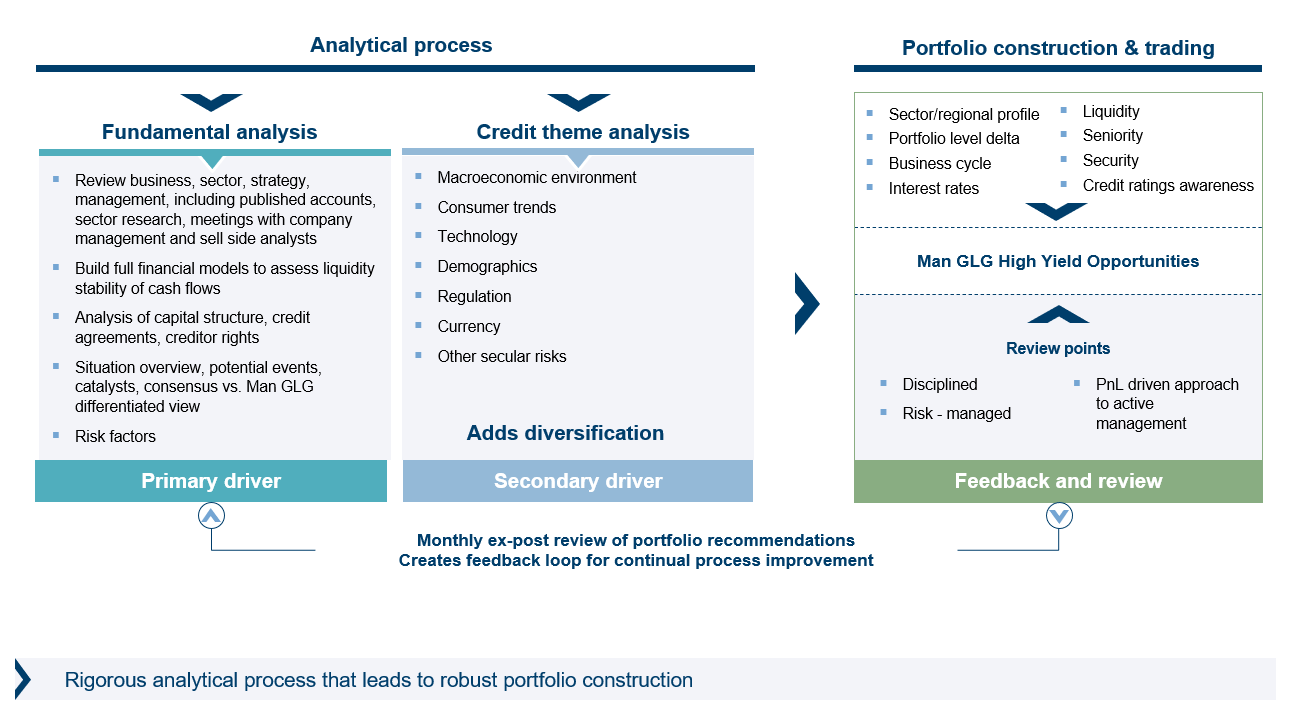

Analytical Process

Fundamental Analysis

Review business, sector, strategy management, including published accounts, sector research, meetings with company management and sell side analysts

Build full financial models to assess liquidity stability of cash flows

Analysis of capital structure, credit agreements, creditor rights

Situation overview, potential events, catalysts, consensus vs, Man GLG differentiated view

Risk Factors

Primary Driver

Macroeconomic environment

Consumer trends

Technology

Demographics

Regulation

Currency

Other Secular Risks

Secondary Driver

Credit Theme Analysis

Portfolio Construction & Trading

Adds diversification

Sector/regional profile

Portfolio level beta

Business cycle

Interest Rates

Liquidity

Seniority

Security

Credit ratings awareness

Man GLG High Yield Opportunities

Review Points

Disciplined

Risk - managed

PnL driven approach to active management

Feedback and Review

Monthly ex-post review of portfolio recommendations creates feedback loop for continual process improvement

Rigorous analytical process that leads to robust portfolio construction