in April3, the highest level since March 2020 (Figure 4). It was also the second-highest reading since 2018, when China first started publishing the data. Indeed, of all the deteriorating trends, rising unemployment is the one policymakers are unlikely to tolerate for long, suggesting more forceful intervention is not far away.

Figure 2. Share of Exports in China’s GDP

Problems loading this infographic? - Please click here

Source: National Bureau Statistics of China, Statista; 2012-2021.

Figure 3. Subway Riders – Top Ten Chinese Cities

Problems loading this infographic? - Please click here

Source: Man Group, City Metro Company websites and Weibo accounts; as of 21 May 2022. Indexed rebased to 100 as of 28 February 2022.

Figure 4. Urban Unemployment – Survey Data

Problems loading this infographic? - Please click here

Source: Bloomberg; as of April 2022.

Construction and real estate account for around 14% of the Chinese economy, giving this slowdown profound consequences for overall growth.

The third challenge for investors to grapple with has been regulatory uncertainty in various sectors – including property, education and the internet – which has weighed on Chinese equities, both onshore and offshore. In the wake of the collapse of Evergrande, the property sector has undergone a prolonged bout of stress, with curbs introduced to reduce speculative purchasing and developer leverage. As a consequence, home sales have been trending down consistently throughout late 2021 and 2022, and are down more than 40% year on year in April 2022 (Figure 5). Likewise, around 70% of Chinese offshore real estate bonds trade at yield-to-maturity of above 15% (Figure 6), reflecting the nervousness of many investors towards the Chinese property market. Construction and real estate account for around 14% of the Chinese economy, giving this slowdown profound consequences for overall growth.

Figure 5. Homes Sales Growth by Value

Problems loading this infographic? - Please click here

Source: CREIS, Morgan Stanley; as of 26 April 2022.

Figure 6. Percentage of Offshore Chinese Real Estate Bonds Trading Above 15% Yield-to-Maturity

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 10 May 2022.

The peak of infections may have passed, although the highly infectious nature of the omicron variant means that we are only cautiously optimistic in this regard.

Finding the Bottom?

However, we may now be closer to the nadir of the Chinese downturn, in our view.

Although the zero-Covid policy appears set to remain in place, the initial easing of conditions in Shanghai is encouraging in the near term, while gradually rising vaccination and booster rates (Figure 7) among the elderly suggest China will be better prepared for reopening in the second half of the year. Furthermore, a Chinese developed mRNA vaccine – similar to those used successfully in Western nations – is currently under trial in the United Arab Emirates and may well be ready for use later this year4. While 10 cities are in full lockdown, the peak of infections may have passed, although the highly infectious nature of the omicron variant means that we are only cautiously optimistic in this regard (Figure 8).

Figure 7. Vaccination and Booster Rates are Improving Among the Elderly in China

Source: Morgan Stanley Research; as of 1 June 2022.

Source: Morgan Stanley Research; as of 1 June 2022.

Problems loading this infographic? - Please click here

Figure 8. The Peak of New Covid-19 Cases in China Appears to Have Passed

Problems loading this infographic? - Please click here

Source: Our World in Data; as of 8 June 2022.

Equally important are the numerous signs that policymakers are embracing the significance of the current slowdown. While the policy response to date remains modest, and near-term economic trends are likely to remain weak, commentary from regulators has become more supportive and policy settings have turned expansionary at the margin. Indeed, of all the deteriorating trends, rising unemployment is the one policymakers are unlikely to tolerate for long. In one sense, bad news for employment is good news generally, with each rise in joblessness making it more likely policymakers will intervene more forcefully to stimulate growth. On the regulation front, the Politburo in April pledged to “support the healthy development of the platform economy”.5 In our view, this signals renewed support for innovative technology firms. Likewise, the property contagion has been largely contained, and although the Politburo have stressed that “housing is for living, not for speculation”, the meeting of 29 April also stressed that local governments are to “support demand for both basic housing and housing upgrades.”

Finally, we believe that monetary policy may be loosened from hereon, acting as another tailwind. To prevent a dangerous build-up in borrowing, policymakers vastly restricted credit creation, with the Chinese credit impulse falling some from around 9% in mid-2020 to around -9% by late 2021 (Figure 9). However, the recent Politburo meeting indicated that policymakers are committed to its growth target of 5.5%. The effects of the renewed commitment to growth have already begun to reverse the attempt at deleveraging, in our view, and credit creation has already started to tick up,.

Figure 9. China Credit Impulse

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 7 June 2022.

Irrespective of the overall direction of the Chinese economy, we believe investors should focus on the one metric that matters: earning revisions. Over the long term, we believe that the direction of earnings revisions is the most important driver of future stock prices.

There is no doubt that the last two years have been profoundly challenging for the Chinese economy. However, we believe we may have touched off the bottom and could now be entering period of relatively stability: lockdowns will hopefully begin to ease, credit conditions are improving and the regulatory uncertainty may be subsiding. While it may be difficult to imagine 5.5% economic growth over the next year, it is more than likely that renewed policy efforts to promote growth will have a beneficial effect on the Chinese economy, and on Chinese equities as a consequence.

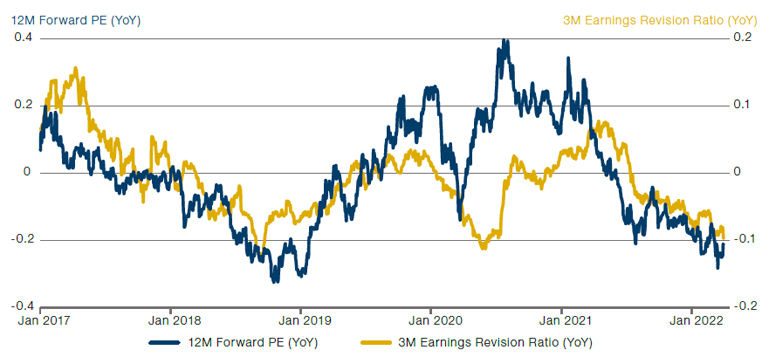

The Metric That Matters: Positive Earnings Revisions

Irrespective of the overall direction of the Chinese economy, we believe investors should focus on the one metric that matters: earning revisions. Over the long term, we believe that the direction of earnings revisions is the most important driver of future stock prices. While the market may fluctuate in the short term, if a company grows its earnings, its price will eventually rise to match – and vice versa. Earnings momentum in China is currently negative (Figure 10) and the country has had the worst relative earnings revisions of any major region (Figure 11). The relative position is moving in China’s favour: China is reaching the end of its tightening phase, whereas the rest of the world is just beginning to apply the monetary policy brakes. If we are indeed reaching a period of relative stability in China, loosening policy may begin to reverse earnings revisions momentum, benefitting Chinese equities overall and in relative terms.

Figure 10. MSCI China – 3-Month Earnings Revisions Factor Versus 12-Month Forward Price to Earnings Ratio

Source: Man GLG, Bloomberg, as of 31 March 2022.

Figure 11. 12-Month Forward, 3-Month Moving Average of Earnings Revision Breadth – US, Europe, Japan, China and Emerging Markets

Problems loading this infographic? - Please click here

Source: IBES, FactSet, Morgan Stanley Research; as of 10 May 2022. Data as of April 2022.

Note: 12-month forward 3-month moving average Earnings Revision Breadth = Trailing 3 months moving average of (number of 12-month forward up estimates less number of 12-month forward own estimates)/total number of 12-month forward estimates.

However, even if earnings revisions remain negative at index level, we still see a great deal of opportunity in Chinese equities.

However, even if earnings revisions remain negative at index level, we still see a great deal of opportunity in Chinese equities.

This is amply demonstrated by earnings dynamics in the Chinese financial sector. Figure 12 shows earnings revisions versus the company’s share price over four years for two listed Chinese banks. Chinese banks have not had the easiest few years, as turbulence in the property sector and the wider disruption of the economy have threatened the profitability of existing loans. However, it is clear that some banks simply have a superior operating model compared to their competitors. Within the same timeframe and confronted with the same challenges, Bank A has consistently outperformed Bank B, with only 2% of positive earnings revisions driving 15% share price appreciation. Indeed, the relative performance demonstrates the magnifying effect of revisions on stock prices. Although the relative differential in revisions was 14%, the relative performance gap was 17%.

Figure 12. Earnings Revisions Drive Share Prices in the Financial Sector…

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 26 May 2022. The organisations mentioned have been anonymized and are for illustrative purposes only and is not intended to be construed as a recommendation.

We observe similar performance in the utilities sector (Figure 13). Again, we see that a small amount of positive revisions can create a much larger wave of positive sentiment, with Utility A up 16% with only a 5% increase in revisions. The same effect is evidence by company B down 35% after a 22% fall in revisions. A key point to note is that this process can take time, and is relatively, though not entirely independent of the macro environment. The utilities in Figure 13 had diametrically opposing share price movements, during a very turbulent six months for the Chinese economy – which in our view highlights the opportunities for discretionary managers within the region.

Figure 13. …As Well as in the Utilities Sector

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 26 May 2022. The organisations mentioned have been anonymized and are for illustrative purposes only and is not intended to be construed as a recommendation.

Drivers of Earnings Revisions

Aside from company-specific factors, revisions are also likely to be generated by policy dynamics within China. The Fourteenth Five-Year Plan indicates a continued focus on technology, with sectors such as artificial intelligence, cloud computing and semiconductor manufacturing singled out for public support.6 To ameliorate fragility exposed by the pandemic, supply chain management will likewise be prioritised, with firms that are able to reduce vulnerability to geopolitical shocks set to receive steady support.

On the responsible investment front, it is notable that the Five-Year Plan makes a series of firm environmental commitments, including achieving an emissions peak in 2030 and net zero by 2060. In addition, the plan aims for non-fossil fuels to account for 20% of energy use by 2025, compared with 15% at the end of 2019. Nuclear power capacity will be expanded by about 40% to reach 70 gigawatts over the next five years, although the government remains frank about its continued to commitment to burning coal. As such, we expect policy support to be directed towards electric vehicles and renewables, with domestic players along all parts of the supply chain likely to be rewarded.

Although the construction sector remains deeply troubled, we note that the plan implied tacit support for housebuilding. The target urbanisation rate is set for 65% in 2025 and 75% in 2035, which will require significant housebuilding along with a shift in occupancy. As such, construction and its related trades may be set for steady growth in the coming years, and better earnings trends once the current deleveraging process is completed. That said, we are mindful that Chinese authorities have clearly moved to discourage speculative investment activity in the housing market, suggesting the sector is unlikely to be the growth driver it has been in the past.

Irrespective of the wider economic backdrop, companies with positive earnings revisions will be the ones that outperform.

In all of these areas – whether or not the market continues to trend down, we are comforted by the knowledge that if a company grows its earnings, positive sentiment and price rises will eventually follow.

Conclusion

The past two years have arguably been the most economically challenging in China’s recent history. However, there are signs that stability is slowly returning.

For discretionary equity investors, we believe the focus should be on the metrics that matter; in particular, earnings revisions. Irrespective of the wider economic backdrop, companies with positive earnings revisions will be the ones that outperform.

1. www.ft.com/content/ebdbc1cf-5cfd-42ac-a4fa-1e928eb702ff

2. Source: Vessels Venture.

3. Source: National Bureau of Statistics; as of 16 May.

4. www.reuters.com/business/healthcare-pharmaceuticals/chinese-omicron-specific-mrna-covid-vaccine-candidate-be-trialed-uae-2022-04-30/

5. www.bloomberg.com/news/articles/2022-04-29/china-s-politburo-pledges-efforts-to-meet-economic-targets

6. www.hkstrategies.com/en/chinas-14th-five-year-plan-2021-2025-report/

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.