This week, we explore why gold equities haven’t hitched a ride on the back of the precious metal’s rally. Also, notwithstanding last week's election announcement, we ask why miserable UK equity flows may be strangely rewarding for investors.

This week, we explore why gold equities haven’t hitched a ride on the back of the precious metal’s rally. Also, notwithstanding last week's election announcement, we ask why miserable UK equity flows may be strangely rewarding for investors.

28 May 2024

All that glitters is gold

Gold equities are leveraged to the gold price. If the metal’s price rises, gold-equity prices typically soar. So, gold’s recent, record-setting rally should have been good news for equities such as mining companies (there are c.85 publicly quoted gold-mining companies of note, with a combined market capitalisation of about $325 billion).

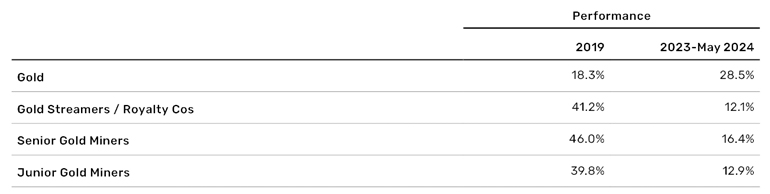

Unusually, gold equities have significantly underperformed the metal itself over the past two years. To understand why they’ve lagged, we need to understand why gold itself has outperformed. This may signpost to us when gold-mining stocks are likely to outperform again.

Figure 1: Gold-mining companies are not benefitting from the gold rush

Source: Bloomberg, Man Group

Why has gold rallied?

For investors, gold is often viewed as a safety net in times of uncertainty. It may offer some level of inflation protection, and a diversifier from the US dollar. These properties have driven the precious metal to outperform the S&P over the past two years.

Geopolitics has played a considerable role – the Ukraine war started the ‘flight to safety’; and the conflict in the Middle East has kept investors needing a hedge against any potential escalation.

But the US’s response to the Russian invasion has arguably been more impactful than the invasion itself. The US decided to freeze dollar assets owned by the Russian central bank. This move surprised foreign holders of dollars and led to many central banks diversifying their asset base away from the dollar. Gold may provide this diversity. It isn’t issued by any country or central bank, and so carries no political or credit risk.

Central banks have increased their gold purchases to record levels, with the People’s Bank of China accounting for over 70% of central-bank purchases last year, driving the gold price up. Chinese consumers have also invested in gold, as they’ve seen their net worth falling amid a property crisis and a slide in the Hang Seng key stock index.

Out of favour

The main drivers of the gold price have been central banks diversifying away from the dollar, and Chinese consumers flocking to safety. The underlying reasons why both types of buyer are acquiring gold do not favour the price of gold mining stocks.

Both groups are atypical buyers of gold equities: central banks rarely invest in specific sub-sectors of the equity market, and Chinese retail investors do not typically invest in Western equities.

Perhaps more importantly, gold miners’ value is denominated in dollars, and their profits are also in dollars – i.e not a good vehicle in which to diversify from the dollar.

No Western appetite

While East Asian buyers have acquired gold, Western owners have sold it. Western exchange-traded funds (ETFs) have parted with 23% of their holdings over the past two years. This can be attributed in large part to the Treasury Inflation-Protected Securities (TIPS) yield rising. The TIPS yield is a proxy for real interest rates. When it rises, investors can achieve a higher risk-free real return, so they may sell gold and swap it for dollars. When the TIPS yield falls, the opposite happens.

Owing to buyers from Asia, gold has held up well in a rising-TIPS-yield environment. Western investors are nervous this relationship will correct should the gold price fall. They have been unwilling, so far, to credit mining names for the metal’s higher price.

When to enter

The value of gold mining stocks will (nearly) always increase when the gold price goes up. And these securities may outperform when Western buyers become interested again. Historically, this has been when interest-rate cuts are imminent, rather than an event which is consistently being pushed back. Alternatively, a separate catalyst may cause a ‘flight to gold’. This might be the Middle Eastern conflict escalating, or a Chinese yuan devaluation.

UK Equities – Reconjuring a Vanishing Market

The performance of UK equities may just be turning a corner, with the FTSE 100 index rising 12.5% over the past three months.1 UK equity flows have suffered since the Brexit referendum in 2016. The asset class has long been an investment wallflower: unpopular with both local and international investors. 20-year valuations are still low when we compare UK equities with those of other developed markets.

So, what’s changing?

Unlike their European and US counterparts, UK pension funds are under-indexed to their home market. This has caught the attention of the Government, which has proposed various efforts to support UK companies. These include: the Mansion House reforms, setting up a British individual savings account (ISA), and discussions about a British sovereign wealth fund.

In 2023, we saw companies take matters into their own hands; many ‘de-equitised’ (swapping debt for equity). That meant a spike in buyback levels, where one of the UK’s largest banks has now repurchased nearly 25% of its shares. This came in the context of minimal initial public offering (IPO) activity and an unusually low level of issuance.

Problems loading this infographic? - Please click here

In addition, many UK companies have opted to re-list in the US, which has driven the share price higher for key names. Merger and acquisition (M&A) activity has also been strong. Last year, about 2% of the market was bid for. 39 companies in the UK with market capitalisations exceeding USD$100 million were bid targets, offering an average premium of 58%. That continues this year, with a further 2% bid for.

Rewards on the horizon

So, although the long-term picture may seem gloomy, companies’ scenario planning (buybacks, M&A and re-listing in the US) has been quite profitable for investors. For example, investors can look to enjoy a buyback yield of nearly 3%.2

While pension funds may have yet to bite, we think that the bids we’re seeing from private equity and companies are a sign that significant value remains in the market.

Ultimately, performance will drive further flows to UK equities. For the shift to accelerate, we expect to see:

- Domestic equity investors stop selling their home asset class

- UK equities spark interest from international investors, which could be achieved through the increased M&A activity of late

- Pension reform, and an improved cost of public listing in the UK versus selling via private markets

In conclusion, while challenges persist, recent performance suggests that UK equities may finally be stepping out of the shadows.

All data Bloomberg unless stated otherwise.

1. Bloomberg, UKX (FTSE100 TR index). Data as at 22 May 2024.

2. Capital Markets Industry Taskforce, Bloomberg. Data as of 31 December 2023.

Index Definitions:

S&P 500: The S&P 500 is a market-capitalisation-weighted index of 500 leading publicly traded companies in the U.S.

Han Seng: The Hang Seng Index, or HSI, is a free-float market capitalization-weighted index of the largest companies that trade on the Hong Kong Exchange.

FTSE 100: The FTSE 100 index tracks the 100 largest public companies by market capitalization that trade on the London Stock Exchange

With contributions from Albert Chu a portfolio manager and Angus Poland, an analyst focusing on natural resource strategies at Man Group and Henry Dixon, a portfolio manager focused on UK equities at Man Group.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.