Why falling PMIs may herald earnings downgrades; and why no country is totally immune from global macro shifts.

Why falling PMIs may herald earnings downgrades; and why no country is totally immune from global macro shifts.

June 2022

This issue contains two pieces: “Here Come the Downgrades” & “Stein’s Law”.

While this does not imply an outright recession, based on historical evidence this would result in a much larger than average downgrade to current earnings forecasts of 20%, courtesy of analysis by Minack Advisors. The 2023 PE multiple would be 20x as a result of such a downgrade, a lot less attractive than currently.

Here Come the Downgrades…

We would love to be greedy now that many are fearful. But our judgement is that the time to raise equity allocations has not quite come yet. Recession or not – earnings downgrades seem inevitable and potentially large.

So far, equities have fallen due to lower multiples, not lower earnings. We calculate that the 1-year forward price-to-earnings (‘PE’) multiple for the US equity market has fallen from 21x to 17.5x this year, a more attractive level.

Earnings expectations remain lofty, with consensus EPS growth expectations of 9%, 10% and 9% in 2022, 2023 and 2024 for MSCI USA, resulting in all-time high return on equity (‘ROE’) numbers of 20%+ based on MSCI data since the 1970s.

With inflation likely rolling over, it is possible that the damage to equity multiples from higher rates is largely behind us. However, the big additional risk to markets from here on is the size of the earnings downgrades. Our own lead indicator for the US Institute for Supply Management Purchasing Managers’ Index (‘ISM’), suggests the ISM will trough at 45 towards year-end, down from the current 56. While this does not imply an outright recession, based on historical evidence this would result in a much larger than average downgrade to current earnings forecasts of 20%, courtesy of analysis by Minack Advisors. The 2023 PE multiple would be 20x as a result of such a downgrade - a lot less attractive.

Figure 1. If US ISM Falls to 45, EPS Downgrades Could Amount to 20%

Problems loading this infographic? - Please click here

Source: Gerard Minack Advisors, Man Group; as of 31 May 2022.

Stein’s Law

“If something cannot go on forever, it will stop”, Herbert Stein (1986)

In investing, if one is not careful, it is easy to get caught up in the details of the short-term and forget about the all-important big picture. What will the governor of the central bank say next week? Will the headline CPI print peak last month or next month? Are we heading for a hard or soft landing? The details are interesting and important, for sure, but we regularly try to step back to get a broader perspective.

Reading Thomas Pikkety’s A Brief History of Equality (2022) provides perspective like little else: his analysis, data and philosophy provide important insights into the last 250 years. Life expectancy and literacy have increased tremendously, and progress towards less concentration of wealth and income has been significant since World War One. There is room for much more progress, nevertheless, and historically such progress has been through wars and revolts, as political systems typically serve vested interests. His progressive policy prescriptions may well be too left-wing for many, but his analysis and perspective is clinical, razor-sharp and enlightening.

The brilliant Lords of Finance (2009) by Liaquat Ahamed provides such perspective, too, with more concrete implications for the next few years. It describes the plight of policymakers in the aftermath of the 1929-32 crash in vivid human detail through highly personable accounts of the dilemmas facing the main actors including John Maynard Keynes, Emile Moreau, Montagu Norman, Benjamin Strong and Hjalmar Schacht.

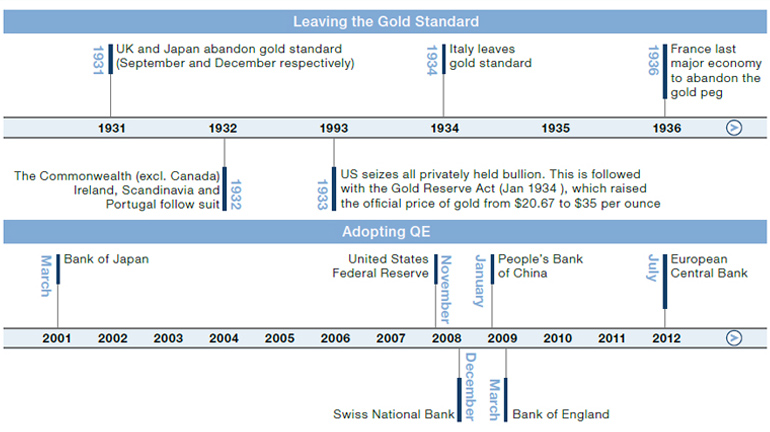

Crucially, it shows that all countries needed to reflate their economies by revaluing their currencies versus the gold standard, eventually. The UK was first in 1931, and while at the outset no one expected France to have to do the same, France being the strong economy at that time, come 1936 it had to follow suit due to the pressure from other countries having revalued and reflated.

The lesson is that when seismic shifts occur in the global economy, no country can escape, eventually, although it may take many years.

The lesson is that when seismic shifts occur in the global economy, no country can escape, eventually, although it may take many years. A similar dynamic happened when quantitative easing (‘QE’) became the key policy tool after the GFC – eventually even the ECB adopted it albeit many years after others.

What does that mean for today, concretely? A persistent inflationary mindset is taking hold, we believe, with policymakers trying to address multiple goals that are consistent with higher inflation, such as inequality, climate change, security spending, high debt levels, and the fragility of global supply chains. In our view, this may cause the following events to occur eventually, however unlikely they seem now. In no particular order:

- As inflation is higher and more volatile globally, Japan needs to abandon yield curve control, thus contributing to a next significant leg in the global bond bear market, as the anchor of (close-to-zero) Japanese government bond yields is raised;

- Chinese policymakers need to make difficult choices, as they aim to stimulate growth while keeping debt levels contained and maintaining a controlled currency. Eventually they may choose to resort to full-blown QE and Modern Monetary Theory (‘MMT’), which could result in such pressure on the exchange rate that policymakers choose to introduce a free-floating currency. While at first disinflationary, this could lead to a large reflationary impetus for the global economy;

- Perhaps, however inconceivable it seems today, the Eurozone embraces MMT-type policies to achieve their policy goals. It may even be true that given the obvious limitations of one-monetary-size-fits-all, fragmented policies are adopted, such that there would be an internal monetary split within the Eurozone. That, or ever-closer fiscal union.

Figure 2. Learning From Seismic Economic Shifts – Leaving the Gold Standard and Adopting QE

Source: Man Solutions, as of 13 June 2022.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.