Combining data science and expert human overlays can help you better judge a company’s ESG credentials.

Combining data science and expert human overlays can help you better judge a company’s ESG credentials.

August 2022

Let’s start with a simple, but deceptively difficult, responsible investing question: is the company Tesla a sustainable investment?

On the one hand, the company has been at the forefront of popularising the use of electric vehicles, shifting consumer behaviour away from environmentally damaging internal combustion engines. However, batteries for these vehicles require mining of rare earth metals which can be very polluting.1 In addition, Tesla has been accused in the past of anti-union practices, product safety issues with their self-driving systems2 and unsafe working environments.3 There are many other factors to consider, but already it has become less clear how one would weigh up these issues to determine if a company like Tesla is a sustainable investment.

This is not an esoteric question - investor demand for responsible investment focused funds is growing fast.4 At Man Group, our approach to responsible investment means being clear and transparent to our clients and regulators about why we believe certain investments are aligned with environmental and social values.

It is clear to us that there will never be a perfect, uncontroversial answer to how you judge every investment’s ESG credentials. Unfortunately, simply saying this is a hard problem and ignoring it does not suffice. Both regulators and investors rightly demand evidence to show how ESG aligned funds’ investments are consistent with their prospectus goals. Simply put – do the investments match the marketing?

This is a classic “perfect is the enemy of good” situation. There will always be disagreements to any ESG rating process but by having a clear methodology, dispute mechanisms and a transparent process we feel we can stand behind our ESG assessments.

Our Target Process

The global investment universe is huge – with thousands and thousands of companies who adjust their business models and behaviours over time. Ensuring you monitor them all, adjust your opinion as the facts change and avoid human biases affecting your scores requires data, and lots of it.

We therefore wanted to utilise Man Group’s long experience of systematically dealing with large datasets and to combine this with the research of the firm’s many highly experienced investment professionals to give a coherent and consistent rationale for our ESG focussed investments.

Using this approach, we aimed to develop a proprietary Man Group rating system to produce firm-level ratings for each issuer, on both its social and environmental impacts.

Systematic Challenges

At Man Group we have a wide range of experience in dealing with systematic analysis of large data sets from long before it was known as data science. We were able to leverage our large compute clusters, our existing Python data analysis tools (both proprietary and open source) and most importantly our experienced data scientists to help process ESG datasets.

“Success is 10 percent inspiration and 90 percent perspiration.” is an often-used quote by Thomas Edison. We have found this applies for many data analysis tasks - most of the time spent is spent on data preparation tasks that enable the more interesting analysis to take place.

We have certainly found this to be true when dealing with ESG datasets. We encountered many challenges when creating a Systematic ESG rating approach:

| Challenge | Our chosen approach |

|---|---|

|

How should we score and categorise different aspects of issuers ESG credentials? |

|

|

ESG datasets have limited histories, quickly changing methodologies and often patchy coverage. |

|

|

Different ESG vendors use different methodologies and scales even for the same metrics. The units & distribution of data varies considerably across metrics (tons of CO2, % females, % revenue in green building...) |

|

|

Different data sources can disagree on whether a company is aligned or misaligned to SDGs. |

|

|

Who is the issuer for an investment? Different vendors use different symbologies. Subsidiaries and differing investment terms e.g. green bonds complicate matters further. |

|

Expert Overlay

Even with a well-designed, systematic approach, we believe judging a firm’s ESG credentials also requires specialist human analysis and validation.

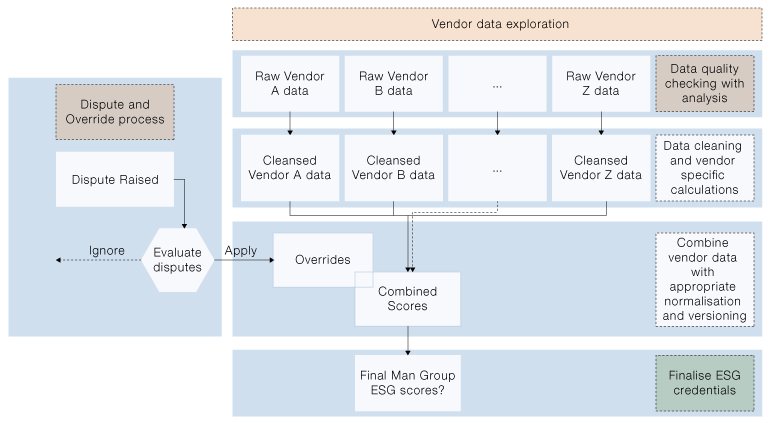

The involvement of human opinion is both a strength and potential weakness in a system that is built to be ‘fair’. Adding opinion adds complexity and ambiguity, and unless it is managed carefully, a loss of transparency and trust. We have therefore designed the process to handle human decisions, disputes and agreements in an auditable manner. This in turn allows for full transparency of where the systematic process is overridden, by whom and for what rationale.

The Detailed Process

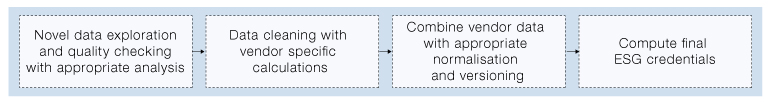

Combing the systematic and the expert overlay led us to the following process:

A consistent Man Group view allows the firm to reach out and engage with company management on a range of matters that both the firm and wider community see as important. It also helps meet new regulations - reducing repetition in the shifting need to report on those funds with an environmental or social emphasis. The use of a systematic approach also allows us to easily show regulators the approach we have taken. Finally, and maybe most importantly this approach moves our universe of issuers with data from a manual set of hundreds to an automated set of tens of thousands.

Back testing, Reporting and Go-live

Once we created a candidate methodology this in many ways was only the beginning. We reviewed the methodology through a variety of lenses.

We ran the data over historic data – we wanted to ensure that the ratings produced are relatively stable. If companies’ scores are changing frequently, it was important to be sure this was reflective of real underlying data changes rather than any instability due to the methodology itself.

We also ran the methodology on existing portfolios and checked the results against manual views. It was essential for us to understand how the methodology differed from manual ratings we had applied previously. This meant that we could identify the differences and make a judgement call on what is appropriate action in each case.

Finally, we made the data and methodology widely available throughout Man Group. This included an internal website to allow examination of individual issuers, integration with our back-office tools to allow easy reporting on the data, and a Python API for more quant-focused users to utilise the data. We believe that having many eyes on the data is one of the best ways to find potential issues.

Having completed these many reviews, we considered feedback and made some iterative updates to the methodology. We think the model will continue to evolve, but it has recently reached the standard where we think it is appropriate for our uses and adds value for our clients. It is therefore now in use as Man Group’s official internal ESG scoring system.

Where It Goes From Here

In future we believe that there is opportunity to expand the model and tooling to forward-looking data sources, to help direct our engagement with companies we are shareholders of and many other uses. Many of our investment teams are now looking at the rich data available as a potential future source of alpha.

Conclusion

No methodology or process is perfect. This is step one. Our aim was to create a methodology which reflects how each company aligns with our environmental and social values. As regulators and client demands change, the methodology will need to evolve as well.

As the ESG space further matures we will begin to see more nuanced approaches being required. We can already see this in the emergence of thematic funds such as those focused on clean water or biodiversity. This will require more detailed scoring mechanisms as well as an improvement in the underlying data sources. This in turn will increase the demands for companies to report clearly and accurately on their impacts across a wide range of factors.

As an asset manager, we believe we have an important role to play in creating a better and more sustainable future for investors and society. Through our systematic approach combined with an expert overlay we believe we have captured and can communicate a full spectrum of shades of green. Demand for ESG investing will continue to grow in coming years, and we in turn aim to grow and improve our internal ESG processes for the benefit of our clients and society.

1. https://www.nature.com/articles/d41586-021-01735-z

2. https://fortune.com/2022/06/10/elon-musk-tesla-nhtsa-investigation-traffic-safety-autonomous-fsd-fatal-probe/

3. https://www.nytimes.com/2021/03/25/business/musk-labor-board.html & https://www.forbes.com/sites/alanohnsman/2019/03/01/tesla-safety-violations-dwarf-big-us-auto-plants-in-aftermath-of-musks-model-3-push/?sh=3ba90beff19c

4. https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.