As global central banks part ways and sovereign-bond yields take different courses, we examine where the opportunities lie for credit investors. Plus, the AI revolution is consuming too much energy. This may halt its growth

As global central banks part ways and sovereign-bond yields take different courses, we examine where the opportunities lie for credit investors. Plus, the AI revolution is consuming too much energy. This may halt its growth

11 June 2024

This month, central bank meetings take centre stage, as investors contend with policy divergences and their implications for global financial markets. Last Thursday, the European Central Bank (ECB) announced a 25 basis-point rate cut, a notable departure from other major central banks. Japanese sovereign bond yields rose on the back of expectations its central bank will cut stimulus further. By contrast, in May, the Bank of England (BoE) voted to maintain rates at 5.25%, and the Federal Reserve (Fed) has similarly maintained a hawkish posture.

So, what are the opportunities for global investors? Rather than simply chasing the region with the highest all-in yield, we think various risk factors -- including economic growth and borrowers’ health -- must also be considered. Below, we explain why investors should consider specific parts of the market; types of debt; and hedging strategies, to target portfolio resilience in the face of persistent inflation and volatile monetary policy.

Picking up yield in the US

Global markets have already been grappling with the prospect of policy divergence for a while. Leading up to the ECB meeting, the euro weakened against the US dollar, and ECB policymakers announced they were comfortable with the risk of a weaker currency further exacerbating inflation. Investors in European assets may not be so sanguine, however. The cut will lower the overall yield of Euribor-based loans as the base rate falls (assuming that credit-spread levels stay the same).

Meanwhile, in the US, although consumers continue to face inflationary pressures, economic growth remains robust. Given that the Fed’s policy stance is driven by continued strength in the underlying economy and labour market, higher bond yields are set against a backdrop of stable fundamentals. In both the US and the UK, all else equal, we expect a ‘higher for longer’ interest-rate environment to maintain a relatively higher level of all-in yield.

The importance of risk management

However, as investors make strategic asset allocation decisions, conversations surrounding the higher all-in yield in the US credit market should be combined with a thorough risk-management framework and an analysis of the trade-offs between different segments of the credit market. Investors who can give up some liquidity may harvest a yield premium from private credit versus the broadly syndicated market in the US. We also believe that core middle-market US-direct loans benefit from smaller investor groups, more active lender involvement, lower leverage, and the presence of maintenance covenants, which enable lenders to proactively engage borrowers at the early signs of credit deterioration. Furthermore, the floating-rate nature of core middle market direct loans offer an inherent structural protection, providing income with an embedded hedge against inflation and interest-rate risk. In a falling rate environment, interest-rate floors provide direct loans with a minimum yield, another potential safeguard.

Given divergences in global central bank policies and continued inflationary pressures, examining issuer fundamentals is critical, even when the economic backdrop is positive. Lenders to US corporate borrowers need to consider their ability to manage their exposure to rising labour and raw input costs. For lenders exposed to the consumer cyclicals sector, the net balance between inflation and wage increases on the consumer bottom line may be a key driver of earnings and cash flow. In the current environment, we believe managers will differentiate themselves by generating consistent alpha through prudent credit selection.

Problems loading this infographic? - Please click here

Alpha generation through capital efficiency

In addition to generating alpha from prudent credit selection, investors also have room to reap value from innovative structures. Liquidity is king. So, optimising a foreign exchange (FX) hedging programme for capital efficiency and minimal cash drag can potentially improve the net return of an investment programme while reducing currency risk for investors.

A typical private markets closed-ended fund is a limited-partnership structure with hedges placed at a special purpose vehicle (SPV) level. For offshore investors looking to take advantage of the enhanced yield on offer in the US, recent regulatory guidance in Europe such as the Alternative Investment Fund Managers Regulations (AIFMD) marketing passport supported the creation of fund structures that are tailored to the needs of EU investors. Luxembourg-domiciled limited-partnership vehicles, such as the société en commandité simple (SCS) and the special limited partnership (SCSP) have been growing in popularity and prominence. Classified under the Reserved Alternative Investment Fund (RAIF) regime, these vehicles can be helpful in navigating administrative and regulatory burdens.

Conclusion: A different way forward

As monetary policy diverges, the answer isn’t just to go after the highest yield on offer. While we think that the US offers strong relative value on a global basis, investors should go back to basics and focus on the fundamentals to ensure that they avoid inflationary traps when choosing credit names. The middle market is attractive due to its structural protections against inflation and falling interest rates and stronger covenants. This is even more important in an uncertain macro environment. Finally, offshore investors can access the US market with innovative new hedging structures that combine management efficiencies with lower currency risk.

How the Tech Industry is Combatting AI's Energy Crunch

The problem

Traditionally, the primary barrier to fulfilling the insatiable demand for technology and computer power has been economics. However, both the slowdown in Moore’s law and the shift from a capex to a rental model with the adoption of cloud computing, mean that power constraints are now becoming the key limitation to artificial intelligence (AI) adoption. To put the issues into perspective: computer capacity has been growing at over 50%, quarter-on-quarter, since the first three months of 2023.

Data centres are often seen as the backbone or "brains" of the internet. They process, store, and network vast amounts of data behind the information services we use daily, such as video streaming, gaming, and AI. “Upgrading” these data centres with AI capabilities -- graphics processing units (GPUs) and related infrastructure -- is leading to extreme stress on electricity grids, generation capacity, and the environment.

Notably, most critical data for large companies still resides in-house. Applying AI to this data is even more costly due to power limitations, as hyperscalers (those large technology companies that operate extensive data centres and cloud services at scale) are significantly more power-efficient than enterprise data centres.

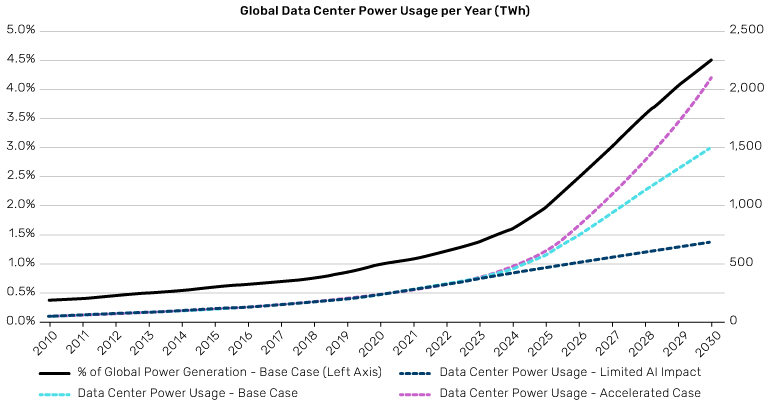

Gartner analysts estimate that by 2027, AI data centres' power usage will reach 500 terawatt hours (TWh), equivalent to Germany's entire energy consumption in 2022. Additionally, for every British pound spent on an AI server, by 2027, an extra 35 pence will need to be budgeted for electricity.

Figure 2: With continued accelerated growth, AI is using up a disproportionate amount of total global energy

Source: Semi Analysis from www.semianalysis.com/p/ai-datacenter-energy-dilemma-race

So, what can be done?

To avoid stunting the growth of AI adoption, we must address power production projections. Currently, an estimated 40% of existing data centres will be restricted by the power available. Access to power sources is becoming a key business differentiator for hyperscalers. In some regions, it is already impossible to get additional power supply, preventing the establishment of new data centres.

There are no quick fixes to ramp up power generation. The power industry has been hit by a copper shortage; and a typical copper mine takes about 10-15 years to explore, develop, and bring online. This situation coincides with the slowing of Moore's law as it reaches its physical limits, meaning scaling no longer provides the linear cost savings it historically did.

To address these challenges, the entire tech supply chain is exploring alternate ways to improve power efficiency, which in itself offers investment opportunities. Efforts can be broadly categorised into three areas:

- Semiconductor packaging innovation: advances in packaging materials, chiplets (multiple chips on a single silicon), memory designs for faster communication and lower power consumption

- Software innovation: Optimising data placement for efficient usage by AI tools

- New data-centre architecture: Innovations in server placement, floorspace reorganisation with GPUs at its heart, and cooling technologies (cooling currently accounts for a third of data centre operating costs)

Beyond chips

Beyond redesigning chips, servers, and data centres for greater power efficiency, the tech industry is also leveraging AI to manage data centres more intelligently. AI ops can help switch off chips and power them back on as needed, enhancing power efficiency. It would be naïve to ignore the influence of geopolitics and regulation on this issue. The next policy debate is likely to be about the ripple effect of AI power demand on energy pricing and the impact on non-tech, low-margin industries.

The global race for AI capabilities is not just about buying GPUs, but building a sustainable and resilient infrastructure that can power the future of technology.

All data is sourced from Bloomberg, unless stated otherwise.

With contributions from Alex Suss, Private Credit Investment Services Specialist, Putri Pascualy, Senior Managing Director at Man Varagon, and Sumant Wahi, Portfolio Manager at Man Group, focusing on technology equities.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.