As defined benefit pension schemes move towards their end game, a multitude of conundrums – such as liquidity and diversification – may arise along the way. To these, we present trend-following as being uniquely poised to offer a solution.

As defined benefit pension schemes move towards their end game, a multitude of conundrums – such as liquidity and diversification – may arise along the way. To these, we present trend-following as being uniquely poised to offer a solution.

April 2023

This article was initially published in Professional Pensions on 18 April 2023.

Introduction

It can be reasoned that the recent collapse of Silicon Valley Bank and the crisis in the UK Liability Driven Investment (‘LDI’) market were both victims of market fragility. Much of the last year has been defined by an unprecedented campaign of monetary tightening which has resulted in simultaneous selloffs across all major asset classes.

Trend-following can help institutional investors navigate uncertain markets.

Navigating such market conditions is essential for institutional investors who must generate a return to keep up with their liabilities. In particular, many defined benefit pension schemes (‘DB schemes’) are now on the edge of an end-game, be that a position of self-sufficiency, where the assets are low risk and expected to cover all future liabilities, or buyout, where the assets are at such a level that the DB scheme can free itself of its liabilities altogether. The path to this end game, however, is fraught with challenges. We believe trend-following can be instrumental in overcoming these challenges due to the following characteristics:

- Diversification – Trend-following’s long observed ‘crisis alpha’ credentials can help protect investors, such as when the simultaneous selloff in bonds and equities marked the breakdown of traditional diversification in 2022;

- Liquidity – A shortage of assets with daily liquidity can cause many headaches for institutions. Trend-following strategies trade the largest markets, facilitating liquidity for investors when it is needed the most;

- Cash efficiency – Recent crises saw cash requirements rise for many derivative based investment strategies, such as Liability Driven Investing (‘LDI’). Trend-following requires very little cash to fund an allocation;

- Portfolio fit – Institutions still need to generate an investment return. An allocation to trend-following can complement traditional risk assets by providing higher expected returns with a more attractive drawdown profile.

Diversification

Neville et al. (2021) highlight how inflation has historically had a detrimental effect on global equities and bonds. Indeed, 2022’s returns of -15.4% and -11.3%, respectively, are consistent with that. Figures 1 and 2 put these annual returns into a long-term historic context for the US. Equities were bad, clearly, but 2022’s bond returns were worse than anything we have seen in over 200 years.

Compounding the problem was that the low (or negative) correlation between the two, relied upon for diversification by almost all institutional investors, failed. Although this has normalised during the current banking crisis when bonds re-assumed their mantle as a safe haven it is, as ever, susceptible to reversion.

Figure 1. Bond Historical Performance

Problems loading this infographic? - Please click here

Figure 2. Equity Historical Performance

Problems loading this infographic? - Please click here

Bonds represented by 10-yr US Bonds Total Return Index. Equities represented by S&P500 Total Return index.

Source: Man Group, Bloomberg; as of 31 December 2022.

Trend-following, on the other hand, had a positive year in 2022. This was consistent with Man Group’s research in terms of both performance in inflationary periods (Neville et al., 2021) and crisis periods for bonds and equities in general (Hamill et al., 2016).

Trend-following performed as traditional assets floundered in 2022.

Trend-following strategies, as represented by the Barclay BTOP 50 Index (the ‘BTOP 50’) of 20 trend-following managers in Figure 3, were able to benefit from classic inflationary price patterns, namely downward trends in bonds and upward trends in commodities. Further, since the inception of the BTOP 50 in 1986, its annualised return is positive and in line with equity returns, meaning this downside protection doesn’t come at the cost of giving up performance in the good times.

Figure 3. Returns of World Stocks, World Bonds and Trend-Following Strategies in 2022 and Long Term

Problems loading this infographic? - Please click here

Source: Man Group, Bloomberg; as of 31 December 2022.

Liquidity

The cameo appearance of Trussonomics and the ensuing crisis in the Liability Driven Investment (‘LDI’) market during September 2022, highlighted that liquidity is king in times of market stress when hit with collateral calls. To contextualise this, Figure 4 shows that DB schemes have been gradually rotating out of public equities and into private markets over the past 15 years. The altered liquidity profile of the remaining portfolio has inevitably left managers with diminished liquidity to call upon in a time of crisis.

Figure 4. Penchant for Privates — Weighted Average Allocation to Public and Private Equities

Problems loading this infographic? - Please click here

Source: Pension Protection Plan, https://www.ppf.co.uk/sites/default/files/2022-11/PPF_PurpleBook_2022.pdf#page=23; as at 1 December 2022.

Trend-following can offer daily liquidity.

In contrast, trend-following, through trading large liquid markets, can offer investors daily liquidity. As well as meeting any short-term funding needs, this profile facilitates opportunistic trading, shifting from growth into bonds when the chance presents itself.

As an example, Figure 5 shows the path of returns for both trend-following, using the BTOP 50, and UK gilts throughout September 2022, at the height of the Trussonomics crisis. We see trend-following gained as gilts sold off, protecting the portfolio, while providing a source of much needed liquidity. Using this liquidity, there is potential to secure a funding level boost by using the trend-following profits to buy (the now cheaper) bonds which are needed to match liabilities. This takes us another step closer to the end game.

Figure 5. Market Stress — The LDI Crisis in September 2022 Saw UK Gilts Slide

Problems loading this infographic? - Please click here

Source: Man Group, Bloomberg; as at 31 December 2022.

Trend-following is highly cash efficient, freeing up resources to be used elsewhere in the portfolio.

Cash Usage

The de-leveraging that followed the LDI crisis resulted in a material increase in the level of cash required to fund the liability matching bucket, which is typically made up of high-quality government bonds. This reduction in cash efficiency leaves investors with a conundrum: do you settle for a lower allocation to the growth bucket, and therefore a lower expected return, or do you apply leverage to this return seeking segment of the portfolio, boosting return but also risk?

There is another way. Trend-following can potentially address this quandary, given that the strategy is inherently cash efficient. Futures require very little capital – perhaps 20% or less – to fund a trend-following trade. This frees up cash to be allocated to either the liability matching or growth bucket, depending on the preference of the investor, while maintaining risk and return targets.

Portfolio Fit

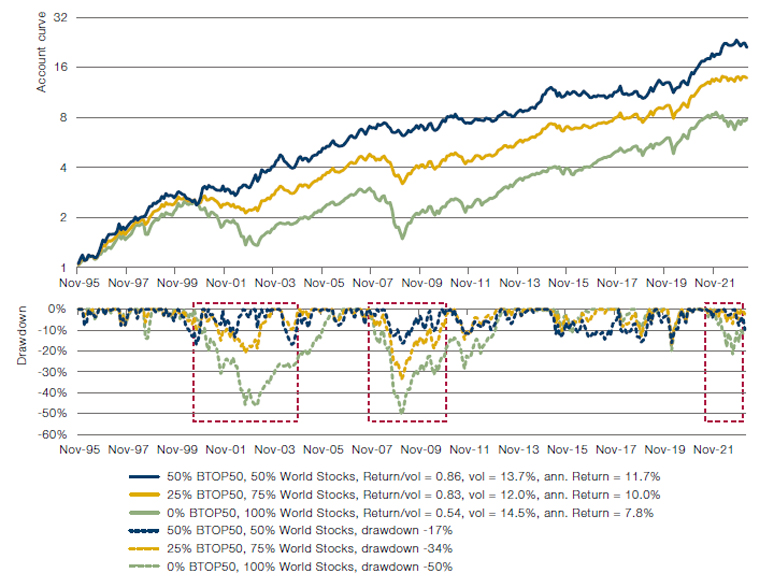

As the end game draws nearer for DB schemes, the allocation to the liability-matching bucket naturally increases, although the question on how best to manage the return-seeking assets remains. A potential answer to this can be drawn from the results presented in Figure 6. Since trend-following offers positive expected returns and a low correlation to traditional assets in the long-term, plus a demonstrated ability to perform in crisis, an allocation can stabilise an institutional growth portfolio, with increased returns for the same level of risk, while also reducing drawdowns.

In Figure 6, the trend-following strategy is represented by a three-times exposed BTOP 50 investment (afforded by the inherent cash efficiency of trend following, as discussed earlier in the note). The remainder of the return seeking portfolio is proxied by the MSCI World Net Total Return Index, hedged to USD. The benefits that can be inferred from this analysis are two-fold; firstly, as the relative allocation to the trend-following strategy is increased, the realised return increases in tandem. Secondly, it is observable that, since 1995, an increased allocation to trend-following, relative to stocks, translates into a more attractive drawdown profile in times of market stress, as highlighted.

Figure 6. Long-Term Returns for Differing Combinations of Growth Assets (MSCI World) With Trend-Following (BTOP 50)

Source: Man Group. Schematic illustration.

The higher level of expected return afforded by trend-following in the growth bucket provides scope to reach the end game of self-sufficiency or buy-out more quickly. The downside protection offered in times of market stress not only protects capital but may also offer attractive opportunities to lock in additional funding gains – again – moving us closer to our end game.

Conclusion

As DB schemes move towards their end game, a multitude of conundrums may arise along the way. How is liquidity sourced in a stressed market? Can drawdowns be mitigated and turned into an advantage? And how can returns from a diminishing growth portfolio be maximised?

To all of these we present trend-following as being uniquely poised to offer a solution, by providing liquidity and diversification when it’s needed most as well as delivering a long-term positive expected return that is highly cash efficient. We conclude that an allocation to trend following can help DB schemes trend towards the end game.

Bibliography

Hamill, C., S. Rattray, and O. Van Hemert, “Trend Following: Equity and Bond Crisis Alpha” (August 30, 2016). Available at: https://www.man.com/maninstitute/beststrategies-for-inflationary-times

Neville, H., T. Draaisma, B. Funnell, C. Harvey, and O. Van Hemert, “The Best Strategies For Inflationary Times”, August 2021. Available at: https://www.man.com/maninstitute/trend-following-equity-and-bond-crisis-alpha

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.