Whether ESG factors are truly ‘alpha’ factors equivalent to their Value, Momentum, Quality and Low Volatility counterparts remains a contentious issue. Still, the performance of ESG factors in 2019 delivered returns worthy of attention.

Whether ESG factors are truly ‘alpha’ factors equivalent to their Value, Momentum, Quality and Low Volatility counterparts remains a contentious issue. Still, the performance of ESG factors in 2019 delivered returns worthy of attention.

February 2020

Introduction

Whether environmental, social and governance (‘ESG’) factors are truly ‘alpha’ factors equivalent to their Value, Momentum, Quality and Low Volatility counterparts remains a contentious issue within the investment community. Despite the ongoing debate, the performance of ESG factors chugged along in 2019 and delivered returns worthy of attention.

ESG sceptics point to the lack of history, messy raw data and inconsistency across vendors. As the narrative goes, both Value and Momentum are easily explained by investors’ behaviorial biases, and thus worthy to be classified as anomalies or alpha factors. Meanwhile, the sceptics would say that the empirical evidence for ESG actors is too limited. And, of course, there is no neat academic finance theory paper to point to.

Meanwhile, ESG champions point to an evolving world where responsibility and sustainabilty take front and centre. They (and we) believe that consumers and investors will increasingly want to be associated with companies that consider their environmental impact, treat their employees well and have in place strong governance structures. Champions believe this will, in turn, lead to meaningful impact on the company’s businesses through increased revenues/profits and better stock prices.

While we at Man Group are strong believers in the latter thesis, we do not expect this debate to be resolved anytime soon. That said, regardless of your point of view, the recent performance of ESG factors, both from a breadth and depth perspective, has been encouraging. In 2019, ESG factors have certainly delivered beyond many investor’s expectations.

ESG Factor Performance in 2019

In 2019, the MSCI Standard indices underperformed their MSCI ESG Leaders counterpart (Figure 1). This was consistent across multiple regions. The MSCI ESG Leaders indices are constructed using MSCI’s proprietary stock-level ESG factors and have sector weights that target the underlying parent index and hence provides a relatively sector-neutral view of ESG.

In the energy sector for example, both the MSCI World and MSCI World ESG Leaders indices are approximately 4-5% weight in the index. As such, the outperformance of ESG cannot simply be attributed to the fact that the energy sector underperformed or that it was simply a temporary low-carbon effect that will reverse when oil prices bounce.

Problems loading this infographic? - Please click here

Source: MSCI; as of 31 December 2019. The ESG model spreads shown are provided for illustrative purposes only and do not represent any product of Man Numeric.

A more nuanced view of the performance of ESG factors is through the lens of Man Numeric’s proprietary ESG model, which is based on 15 fundamental pillars. We use multiple data sources to construct our ESG model. In addition, we ensure that the ESG model is sector neutral and is neutral to common factors (e.g. Size, Value, Momentum, Beta, etc). As we described in ESG Data: Building A Solid Foundation, non-neutral common factor exposures are typically observed in raw ESG data. By cleansing the data of these factor exposures, we ensure that the ESG factor investor is not simply buying ‘some other factor’, and the performance observed is not simply a proxy for Value, Size or another common factor.

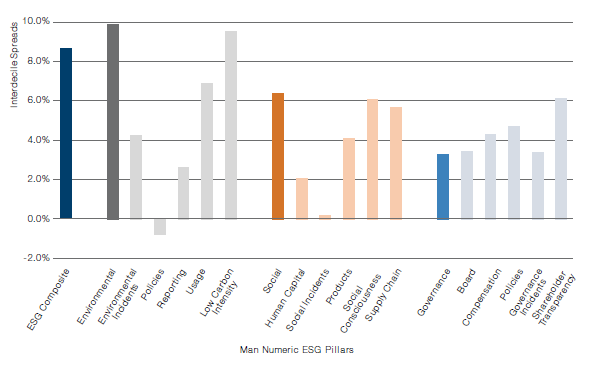

Figure 2 shows the positive returns to a series of ESG-related factors, compiled using Man Numeric’s proprietary alpha signals across our global investment universe. Early sceptics of ESG factors wondered if Governance (long utilised by quants in their investment processes) may be the lone productive ESG factor. Contrary to the case, the 2019 ESG factor returns paint a different picture. Environmental factors performed the best, with low carbon intensity companies being rewarded strongly. In the Social dimension, investors rewarded social consciousness amongst others, while shareholder transparency was the best-performing Governance factor. All in all, 14 out of the 15 Man Numeric ESG pillars were positive for the year, which we think is a remarkable statistic in itself and is reflective of ESG more generally performing positively over the period.

Figure 2. ESG Model Spreads. Global Universe 2019

Source: Man Numeric; as of 31 December 2019. The ESG model spreads shown are provided for illustrative purposes only and do not represent any product of Man Numeric.

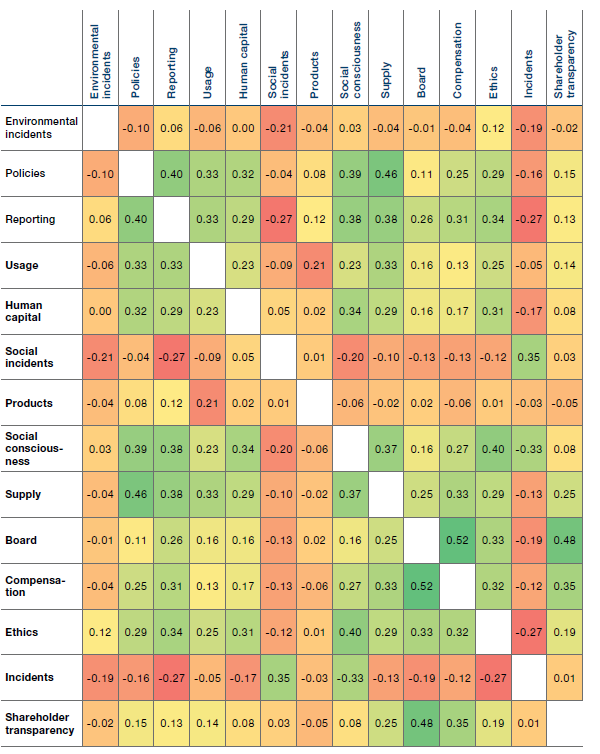

Finally, it is also important to note that each of Man Numeric’s 15 ESG pillars are independent definitions of different ESG concepts, each with low correlation relative to one another (Figure 3). Clearly, Man Numeric’s ESG pillars are not simply slight variations of the same concepts, but orthogonal factors all expressing independent views of the strength of ‘ESG’ of a company. Statistically, the low score correlation adds to the unusualness of their concurrent outperformance.

Figure 3. ESG Component Score Correlation. Global Universe 2019

The ESG model spreads shown are provided for illustrative purposes only and do not represent any product of Man Numeric.

Conclusion

There are a number of possible explanations for the outperformance of ESG factors in 2019. ESG champions point to alpha, while ESG sceptics may argue otherwise. Yet another possible explanation may be that some of the outperformance is simply related to flows into ESG strategies.

At Man Group, we continue to monitor the performance of our ESG factors and strategies. In addition, we have started to monitor the valuation of ESG factors for potential crowding. That said, we believe it is still in the early innings of flows into ESG strategies.

To conclude, the debate about ESG factors will not be resolved by one year’s worth of data. Nevertheless, the performance of our factors in 2019 provides a useful data point for ESG champions to use in discussion with sceptics.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.