History

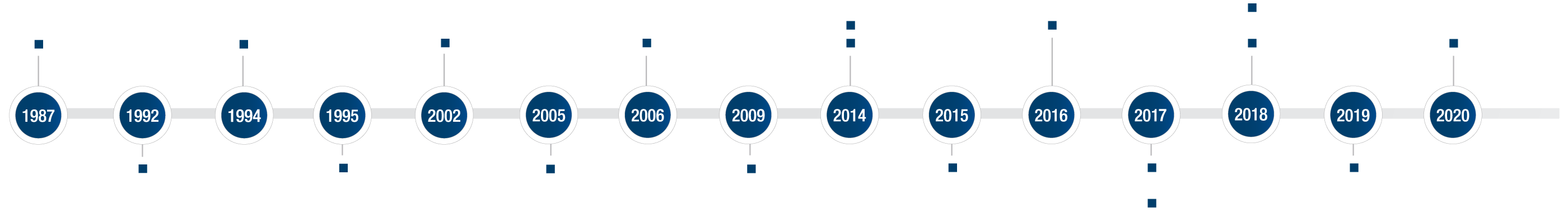

With more than 30 years experience of research and innovation, Man AHL has been one of the longest running systematic managers.

Man AHL was founded in 1987 as a Commodity Trading Advisor ("CTA"), with Man Group initially taking a

majority stake in the business in 1989 before acquiring the remaining share in 1994. From an initial focus on trend-following strategies, Man AHL has evolved into a multi-strategy quant business.

While leveraging from a long standing experience, Man AHL also thrives to constantly promote innovation and unconventional and unconstrained thinking.

Important milestones in our development

CLICK TO EXPAND

Investment philosophy

Risk management is built into all our models, and is further enhanced by our independent Risk team who use proprietary systems developed since our founding in 1987.

Engaging with our clients in a strategic partnership is our number one priority. We strive to exceed expectations through the quality of our investment solutions and by providing outstanding levels of client service and transparency.

We bring a scientific, empirical mind-set to investing. We only trade ideas and theories that we can test and prove. We act on evidence and strive to model and understand all aspects of the investment universe. But we are not academic theorists. We are practical scientists who apply our knowledge to producing something of financial value.

Our unique partnership with the University of Oxford, the Oxford-Man Institute, highlights this.

The Oxford-Man Institute is a research institute which brings together faculty, post-docs and students who are interested in quantitative finance, particularly machine learning techniques and data analytics. Man AHL’s researchers work alongside OMI academics and this collaborative approach yields deep academic insight into practical commercial research.

Research

Oxford-Man Institute

The Oxford-Man Institute ('OMI') is Man Group’s unique collaboration with the University of Oxford. Over the last decade, the OMI, part of the university’s Department of Engineering Science, has been conducting research into quantitative finance, and now focuses primarily on machine learning techniques and data analytics.

Located in the same building as Man AHL’s Oxford Research Lab, the OMI provides us with a direct connection to advanced machine learning research and allows for the fruitful cross-pollination of ideas between the investment and academic communities. Work done at the OMI, including in areas seemingly unrelated to investment – such as galaxy classification and measurement of the height of tides – has directly contributed to our investment methodologies.

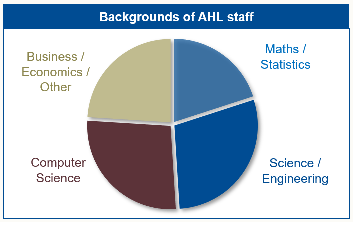

Diversified backgrounds of AHL

Technology

At Man Numeric we team innovative technology with talented investment professionals.

In Execution technology, our core goal is to ensure best execution for our clients. As we fundamentally consider

that competition is key to this, we have multiple trading routes; AHL-developed algorithms, third-party algorithms and a manual trading desk. We continually enforce rigorous competition between these routes in an effort to ensure that we are always trading optimally.

Through a thoughtful combination of specialised hardware, proprietary software, and heavy investment in open-source technology we have created a technology platform that greatly increases research velocity and satisfaction, with the intent of ultimately benefiting our clients.

TECHNOLOGY AT MAN GROUP

FOLLOW US ON TWITTER @MANQUANTTECH

Responsible Investment

At Man AHL, we incorporate RI in our investment process whilst recognising our fiduciary role and aiming to deliver attractive risk-adjusted returns to our clients.

Our breadth of capabilities means that there is no single environmental, social and governance (‘ESG’) framework which can be applied uniformly across our programmes.

As such, we are constantly looking at innovative ways to incorporate RI into our systematic portfolios. We also integrate RI into the investment process via a proprietary RI exclusion list. This list supports the exclusion of 4 areas across our single name universe, namely: controversial arms and munitions, nuclear weapons, tobacco and companies that derive over 50% of their revenue from coal production. A RI-oriented

VISIT RESPONSIBLE INVESTMENT ON MAN.COM

Programmes

We offer a broad and diversified range of systematic programmes according to the following three categories:

Momentum

Man AHL has been trading momentum strategies for around three decades. Today, flagship momentum programmes access a broad array of momentum models spanning over 800 markets.

Multi-Strategy

These programmes offer unconstrained access to the entire suite of Man AHL’s systematic momentum, mean-reversion, and fundamental models. The Institutional Solutions Programme gives larger

investors the opportunity to customise their investment to suit their own requirements.

Our investment programmes are based on a long-standing philosophy that markets exhibit persistent anomalies, such as price trends, mean reversion, carry or other repeatable patterns, which can be identified through careful statistical analysis. We believe many of these inefficiencies result from behavioural biases, for example risk aversion, anchoring and herding.

Our core principles centre on diversification, efficiency and risk control. In addition to our continuous efforts to expand the range of trading strategies, great effort is afforded to researching new markets in order to maximise portfolio diversification. With thousands of trading signals generated each day, we believe it is vitally important to streamline trade execution – including order netting, automating flow, maintaining a breadth of counterparties and backup trading centres which can operate 24 hours per day.

Programmes

We offer a broad and diversified range of programmes according to�the following three categories:��Multi-Strategy quant: These programmes offer unconstrained�access to the entire suite of Man AHL’s systematic momentum,�mean-reversion, and fundamental models. The Institutional Solutions�Programme gives larger investors the opportunity to customise their�investment to suit their own requirements. ��Momentum: Man AHL has been trading momentum strategies for�around three decades. Today, flagship momentum programmes�access a broad array of momentum models spanning over 800�markets. These feature the AHL Evolution Programme which trades�highly liquid but harder to access instruments than the traditional CTA�set of futures and FX forwards.��Liquid strategies: These programmes trade a similar universe of�models to the above programmes, but are constrained to the most�liquid markets. This category includes the AHL TargetRisk Programme�which seeks to implement its long-only exposure to equities, credit,�fixed income and inflation markets by using models which monitor�volatility, correlations and momentum in order to dynamically scale in�and out of markets as regime changes are detected.

VIEW OUR FEATURED STRATEGIES

GLOBAL

GLOBAL

Man Numeric began managing developed market global equity strategies in 2011. The suite has since expanded to include small caps and low volatility variations.

EMERGING

EMERGING

Man Numeric began managing emerging equity strategies in 2010. The suite has expanded to include small caps, active extension (130/30 or similar), market-neutral long short, low volatility, and country-focused strategies.

NON-US

NON-US

Man Numeric began managing non-US equity strategies in 1998. The suite has since expanded to include country, region or multi-region focused strategies including active extension (130/30) and low volatility variations.

US

US

Man Numeric began managing US equity strategies in 1989. The suite has since expanded to large and small caps including active extension (130/30) versions.

ALTERNATIVES

ALTERNATIVES

Man Numeric has been developing quantitative alternative strategies since 1990 when we launched our first market neutral strategy. The Alternatives platform continues to evolve and now includes risk premia and liquid illiquid offerings like liquid private equity.

CREDIT

CREDIT

Man Numeric launched its first systematic credit strategy in 2018. The approach leverages Man Numeric’s decades of systematic investing experience and the discretionary credit expertise within the broader Man Group to create the robust, internally developed credit-specific models that power these strategies today.

CREDIT

CREDIT

Man Numeric launched its first systematic credit strategy in 2018. The approach leverages Man Numeric’s decades of systematic investing experience and the discretionary credit expertise within the broader Man Group to create the robust, internally developed credit-specific models that power these strategies today.

WANT TO LEARN MORE?

Click on any of the buttons on the left

to learn more

Liquid strategies

These programmes trade a similar universe of models to the above programmes, but are constrained to the most liquid markets.

proxy voting policy is applied to all holdings as we

believe that it is our duty to use our voting rights to promote sound corporate governance practices at our

investee companies on behalf of our clients.

Our responsibility extends further than the investment process to aspects such as stewardship and diversity. For example, a diverse workforce allows us to have a range of academic and technical expertise, fostering an inclusive and innovative research environment which, we believe, ultimately benefits our investors.

Finally, Man AHL engages with the wider investment management community to discuss, critically evaluate and shape emerging best practice.

OUR PROGRAMMES

We believe that no data-set, market or model is out of bounds. We are constantly looking for systematic trading opportunities across the globe and actively encourage our people to find alpha in new places.

The process that turns an idea into a trading strategy is a very systematic and measured one. We start with a large number of ideas and we need to work out which of these has the potential to produce sustainable returns for our investors.

We do that in a two-stage process. The first is simulation, where we take ideas, build strategies out of these ideas, and see how they would have behaved over a long period of time and through many different environments. If we are satisfied with this, we move to the second stage of the process where we paper trade the idea. We trade it live but on paper, so no money is used in the trading but we simulate live trading through the process of time to make sure that this strategy is robust during this live period.

WANT TO LEARN MORE?

Click on any of the buttons on the left

to learn more

MARKET MILESTONES

TRADING MILESTONES

MODEL MILESTONES

Unconventional & Unconstrained

We bring a scientific, empirical mind-set to investing. We only trade ideas and theories that we can test and prove. We act on evidence and strive to model and understand all aspects of the investment universe. But we are not academic theorists. We are practical scientists who apply our knowledge to producing something of financial value.

Science Applied to Finance

We believe that no data-set, market or model is out of bounds. We are constantly looking for systematic trading opportunities across the globe and actively encourage our people to find alpha in new places.

MAN AHL ON MAN INSTITUTE

SCIENCE APPLIED TO FINANCE

SCIENCE APPLIED TO FINANCE

We believe that no data-set, market or model is out of bounds. We are constantly looking for systematic trading opportunities across the globe and actively encourage our people to find alpha in new places.

The process that turns an idea into a trading strategy is a very systematic and measured one.

We start with a large number of ideas and we need to work out which of these has the potential to produce sustainable returns for our investors.

We do that in a two-stage process. The first is simulation, where we take ideas, build strategies out of these ideas, and see how they would have behaved over a long period of time and through many different environments. If we are satisfied with this, we move to the second stage of the process where we paper trade the idea. We trade it live but on paper, so no money is used in the trading but we simulate live trading through the process of time to make sure that this strategy is robust during this live period.

UNCONVENTIONAL & UNCONSTRAINED

UNCONVENTIONAL & UNCONSTRAINED

We bring a scientific, empirical mind-set to investing. We only trade ideas and theories that we can test and prove. We act on evidence and strive to model and understand all aspects of the investment universe. But we are not academic theorists. We are practical scientists who apply our knowledge to producing something of financial value.

Our unique partnership with the University of Oxford, the Oxford-Man Institute, highlights this.

The Oxford-Man Institute is a research institute which brings together faculty, post-docs and students who are interested in quantitative finance, particularly machine learning techniques and data analytics. Man AHL’s researchers work alongside OMI academics and this collaborative approach yields deep academic insight into practical commercial research.

Responsible Investment

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt

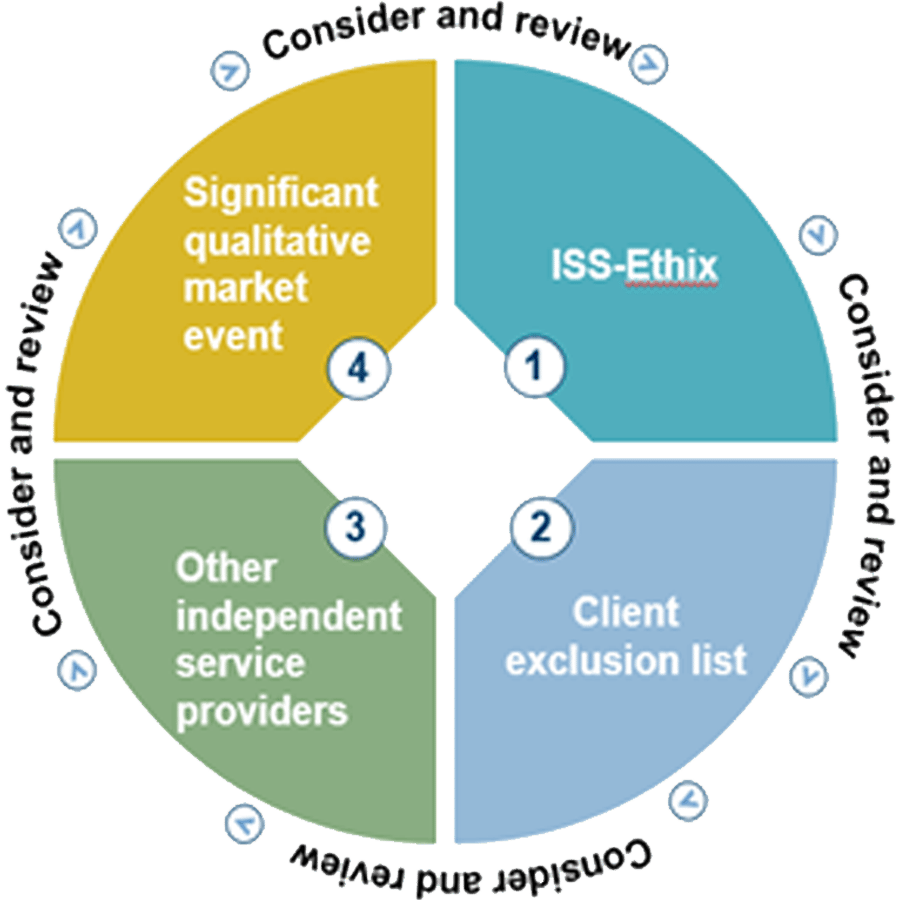

Our approach

Our breadth of capabilities means that there is no single environmental, social and governance (‘ESG’) framework which can be applied uniformly across our programmes. We apply the best practices of responsible investment - there is no ‘one size fits all’.

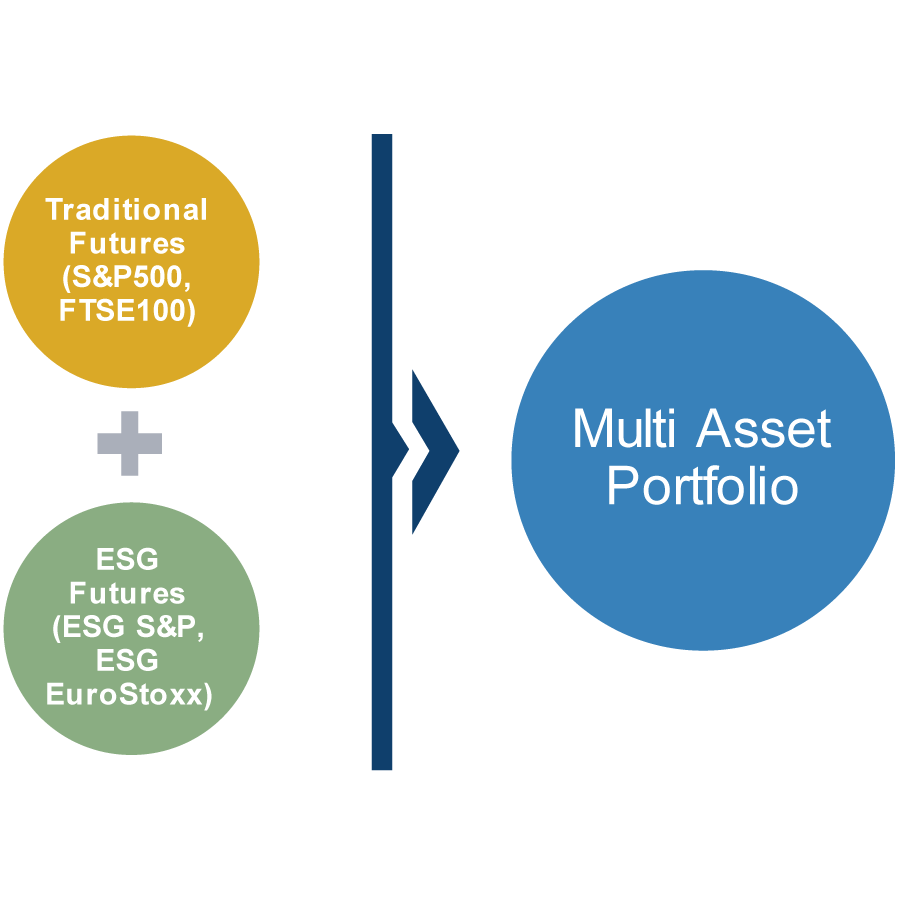

Macro assets

We are looking at innovative ways to apply ESG principles to our macro funds, which trade broad market indices. Current research includes the potential addition of ESG futures as well as how we could incorporate ESG scores into the asset allocation process.

Single name securities

The RI exclusions committee approve additions and removals for the list of securities to be excluded on ESG grounds. This applies to all AHL funds which trade single name issues.

VIEW OUR RESPONSIBLE INVESTMENT POLICY

MACRO ASSETS

SINGLE NAME SECURITIES

Data

Man’s Data Science group is a critical backbone within the organization. Having a common data platform encourages cross group collaboration and innovative

thinking to find unique insights in data. We look beyond the traditional landscape to develop creative solutions

for a variety of complex investment thesis. Data specialists collaborate with our researchers to guide new ideas, investment strategies, and differentiated alpha decisions for the benefit of our clients.

Macro assets

We are looking at innovative ways to apply ESG principles to our macro funds, which trade broad market indices. Current research includes the potential addition of ESG futures as well as how we could incorporate ESG scores into the asset allocation process.

SCIENCE APPLIED TO FINANCE

SCIENCE APPLIED TO FINANCE

We believe that no data-set, market or model is out of bounds. We are constantly looking for systematic trading opportunities across the globe and actively encourage our people to find alpha in new places.

UNCONVENTIONAL & UNCONSTRAINED

UNCONVENTIONAL & UNCONSTRAINED

We bring a scientific, empirical mind-set to investing. We only trade ideas and theories that we can test and prove. We act on evidence and strive to model and understand all aspects of the investment universe. But we are not academic theorists. We are practical scientists who apply our knowledge to producing something of financial value.

WANT TO LEARN MORE?

Click on any of the buttons on the left

to learn more about our Research.

OXFORD-MAN INSTITUTE

Oxford-Man Institute

The Oxford-Man Institute ('OMI') is Man Group’s unique collaboration with the University of Oxford. Over the last decade, the OMI, part of the university’s Department of Engineering Science, has been conducting pioneering research into quantitative finance, and now focuses primarily on machine learning techniques and data analytics.

Located in the same building as Man AHL’s Oxford Research Lab, the OMI provides us with a direct connection to cutting-edge machine learning research and allows for the fruitful cross-pollination of ideas between the investment and academic communities. Work done at the OMI, including in areas seemingly unrelated to investment – such as galaxy classification and measurement of the height of tides – has directly contributed to our investment methodologies.

VIEW OUR RESPONSIBLE INVESTMENT POLICY

We truly believe that advanced quantitative trading strategies necessitate robust technology at all stages; from market data acquisition and initial research through to model implementation and trade execution. We believe this primary focus enables our scientific models to move from concept through back-testing and into production trading with minimum overhead and maximum efficiency.

Having a common programming language and unified codebase promotes collaborative and stimulating working practices. Our hardware, tools and software engineering practices ensure high levels of productivity, quality and the necessary agility to quickly meet the needs of a dynamic business.