Inflation will not be enough to keep nominal earnings high; commodities selloffs may spell doom for Momentum; and the negative implications of improved delivery times.

Inflation will not be enough to keep nominal earnings high; commodities selloffs may spell doom for Momentum; and the negative implications of improved delivery times.

2 August 2022

Inflation Won’t Save Your Earnings

As the economic backdrop worsens – to the point where many analysts anticipate a full-blown, rather than merely technical recession in the US – we have been considering what this might mean for earnings. For the last 40 years, with inflation running around 2%, the effects of a recession have been fairly simple: negative real growth, low or non-existent nominal growth and a consequent fall in earnings, feeding through to stock prices.

But this recession may be different, with US CPI running at 9.1% year-on-year. Given that corporate earnings are nominal, does a recession in an inflationary environment matter that much? Put another way, will higher inflation be enough to save earnings in nominal terms?

History suggests not. We look at instances where US CPI is above 4%, and the ISM PMI is below 49 and falling. Although 45 is considered the recessionary threshold for PMIs, we chose 49 to capture the slide towards recession rather than simply the recession itself. Over four instances, the outlook is bleak (Figure 1). 12-month median forward earnings per share (‘EPS’) fell by 9%, while the S&P 500 Index fell by a median of 12%. The minimum falls were 3% and 11% respectively. For investors looking for a possible silver bullet to save nominal earnings, the answer is unlikely to be inflation.

Figures 1. 12-Month Earnings and S&P 500 Index Performance

Problems loading this infographic? - Please click here

Source: Bloomberg, Man GLG; as of 26 July 2022.

Commodities Collapse – and May Bring Momentum Down With Them

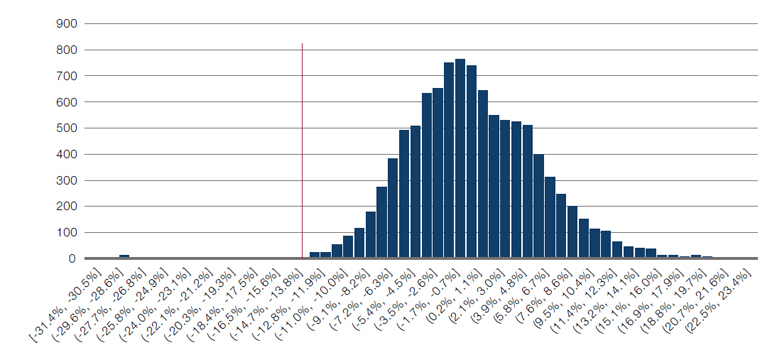

May, June and July have seen a rare collapse in the CRB Rind Index. The index measures the spot prices of non-speculative commodities such as rubber, wool tops, copper scrap and tallow, and has fallen by around 13% on a rolling three-month basis (Figure 2). Such a selloff has not occurred since 2008, and places it firmly in a the left tail of the distribution of returns (Figure 3).

But a sharp fall in commodity prices has wider implications, especially for factor moves and particularly for Momentum. Using a sample of the worst 2.5 percentile of CRB RIND returns on a 3-month rolling basis, we find that forward returns to 12-month long/ short Momentum get progressively worse, reaching a nadir of -18% over a 6-month time horizon (Figure 4).

Our explanation is that a sharp reversal in commodity prices reflects much weaker demand and major change in economic conditions. This effectively reverses the composition of the Momentum factor, and thus causes prior winners (as reflected by using the longer lookback of 12-month Momentum) to significantly underperform.

Figure 2. CRB RIND Index

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 28 July 2022.

Figure 3. Rolling 3-Month Returns to CRB RIND – 1981-2022

Source: Bloomberg, Man GLG; as of 26 July 2022.

Figures 4. 12-Month Earnings and S&P 500 Index Performance

Problems loading this infographic? - Please click here

Source: Bloomberg, Man GLG; as of 26 July 2022.

Delivery Status: Shipped

Just a few months ago we examined the unprecedented waiting times for ships unable to load or unload at the port of Shanghai. Last year, all eyes were focused on the congestion outside of the port of Los Angeles. But now it seems that the wish for a return to normal delivery times has been granted. Delivery times, as measured by the Federal Reserve Bank of Philadelphia, have suffered their third largest one-month fall since the inception of the index and has entered negative territory (Figure 5).

But should investors be careful about what they wish for? In our view, while this may help to tame inflation, this is another sign of weakening end consumer demand. If delivery times fall, we would expect inventories to soon rise in response, rarely a positive for corporate margins – and something we will monitor over the coming weeks.

Figure 5. Delivery Times

Source: Federal Reserve Bank of Philadelphia; as of 26 July 2022.

With contribution from: Ed Cole (Man GLG – Managing Director, Discretionary Investments)

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.