Despite a bumpy Q3, we remain positive that Q4 may be an improvement for hedge funds.

Despite a bumpy Q3, we remain positive that Q4 may be an improvement for hedge funds.

October 2021

Introduction

The end of Q3 was marked by a number of risks coming into focus: persistent inflation and fears of stagflation stoked by signs of an economic slowdown, uncertainty around the shift to tighter monetary policy and the size of additional fiscal stimulus in the US, and developments in China are among the most notable. These challenges prompted us to reduce risk in some areas, while also shifting portfolios toward strategies that we expect to perform better in an environment in which these risks come to fruition.

We remain favourable on the opportunity set for convertible arbitrage managers in the current environment, and we also believe the strategy would be well-placed to perform in the event we enter into an environment of higher market volatility which could be triggered by persistent inflation.

We have a positive view on Macro strategies, namely discretionary and quantitative strategies with expertise in commodities. On the discretionary side, we believe that managers can generate returns from the transition to tighter monetary policy and asset class volatility stemming from inflation. On the quantitative side, the volatility we have seen (and expect to continue) in energy markets is largely a positive for managers with expertise in the space.

The scope of our positive outlook on event driven strategies has widened as a result of the pressures in China, as increased difficulty around foreign investing will likely lead to capital markets events that these strategies can capitalise on.

Overall this leaves us with a positive view on hedge funds; we believe that there are attractive opportunities to generate returns. Additionally, we believe that the diversification that hedge funds can deliver will be of real value to asset allocators when the markets test assumptions that are used to build traditional portfolios, such as the role of bonds in an equity sell-off. We may be moving closer to that point.

Hedge Fund Performance Review

Q3 was marked by muted returns for hedge fund indices despite several bouts of higher volatility and temporary disruptions in risk assets’ march higher. This contrast can be explained by the short-lived nature of the volatility spikes, combined with lower risk levels relative to the previous 12 months across some of the more directional strategies such as equity long-short and credit long-Short. Diversified hedge fund and fund of hedge fund indices posted a mix of small positive and small negative results, with the HFRX Global Hedge Fund index returning -14bps for the quarter.

Discretionary equity long-short (“ELS”) managers were challenged in Q3, delivering slightly negative returns for the quarter. Year-to-date, a lack of persistence in market leadership has plagued hedge funds, meaning short-term tactical traders have prevailed over long-term fundamental investors. More specific to Q3, the underperformance of crowded long positions1 , the growth sell-off in the final days of September, and weakness in Chinese markets impacted performance negatively. Tightened Chinese regulations across a range of sectors which caused widespread weakness in the Chinese equity markets that was further compounded by elevated net selling activity as foreign investors swiftly de-risked. Chinese ADRs were widely held by ELS funds and a key factor in the July performance struggles of not just Asia-focused ELS funds, but TMT sector specialists and global generalists as well. The Evergrande2 debt crisis rattled Chinese equity markets further. ELS funds did not hold outsized exposure to Chinese real estate or banks, but the performance of Asia-focused funds was impacted by beta to the unsettled Chinese equity market.

Corporate credit managers were generally positive albeit muted during the quarter. While there were several periods of volatility in risk assets (largely due to concerns related to Covid-19, China, and inflation), these tended to be very short lived and credit markets were not impacted in a lasting way. Convertible arbitrage saw weakness early in the quarter as convertible bonds associated with Chinese ADRs in the technology sector underperformed. The strategy finished the quarter on a strong note as market volatility increased. Similarly, SPACs were initially negative contributors on increased regulatory scrutiny, but the market subsequently stabilised. Energy-related stressed/distressed credits/reorg. equities performed well during the quarter on the continued rally in commodities prices. Structured credit managers also saw a modest positive quarter with gains driven by a combination of modest spread tightening across most sectors and coupon income.

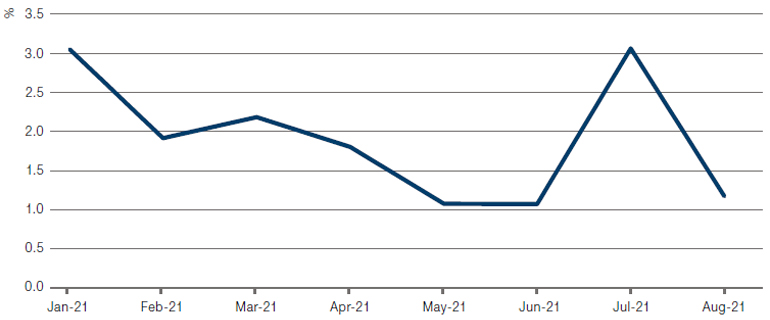

In relative value, event arbitrage managers had a mixed quarter, which got off to a difficult start as the USD30 billion acquisition of Willis Towers Watson by Aon3 was mutually terminated in response to US FTC antitrust litigation pressure. This deal break caught most merger arbitrage participants by surprise, as there appeared to be many paths for the deal to still move forward. The downside from the break was worse than most managers had modelled as fundamental investors appeared to favour Aon over Willis, which was yet to report financial results, pushing the spread wider. As the deal was widely held, this not only caused notable realised losses, but other large deals, as well as mergers sensitive to regulatory approvals were also de-risked. This resulted in general contagion of spread widening that impacted July and early August returns, particularly in US deals. For the remainder of the quarter, merger spreads remained range-bound but volatile, while at the same time M&A deal activity continued to be very strong, although this did taper a bit in September. A multitude of competitive situations were consistently the largest P&L drivers, notably in Europe. Return dispersion across managers spiked in July, after declining steadily since January (Figure 1).

Figure 1. Event Arbitrage Return Dispersion (inter-quartile range)4

Source: Man Group Database, FRM Event Arbitrage peer group, August 2021.

In other relative value strategies, China A/H pair trading was materially negatively impacted in July by the sell-off in Chinese equities, which led to spread widening in A/H pairs intra-month. Index arbitrage has been steadily accretive, with both active trading and scheduled rebalances generating profits. The announced collapse of the dual BHP share class structure was another opportunity for relative value managers. SPACs posted quiet returns in Q3, with managers selectively adding names trading at a discount to trust value, especially post deal announcements, as these offer reasonably near-term and safe spread-to-close opportunities. In volatility arbitrage, managers produced small, but disperse returns, depending on the level of long volatility bias, which was detrimental as volatility spikes did not last in equity markets.

Statistical arbitrage strategies performed respectably in Q3. Approaches in equities using alternative data continued to have a decent recovery post the initial Covid-19 shock, and machine learning was also profitable in equities for some (but not all) managers. One area of weakness was flat performance for quantitative credit strategies which, reportedly, was due to a lack of dispersion in credit.

Discretionary macro had a negative quarter, as the moves in US Treasury yields and the US dollar following the June FOMC meeting worked against managers’ curve steepener positions and short US dollar exposure. This set the tone for a difficult spell in Q3 where trading conditions became increasingly challenging and, in response, risk levels across the space came down and the focus shifted towards shorter-term opportunities.

We did however see positive results for some quantitative macro strategies in Q3, namely alternative trend and machine learning based strategies with significant (or sole) exposure to commodities. Several managers were able to capitalise on the strong appreciation in European natural gas and power markets, which rallied on lack of supply and low storage levels in Europe combined with competing demand from Asia. There was however dispersion within the systematic macro space, and we also saw some managers prove less successful in navigating commodity markets, particularly in July, and these ended Q3 with a negative result. Meanwhile, the classic trend following space was only modestly positive and impacted by poor results in FX futures.

Hedge Fund Outlook

Market Backdrop

During most of Q3 markets were sending mixed signals to investors: While strong earnings helped to push developed market equities ahead until the beginning of September, the contemporaneous decline in government bond yields, a flattening yield curve and high cost for insurance in option markets set a different tone to the optimistic picture in equity and credit markets. This dynamic shifted in September and equity indices gave back the majority of gains from earlier in the quarter on concerns about an economic slowdown, and interest rates increased sharply due to increasing inflation expectations. The looming paradigm shift to a tightening monetary environment, the uncertainty around the size of additional fiscal stimulus in the US, and the debt ceiling debate further added to uncertainty at quarter end. Under the hood, equities experienced a factor rotation out of momentum/ growth into value stocks.

Developments in China have also raised concerns. While China’s unparalleled economic ascent has been a driver for the world economy and its countercyclical stimulus supported markets during the Global Financial Crisis and Covid-19 crises, investors are now looking at the possibility of a slowdown in China.

In July, regulatory moves to reign in the for-profit education sector and to increase scrutiny of China’s global tech players hurt hedge funds beyond just those with positions in the directly impacted companies given the contagion to Western growth names. These regulatory steps are leading to a more cautious approach towards investing in China for many market participants. China-related news once again dominated headlines in September as Evergrande’s5 debt crisis came into focus. While the Evergrande saga has yet to pose a direct impact to hedge funds due to the minimal exposure to the real estate and banking sectors, it does add to the downward pressure on the Chinese economy, and the risk remains that this could have knock-on effects on markets beyond China.

While these were certainly short-term negative developments, they could also open new long-term opportunities for hedge funds. The expected de-engagement of Chinese companies from US capital markets will create capital markets transactions that event driven managers should be able capitalise on. Furthermore, balance sheet restructurings of Chinese companies may allow distressed managers to participate in the reorganisation of over-levered corporates, and a slowdown of exports to China could result in restructurings in Western countries.

Besides the regulatory action on Chinese tech, additional pressure on growth stocks came from the rise in yields in September. With interest rates now rising because of higher inflation rather than stronger growth, equities became vulnerable to the sell-off in bonds, especially growth stocks due to their valuation dependence on discounting cash flows that are far out in the future.

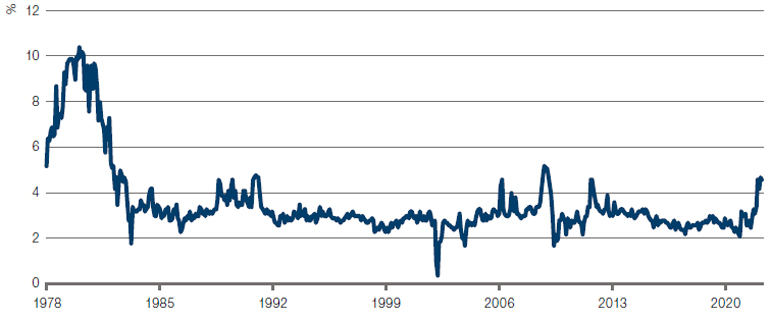

Broker surveys show that most market participants still expect the increase in inflation to be transitory. Long-term consumer inflation expectations are increasing but remain at levels that don’t justify panic yet (Figure 2). However, as we discussed last quarter, if inflation expectations become persistent, the market backdrop would become challenging. While equities often get an initial boost from higher inflation (especially Value stocks), as they have already realised earlier in 2021, eventually inflation is bad for equities, which adds to the pain that bonds would obviously endure in this scenario due to higher nominal rates. This risk leads us to robust allocations to trend and commodity strategies in our portfolios which we believe would do well during inflationary times.

Figure 2. University of Michigan 12-Month Inflation Expectations

Source: Federal Reserve Bank of St. Louis; as of August 2021.

The rise in bond yields in September and the economic slowdown have brought back another concern: stagflation. While we would expect that stagflation comes after a period of inflation – before the economy transitions into disinflation –, we need to consider the consequences of stagflation on portfolios as it would require us to make reallocations. We expect that some strategies would fare better than others: for example, convertible managers could benefit from higher underlying stock volatility, but we would be more cautious on structured credit because of the weakening collateral values and higher borrowing costs. Many equity long-short funds would struggle, unless we can find managers that are nimble and factor aware. Trend followers would likely struggle in the transition period from inflation to stagflation, but could pick up new trends as they establish themselves.

The increasing risk of a significantly more challenging market backdrop driven by persistent inflation has led us to adjust portfolios by reducing risks where necessary, while concentrating on hedge fund strategies that offer the best opportunities in the coming quarters.

Credit Strategies

There is no change in our outlook for credit strategies since the last update as we maintain a neutral outlook on credit long-short and a negative outlook on distressed.

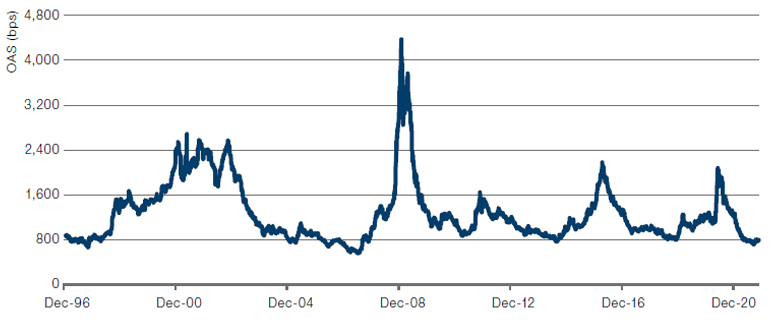

Credit spreads were modestly wider over the third quarter, but still largely remain near multi-year lows (Figure 3). In our view, the risk/reward for taking a lot of outright credit risk is unfavourable with the potential exception of a few sectors (e.g., entertainment, transportation, energy) that could see further spread compression if the market environment remains benign in the near term.

Dispersion across high yield and investment grade markets remains low, posing a challenge for fundamentally-driven credit long-short managers. We have seen managers selectively add convex single-name US HY bond shorts to take advantage of the spread tightening across the rating spectrum. Capital structure arbitrage (typically long credit versus short equity) remains an area of focus for some managers.

Figure 3. US HY CCC & Lower Rated Spreads

Source: Bloomberg; as of September 2021.

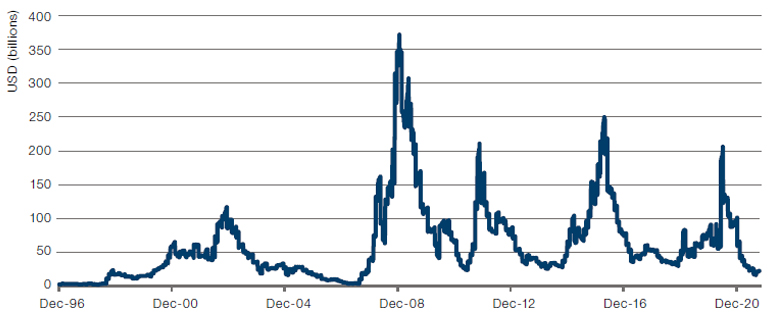

Defaults and distressed transactions continued at a modest pace in Q3 (similar to YTD), with only ten defaults impacting USD7.6 billion of bonds and loans YTD6 . In addition, there have been USD1.8 billion of distressed exchanges so far this year. This compares to around USD123 billion of volume as of the same time last year. The par-weighted US high-yield default rate now stands at 1.1%, a two year plus low, and the market value of outstanding US high yield distressed debt remains at very low levels (Figure 4). Default expectations for the near to medium term also remain modest by historical standards.

As a result of above, we continue see a more challenging capital deployment environment for distressed managers once they have capitalised on the pipeline of now primarily reorg. equity opportunities created by the significant uptick in defaults last year. Hence, we maintain our negative outlook.

Figure 4. US HY bonds trading over 1,000bps (market value, $bn) 7

Source: Bloomberg, as of September 2021.

We remain favourable on the opportunity set for convertible arbitrage managers. Markets continue to digest the heavy YTD supply (, which has kept valuations in check. However, we see the increase in the size of the convertible market (a roughly50% increase in par value of US convertible bonds versus December 2019)8 as well as a broader issuer base (around 30% increase in issuer count over the same period) as a plus for the long-term opportunity set. Managers are also able to selectively source implied volatility through convertible bonds (with minimal credit risk) cheap to recent realised as well as listed volatility. A decline in single-stock volatility remains the key risk for convertible arbitrage strategies in our view.

We retain a balanced outlook for structured credit managers. Spreads across securitized products sectors continued to modestly tighten in Q3 but still selectively remain wide to pre-Covid levels and credit curves are generally steeper. The fundamental backdrop for US housing (low inventory/distressed supply) and consumer (low delinquency rates/strong balance sheets) remains positive. In a world starved for yield, structured credit continues to represent good relative value versus other fixed income sectors. However, our forward-looking return expectations are more modest for the strategy as there is less room for further significant spread compression, and a meaningful backup in rates could be a headwind.

Relative Value Strategies

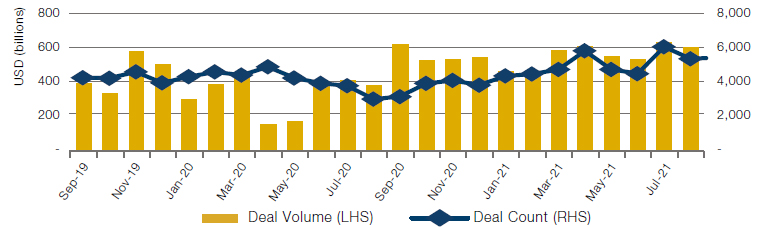

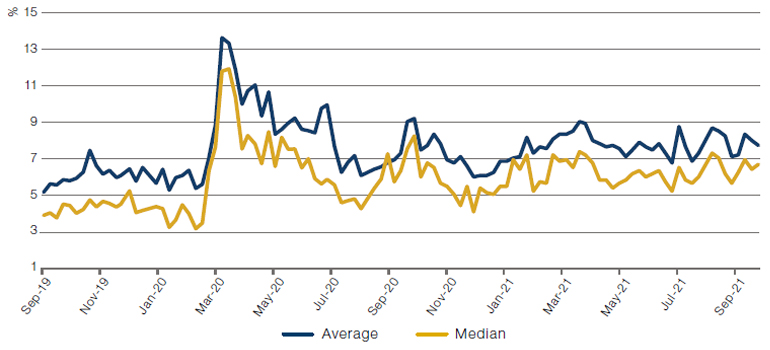

In relative value, we remain positive on event arbitrage. The most prevalent sub-strategy, merger arbitrage continues to benefit from deal activity remaining very high across all regions (Figure 5). Specifically, a high volume of large cap mergers, which can absorb a lot of arbitrage capital, are keeping spreads wider (Figure 6).

Figure 5. Global M&A Deal Count and Volume

Source: Bloomberg; as of August 2021.

Figure 6. Annualised merger spreads (in US)

Source: Bloomberg; as of September 2021.

The current M&A environment is healthy due to still positive business sentiment despite the market risks we described above. Following the WTW/Aon9 break there is an additional level of uncertainty represented by US antitrust enforcement, however this appears to be suitably incorporated into wider deal spreads. Also, this increased regulatory risk may be mostly a short-term issue, considering the newness of the FTC and DOJ appointees and lack of actual enforcement examples. Average closure rates are unlikely to change materially. Companies may, however, adjust their deal-seeking approach in response to regulatory signalling, and avoid mergers that attract enhanced scrutiny. Target companies may also increase protections in case deals do not conclude. Apart from the topical US antitrust risk, a perennial risk factor is deals exposed to Chinese regulatory approvals. These are generally subject to more risk premia, but the most recent actions from China have not been unduly concerning for international mergers – although domestic mergers as well as primary and secondary capital market activity have been subject to interventionist pressure and execution uncertainty.

Outside of mergers, broader corporate actions have continued to pick up steam with events like restructurings, spin-offs, asset sales, pre- and post-M&A trades etc., which collectively represent a large opportunity set for hard and softer catalyst trading. These events are being triggered and driven by pressures to respond to and expand capabilities in areas like ESG, supply chain management, and digitalisation. Investors’ ESG focus has been facilitating tangible corporate actions, e.g. spinning out renewable technology or carbon intensive assets, changing governance models and simplifying complex corporate structures. As mentioned in the market backdrop, there is also an opportunity for managers to take advantage of opportunities from capital markets events associated with de-listings (from US exchanges) and re-listings (in China or Hong Kong) of Chinese companies.

SPACs continue to be in a period of consolidation, with some high-profile merger disappointments, e.g. after sobering post-combination financial results. Most diversified SPAC portfolios now trade at an average discount to the trust value. This is, however, attractive for arbitrage trades with safe spread closure assumptions, especially when the duration is relatively near-term after deals have been announced. The purpose of the SPAC vehicle, namely to raise capital for private companies outside of traditional IPOs, is being somewhat undermined by very high redemption rates post deal announcement. Currently, a median of approximately 50% of investors are preferring the return of trust capital to owning the future company, with some deals seeing up to 90% redemption rates. SPAC issuance collapsed in Q2 2021, only recently showing a slight pick-up. Key dampeners have been regulatory and legal scrutiny, e.g. around accounting practices and disclosure liabilities, as well as the underwhelming performance post deal completion as mentioned above. The opportunity set has certainly reset from the heady days of Q4 2020 and Q1 2021, however, the innovative SPAC market will likely continue to evolve with improved incentives and control mechanisms for sponsors and investors to generate value-accretive deal economics. SPACs should continue to be a favourable avenue for high-quality sponsors to identify and structure compelling mergers, albeit investors need to be selective.

We continue to have a neutral view on volatility arbitrage, as the continued absence of sustained dislocations across volatility markets hampers tactical trading. However, FX pair volatilities are at record lows, and could pick up if there are diverging policy decisions or idiosyncratic market events. In general, it remains to be seen whether current market dynamics support a possibly significant and quick volatility increase. There is potential fragility, e.g. structured products, vol hedging and systematic strategies contributing to a large market trend. However, the current record VIX premium over realised volatility and put-call skew indicate a lot of downside risk is already being priced in by market participants. This could also mean that even sizeable market corrections would not necessarily disturb the volatility surfaces, unless they extend to more severe downturns.

Our outlook for statistical arbitrage is mixed. Positively, China A stocks continue to be a source of significant alpha for some quant managers who have utilised the growing synthetic equity market (both for borrow and to access QFII longs) offered by global brokers. However, it is difficult to disentangle such alpha from its CSI benchmark and tap it purely on a market neutral basis. Therefore many opportunities come at the price of running long-biased exposure, which presents obvious challenges for alternative investors. We remain less enthused by US quant equity. As we have said before, we are concerned that

- the general weight of quant money in the US is a dampener and;

- the payment-for-order-flow model, used by many discount retail brokers, is at least negative at the margin for some market neutral equity managers (even after some respite and reversal of US retail investor flows this year); since we believe it creates information asymmetry that may be exploited by market making specialists.

Given this view, we will focus our efforts on finding new opportunities in China A stocks and other developing areas like ESG applied to quant (perhaps to create negative CO2 tilts and identify companies that are “inefficient” with respect to their uses of global resources).

We have a positive view on alternative risk premia which has shown no sensitivity to crowded equity style factors following an upgrade to the program and lowered allocation to the US market last year. The diversification and capital efficiency benefits that this allocation brings to our portfolios are highly valuable.

Lastly, we hope to see stronger results from quant credit in the coming quarters, but we do not have a strong view about the likelihood of this nor are we overly deterred by the relatively muted performance in 2021. We continue to believe it is a useful diversified source of return.

Equity Long-Short Strategies

Heading into the end of 2021, we have a neutral view on equity long-short due to the market backdrop, manager positioning, and a more limited number of alpha generation opportunities.

Crowded longs have been a source of pain for ELS funds this year. This group of stocks is over-indexed to technology and growth names, which traditionally have struggled in rising interest rate environments. Fears of rising inflation may further challenge this cohort of stocks. Outside of crowded longs, exposure remains elevated across TMT and Growth stocks, providing a further headwind for ELS funds.

More recently, China Evergrande’s10 debt crisis has added to the volatility in Chinese equity markets this year and represents another risk to investors in the region. We have seen that investors without boots on the ground in China have generally taken to the sidelines. It was more so regional specialists that used the dislocation to concentrate exposures in A-shares and/or small-/mid-cap stocks. Given the amount of risk that has been taken off the table, we expect the potential for alpha generation in China to be limited in the short term.

All of this said, there are certainly pockets of opportunities we are keeping an eye on: the healthcare sector has notably underperformed the broader market since February with the weakness driven by several factors, including dampened M&A activity in the sector given perceived FTC scrutiny, delayed reviews as Covid-19 drug applications have been prioritised, an over-saturation of equity new issuance, investor rotation out of long-duration growth assets, and uncertainty related to insurance coverage and drug pricing. Despite this, the sector has both structural and secular tailwinds: An aging population and increasing wealth in emerging markets should boost demand for drugs, treatments, and medical care, whereas technological innovation could create new opportunities across the sector.

We also expect that the heightened focus on ESG will present an opportunity for ELS. Thematic funds will naturally benefit from a clear divide in “winners” and “losers” of the energy transition and/or move towards carbon neutrality. Investor focus on ESG and changes in consumer preferences have forced companies to re-evaluate not just their environmental impacts, but their social impacts as well. This should serve as an additional form of distinction between companies that investors should be able to exploit.

Global Macro Strategies

Our outlook on discretionary macro strategies remains modestly positive. While the big opportunities that the Covid-19 crisis generated are arguably gone, we believe that managers can generate returns from the transition to tighter monetary policy and asset class volatility stemming from inflation. Clearly, the experience that we have had over years with this sector indicates a somewhat loose relationship between opportunity set and returns. However, macro managers have proven to be additive to portfolios as they have the potential to add convexity. We are focused on sourcing managers with a regionally unconstrained mandate.

Directional managers remain exposed to inflationary pressures in developed markets, notably in the US and Europe, whereas managers with a relative value focus are positioning for Asian economies to lag the broader recovery given their increased sensitivity to a slowdown in China, and are expressing this via a receiving Asian rates versus US allocation.

The quantitative macro space has delivered and continues to offer some exceptional opportunities in European gas and power in Q4 (and hopefully throughout the winter season into Q1 2022). The volatility in these markets has been incredible and shows no signs of abating – with several supply and demand stories set to influence the EU energy markets until at least Christmas. Such volatility is largely welcomed by quant managers. Longer term, we believe themes like the importance of inflation expectations, climate change and China opening will be drivers of returns and investment opportunities for managers in this space.

1. As measured by Goldman Sachs’ Hedge Fund VIP basket.

2. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

3. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

4. Source: Man Group Database, FRM Event Arbitrage peer group, August 2021.

5. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

6. Source: Bloomberg, August 2021.

7. Source: Bloomberg, September 2021.

8. Source: BAML, August 2021.

9. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

10. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.