Natural resource equities or futures?

Natural resource equities or futures?

March 2024

Introduction

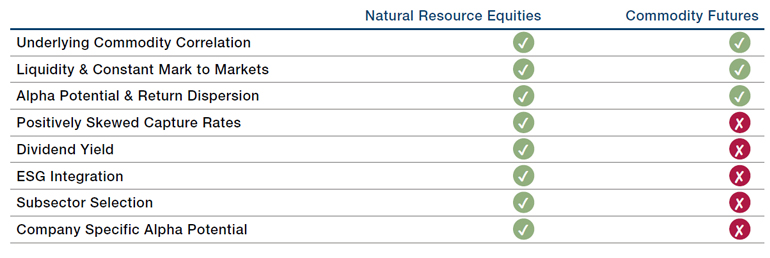

In Part I of this series, we outlined the potential benefits of investing in natural resources, particularly given the unique combination of cyclical and secular forces investors may face. It is important to acknowledge, however, that there is more than one way to invest in natural resources, namely equities and futures. All will offer the basic commodity correlation seen in the broader asset class, but here we outline what we believe are the differentiating features of investing in natural resource equities and commodity futures, which we summarise in Table 1 below.

Table 1. Features of natural resource equities and commodity futures

Source: Man Group.

We view natural resource equities as a hybrid security. While the structure is an equity, the correlation is more closely tied to the underlying commodity than to broader equity markets.

1. Positively skewed capture rates

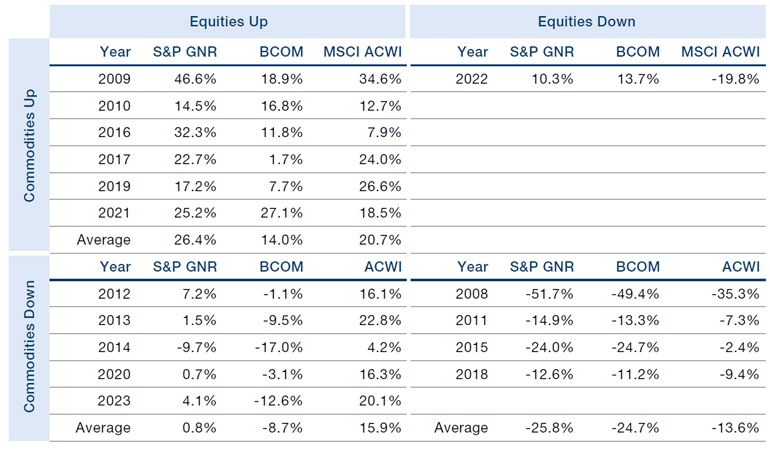

We view natural resource equities as a hybrid security. While the structure is an equity, the correlation is more closely tied to the underlying commodity than to broader equity markets. The investment case for equities offers better upside and downside capture rates, as shown in Table 2 where we highlight the performance in various market conditions over the past 15 years of the three asset classes: natural resource equities (as measured by the S&P Global Natural Resources Index); commodity futures (as measured by the Bloomberg Commodity Index); and broader equity markets (as measured by MSCI All Country World Index). Note that natural resource equities perform relatively well in three of the four markets scenarios. Further, the capture rates were particularly strong during periods of higher commodity prices due to the equity premium and the ability to generate additional alpha in equities.

Table 2. Natural resource equities perform relatively well in three of the four markets scenarios

Source: Bloomberg, as at 31 December 2023. Data compares the performance by year of the S&P Global Natural Resources equity index, the Bloomberg Commodity Index and broad market equities as represented by the MSCI All Country World Index.

2. Potential to generate positive dividend yield

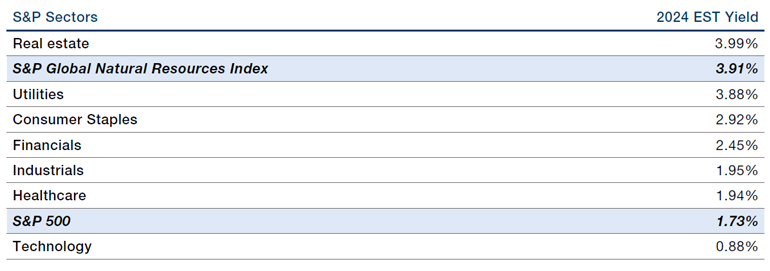

Facing an uncertain long-term market outlook and governance pressures, natural resource companies are increasingly focusing on rewarding shareholders with dividends and stock buybacks.

Over the last several years, we have seen a general shift away from management seeking production growth at all costs to a more shareholder-centric approach. Facing an uncertain long-term market outlook and governance pressures, natural resource companies are increasingly focusing on rewarding shareholders with dividends and stock buybacks. Indeed, several companies have adopted variable dividend models whereby a percentage of free cash flow is distributed among shareholders. As shown in the table below, natural resource equities are among the highest dividend yielding sectors in the S&P 500 Index with the potential to grow the underlying notional dividend in future years.

This positive dividend yield is also an important consideration when comparing natural resource equities to commodity futures. A futures contract can capture a positive roll yield in some markets, but the same roll yield can be negative if the futures curve is in contango. Compare this to an equity’s dividend, which cannot go negative.

Table 3. Natural resource equities are among the highest dividend yielding sectors in the S&P 500

Source: Bloomberg, as at 6 November 2023

Through the commodity cycle, value accretes to different parts of the supply chain and equity investors can delve deeper into the value chain to extract potential excess returns.

3. Opportunity to generate alpha from equity subsector and stock selection

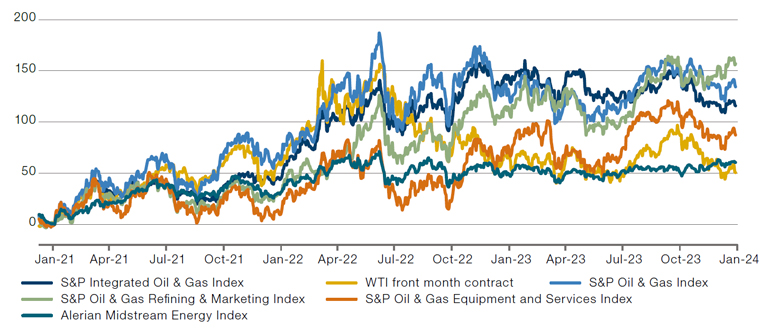

Through the commodity cycle, value accretes to different parts of the supply chain and equity investors can delve deeper into the value chain to extract potential excess returns. Using the energy market as an example, from the start of 2021 until Q3 2023, West Texas Intermediate (WTI) front-month futures rallied more than 100% while certain subsectors like Exploration and Production led with a rally of approximately 150% (at times near 200%), materially outperforming underlying crude oil futures – all without derivatives or leverage being utilised from the portfolio level. If we look at another timeframe, for example mid-2022, the sub-sector leadership changed again as oilfield service companies outperformed all other energy subsectors1. Timing and identifying specific fundamental trends within a broader commodity cycle clearly matter.

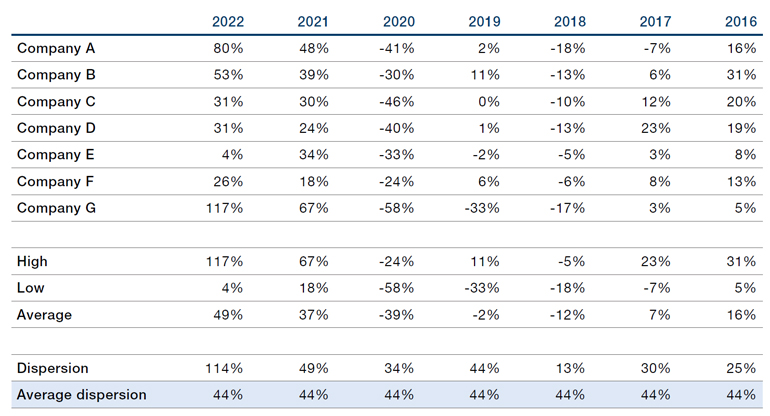

In addition to commodity and subsector selection, an active investor can potentially further generate alpha from stock selection. This idiosyncratic source of returns can range from a variety of financial and/or operating torque that are unique to the specific company. As shown in Figure 1, using a selection of mega-cap Integrated Oil companies as a subset example, the average dispersion between the top performer and the bottom performer per annum is approximately 45%.

Figure 1. Energy subsector returns since 2021

Sources: Bloomberg, as of 31 December 2023.

Table 4. Dispersion among integrated oil and gas companies

Source: Bloomberg, as of 30 December 2022.

4. An active equity investor can be a positive agent for change

An active equity investor can further engage with management teams to ensure a continued evolution of best ESG practices and can thereby be a positive agent for change.

Viewing commodities from an environmental, social and governance (ESG) perspective can be complicated. Aside from adopting an exclusion policy and thus turning a blind eye to real world implications, it can be challenging to effect change or track progress from the commodities angle. A barrel of oil or coil of copper is difficult to track and measure on an ESG basis once it has entered the consumer market while it is much easier and efficient to measure a specific company’s practices and ESG policy adherence. Furthermore, an active equity investor can further engage with management teams to ensure a continued evolution of best ESG practices and can thereby be a positive agent for change.

Using ESG disclosure as a preliminary view on improvement, the transparency and accountability of the companies have continued to show progress. In 2022, Ernst and Young published an update on oil and gas producers (50 of the largest publicly traded exploration and production companies) which highlighted a continued increase in sustainability and ESG reporting. The industry bellwether integrated oil companies and large independents led the way on disclosure, as well as adopting greenhouse gas (GHG) reduction goals. While the efforts are early stage, and will be marked by fits and starts, it is encouraging to see companies adapting and evolving with the engagement of active investors.

Conclusion

Our goal in this paper was to outline why we believe natural resource equities present a more compelling opportunity than futures as a component of a well-diversified portfolio. In summary, we find that equities offer superior potential upside and downside capture rates, potential benefits given the increasingly shareholder-centric approach of natural resource companies, while also giving investors the opportunity to help effect positive environmental change.

1. The following indices serve as proxies for specific subsectors: Integrated oil - S&P Integrated Oil & Gas Index, WTI oil - WTI front month contract; Exploration and production - S&P Oil & Gas Index; Refiner - S&P Oil & Gas Refining & Marketing Index; Oilfield services - S&P Oil & Gas Equipment and Services Index; Midstream - Alerian Midstream Energy Index.

Disclosures

One should carefully consider the risks associated with investing, whether the strategy suits your investment requirements and whether you have sufficient resources to bear any losses that may result from an investment.

Commodity Risk: The value of commodities can be volatile and may carry additional risk. Commodity prices can also be influenced by the prevailing political climate and government stability in commodity producing nations.

Market Risk: Commodity and natural resource investments are subject to normal market fluctuations and the risks associated with investing in domestic and international securities markets; therefore, the value of your investment and the income from it may rise as well as fall and you may not get back the amount originally invested.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.