After the financial crisis, private equity was in its element; now, it’s the turn of private credit.

After the financial crisis, private equity was in its element; now, it’s the turn of private credit.

September 2020

Introduction

It feels like every crisis is spent comparing and contrasting the present meltdown with previous ones. So it is that we’ve spent a great deal of time recently looking back to 2008, thinking about how our experience of that period of intense volatility and existential anxiety might inform our actions now. If anything, what’s striking is how different the current crisis is from the Global Financial Crisis (‘GFC’): we’re not (over) worried about the financial system this time; it’s developing rather than developed economies that seem most at risk; and liquidity in public markets has remained strong throughout.

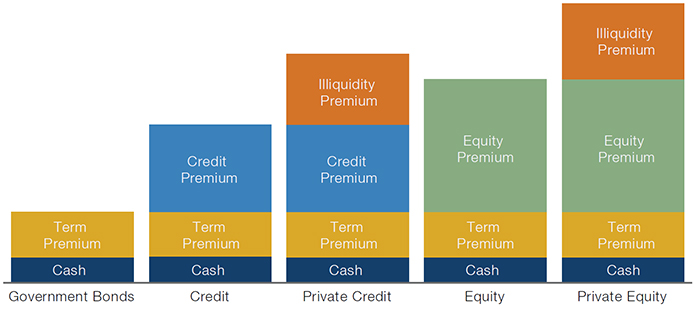

Crises are about opportunities as well as challenges, though. Private equity (‘PE’) firms thrived in the wake of 2008, deploying their capital into situations where public equity providers had retrenched. It is a good rule of thumb that private markets tend to perform best in the aftermath of public market volatility. Figure 1 provides a theoretical overview of the relationship between public and private markets, and between equity and credit, with an illustration of the various premia investors should demand for participation in each asset class.

Figure 1. The Relationship Between Public and Private Markets

Source: Man FRM. For illustrative purposes only.

Separately, private credit has undergone transformative evolution over the past decade. From a relatively niche asset class, private credit has increasingly become an integral part of many institutional investors’ asset mix. As investors cycle their portfolios out of public equities – cognizant of the historical opportunities presented by private markets in the wake of market pullbacks – we believe there is a strong case for preferring private credit over both public credit and public and private equity at this point in the cycle.

The Road from PE to PC

As indicated in Figure 1, the theoretical difference between private and public markets lies in the illiquidity premium – the extra return received by transacting in the private market space through additional fees and superior terms from bespoke negotiations.

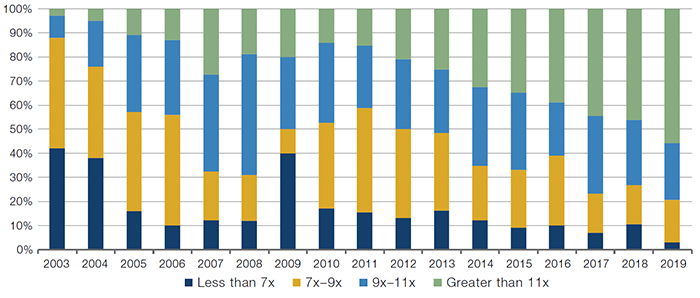

The problem is that private equity simply isn’t currently delivering investors the returns they require. This is down to a number of factors, from the outperformance of public equities on the one hand, to the massive dry powder waiting to be deployed by PE firms and the relative paucity of genuine growth opportunities in which to deploy it. As a recent study by Bain1 indicated, PE has largely been delivering performance by applying greater leverage to transactions and through multiple expansion (Figure 2). This is a highly competitive, mature market in which vast sums of capital are chasing increasingly rare opportunities in our view. The illiquidity premia paid to private equity holders simply isn’t adequate, we believe, to compensate them for the meaningful risks involved.

Figure 2. Average EV/EBITDA Purchase Price Multiple for US Buyout Deals

Source: Refinitiv; as of end-2019.

Note: Includes deals with disclosed purchase price and leverage levels only.

In contrast, the premium paid to investors in private credit relative to public credit appears highly compelling to us. In what was already a low-rate environment, central bank responses to the coronacrisis have driven public credit spreads to historical tights. The premium investors receive for investing in private credit over both public high-yield and leveraged loans is at near-record levels. This increase in the premium commanded by private credit comes at a time when the universe encompassed by the asset class has expanded rapidly.

If we look at the evolution of private credit, we can see that the first real surge in interest in the asset class came in the wake of the GFC, when banks drew back from corporate lending under regulatory pressure and non-traditional financial services firms stepped into their place. Since then, corporate direct lending has grown exponentially, with lenders demonstrating a high degree of sophistication and impressive underwriting standards. This has effectively provided a blueprint for non-traditional lenders to move into a range of other lines of credit provision, as banks not only focused on lower capital charge activities but have also streamlined lending, shedding smaller or specialised lending business lines. This means investors can access a whole host of new exposures in private credit, diversifying their portfolios away from corporates towards specialty finance. Categories available include risk transfer, consumer lending, real assets, real estate, structured finance and orphaned and special assets such as non-performing loans, receivables and equipment leasing.

Essentially, if the years following the GFC were about private credit stepping into the corporate lending market, then the more recent evolution of the market has involved private solutions to a host of specialty lending opportunities that were previously the preserve of the big banks. The lack of traditional financing sources for these categories and the favourable supply/demand dynamics within them mean that returns are often highly attractive. It should also be noted that these lending categories demonstrate a range of attractive characteristics from a risk perspective, generally experiencing stable performance even under stress; being asset heavy with strong underlying fundamentals; often structured to help mitigate downside risk but maintain the upside optionality of capital gains; producing durable cash flows to support self-amortising exits.

Conclusion

In summary, private credit has long been considered one of the more compelling asset classes for investors looking for diversification away from traditional public markets. In recent years, the range of exposures offered by the asset class has broadened dramatically and the current opportunity coincides with a period in which private equity is facing significant challenges. Investors should take steps to educate themselves about an asset class which is likely to feature increasingly prominently in portfolio allocations as we move through the latter stages of the crisis and into the next stage of the cycle.

1. Source: Bain & Co; Private Equity in 2019: Strong Deal Activity Despite Worsening Macro Conditions; 24 February, 2020.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.