Dissonance between perception and reality persists, creating notable opportunity.

Dissonance between perception and reality persists, creating notable opportunity.

June 2024

Introduction

Banks came under significant stress in early 2023. US regional banks such as Silvergate, Signature and perhaps most famously, Silicon Valley Bank (SVB), collapsed. European giant Credit Suisse had to be rescued by UBS in a deal brokered by the Swiss government and the Swiss Financial Market Supervisory Authority. While we believed it was localised within certain subsectors of the industry, the market implied that the entire banking sector would undergo stress. More than one year on, what do banks look like and where are the risks and the opportunities for credit investors?

In this paper, we will begin by looking at the banking sector today and the stark differences between the attractiveness of European and US banks, before moving on to consider the rise of credit risk sharing (CRS), and the role it plays in supporting banks, as well as what CRS can offer investors. Finally, we will move beyond banks to examine some of the select opportunities emerging more broadly within financial credit.

Let’s dive in.

The European and US banking sectors are a world apart, largely owing to the distinct differences in how they are regulated.

Part I: The global banking sector today

The global banking sector is not homogeneous. Rather, the European and US banking sectors are a world apart, largely owing to the distinct differences in how they are regulated. Since the Global Financial Crisis (GFC), the European regulator has implemented a far more stringent regulatory system for banks compared to that which operates in the US.

What are the differences?

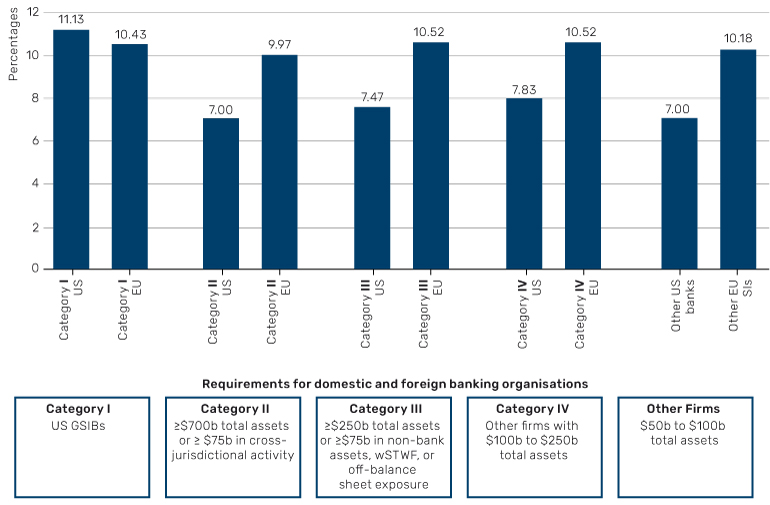

Turning first to capital requirements, which describes the amount of capital a bank or financial institution is required to hold by its regulator, Figure 1 shows the requirements for both large and small banks in the US compared to Europe. It clearly shows that while there is relatively little deviation between the requirements for large and small banks in the European market, in the US, the capital requirements for regional banks are much lower.

Figure 1. Capital requirements for regional banks are much lower in the US

Source: ECB, as at 30 November 2023.

When rates were volatile during the European Sovereign Debt Crisis of 2009- 10, European banks became accustomed to hedging or carrying higher capital levels relative to their exposures.

Further, any losses European banks make on their liquidity portfolios (a book that’s available for sale if banks need to raise liquidity) must be marked to market. Consequently, when rates were volatile during the European Sovereign Debt Crisis of 2009-10, European banks became accustomed to hedging or carrying higher capital levels relative to their exposures. This meant that when interest rates started to rise at the end of 2021, it posed less of an issue for European banks. Further, every quarter, the impact of rising rates and low government bond prices on their capital was visible to investors.

By contrast, prior to the collapse of SVB, US banks with less than USD 250 billion in assets did not have to deduct losses from their liquidity portfolios. This figure has since been reduced to USD 100 billion – although there is notably a five-year transition period – but this helps to explain how the SVB debacle, a topic we wrote about in an earlier paper, was able to happen. Once SVB’s losses on government securities were taken into account, the firm was in negative equity. It was this which drove the regional bank to need to raise capital, leading to fears about solvency and ultimately driving out liquidity. So, while liquidity led to the demise of SVB, it was capital that drove the initial concerns.

The investability of the European banking sector has improved dramatically, which is also good news for bondholders.

The stricter regulations that banks of all sizes in Europe have been subject to since the GFC has also meant that they have shown resilience through the recent period of rising rates. During the era of zero to low interest rates, European banks produced sub-par earnings leading the equity to trade at low multiples and many to regard European banks as uninvestable. In response, many European banks took steps to become leaner, including through establishing and developing their digital footprints. As we then entered a rising-rate environment, European banks not only operated with lean business models, but were also the beneficiaries of higher rates. Today, the average return on equity (ROE) is 12% and banks are giving capital back. In short, the investability of the European banking sector has improved dramatically, which is also good news for bondholders.

Problems loading this infographic? - Please click here

In the US, a large question mark continues to hang over commercial real estate, particularly the office sector.

Is this sustainable in an interest cutting environment?

With inflation proving sticky, rate cuts look likely to be fewer in number and further into the future than we expected at the beginning of the year. Nevertheless, many of the European banks with short-duration portfolios are hedging their balance sheets. This means that even when rates begin to fall, their earnings will be more resilient. We saw this trend play through into the first quarter as banks published their full year 2023 results and highlighted how much they hedged in the third and fourth quarters of 2023 and stated that they will continue to do so. This is improving the quality of earnings, which improves the investability of the equity. From a credit investor’s standpoint, it is a very positive sign when the equity is once again an attractive investment and the returns look sustainable.

By contrast, in the US, a large question mark continues to hang over commercial real estate (CRE), particularly the office sector where vacancy rates are between 15-30%, depending on the location. The largest lenders to the CRE sector are the US regional banks and that is where we expect the stresses to occur. Investors therefore not only need to be concerned about less stringent regulation in the US, but also credit quality.

Problems loading this infographic? - Please click here

With vacancy rates between 3-7% and a lower exposure to CRE compared to the US regional banks, Europe does not face the same issue. While there are likely to be pockets of stress, owing to higher for longer interest rates, this is unlikely to be as widespread as in the US. Another point of difference to note is that the sponsors of CRE deals in Europe are generally from smaller families who often have much more of a connection to the area and are consequently more willing to put in money to refinance a deal.

Deposit beta – the quantum of central bank rate increases actually passed on to banks’ customers – has remained low in Europe compared to prior cycles.

Deposit beta presents a further challenge to US banks

A further concern for US banks relates to revenues, which are largely achieved through net interest income. Banks are tasked with modelling what depositors are likely to do in any environment. Although very few banks on either side of the Atlantic have got this right of late, in Europe, banks have been significantly more conservative, because the last time rates were as high as they are today, depositors were much more active with their money, moving it into term deposits. This has not come to fruition this time around, however, so deposit beta – the quantum of central bank rate increases actually passed on to banks’ customers – has remained low in Europe compared to prior cycles.

Problems loading this infographic? - Please click here

In contrast, deposit beta in the US has been much worse than expected, particularly in the regional banks. One might argue that this has, in part, been a response to the collapse of SVB, as retail depositors have chosen to put their money into larger banks rather than smaller, regional banks which they perceive to be less safe. As a consequence, over the last four quarters, regional banks have been forced to make upwards revisions to their deposit beta. Many were counting on rates being cut by 100 basis points (bps) in 2024 and expected this to drive loan growth in the tail end and to lead to an improvement in their net interest margins through reductions in deposit rates but this has not, to date, played out.

To summarise, US regional banks are experiencing pressure on the top line, cost pressures from inflation and a potential asset quality problem with CRE – and all these problems are happening simultaneously.

Dissonance between perception and reality opens up opportunities

It perhaps will not come as a surprise with all of the above said that we believe there are opportunities in financial credit, and most are skewed towards Europe.

Problems loading this infographic? - Please click here

When there are those fears without the ultimate bust, it creates opportunities for nimble and experienced investors.

Taking a step back, investors often worry about the performance of financials through the cycle but as Moody’s data shows, very few of them go bankrupt. However, when there are those fears without the ultimate bust, it creates opportunities for nimble and experienced investors, namely the chance to buy quality credit at attractive prices. This has been true since 2008 as the perception persists that banks are operating as they did before the GFC – extremely highly levered and taking on significant risk. However, as we have previously discussed, regulation has markedly evolved since then and has, in effect, been a friend to bondholders. This dissonance between perception and reality creates notable opportunity for active, research focused managers.

Problems loading this infographic? - Please click here

We think those banks with secured balance sheets, funded primarily by a largely retail deposit base, are particularly attractive in the current environment.

Not all European banks are created equal

The emphasis on active management and in-depth research is key because, perhaps to state the obvious, not all financial credits are created equal. As outlined in a previous paper, we remain on guard for global growth to slow. With this in mind, our preference is for financials as a more defensive play. Specifically, we think those banks with secured balance sheets, funded primarily by a largely retail deposit base, are particularly attractive in the current environment. This lends itself, in particular, to banks in the UK, Ireland as well as Iberia, where floating rate mortgages are commonplace and banks there are consequently benefitting from the higher interest-rate environment.

Pockets of value are also appearing higher up the capital structure in parts of Eastern Europe, where the large national champions, many of whom have not accessed the market before have to raise debt for regulatory purposes. Eastern Europe is not always given consideration by investors because it falls between emerging markets (EM) and Europe. It is likely to continue to be a good hunting ground, throwing up some very attractive opportunities for credit investors who are being paid for both the geopolitical risk and for the fact that many of these banks are new issuers. In addition, parts of Eastern Europe are already in the downcycle in terms of rate cutting, thereby circumnavigating questions about what higher rates for longer does to the economy. Although these banks will have lower net interest margin (NIM) owing to lower rates, they are also likely to have fewer asset quality issues.

European credit has historically formed a small proportion of global credit benchmarks and consequently a much smaller component of most global portfolios, but we believe the current banking landscape offers an attractive opportunity set for high conviction, bottom-up, active managers able to identify those banks which have very strong solvency, profitability and liquidity.

Part II: An opportune time for credit risk sharing?

An often less discussed or explored area of credit markets – and one which has served to support banks in the face of increased pressure to optimise their balance sheets in the years since the GFC – is credit risk sharing (CRS).

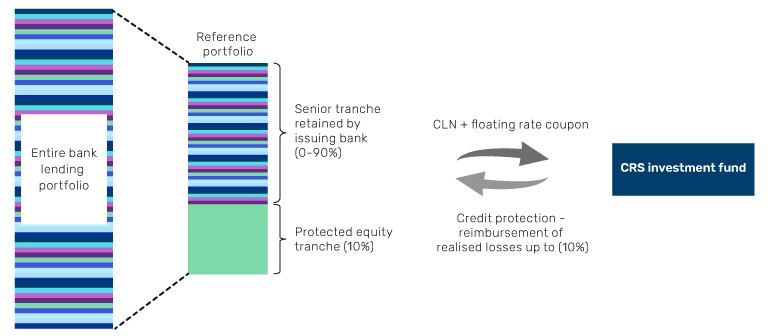

For readers who are not already familiar, CRS typically involves a bank issuing a credit-linked note (CLN) whose performance is tied to an underlying reference portfolio of loans originated by the bank. Institutional investors receive a floating-rate coupon while the bank effectively buys protection on the portfolio, reducing its overall credit risk. Typically, the loans in the reference portfolios are revolving credit facilities and first lien loans, but can vary across a wide range of asset classes and sectors. CRS is sometimes used interchangeably with significant risk transfer or SRT, but the latter specifically refers to a form of securitised credit risk sharing.

Figure 7. The typical CRS structure

Source: Man Group. Schematic illustration.

Since the GFC, banks have sought methods of optimising their capital usage to grow lending operations while maintaining key relationships with their clients.

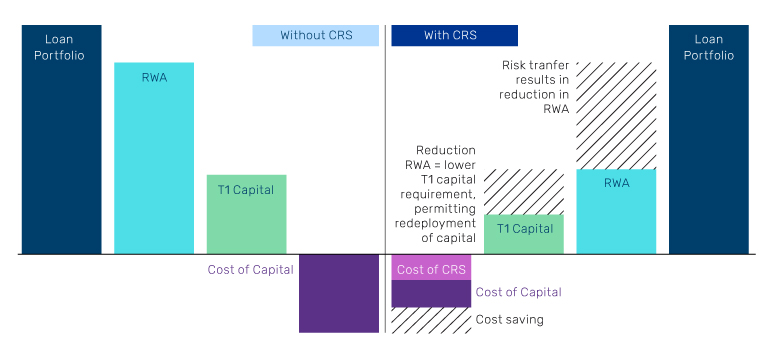

Since the GFC, and the ongoing implementation of increasingly stringent regulatory requirements, including Basel III, banks have sought methods of optimising their capital usage to grow lending operations while maintaining key relationships with their clients. CRS allows a bank to redistribute credit risk to third-party investors. In turn, this enables the redeployment of a substantial amount capital (which would normally be held on balance sheet as a regulatory requirement) back into income generating operations. This can support growth in bank profitability as evidenced earlier in the paper. CRS is supported by the banking regulators as they are seen as a tool to help the sector mitigate credit risk.

Figure 8. Banks issue CRS to reduce regulatory capital, optimise balance sheets and to generate higher returns on capital

Source: Man Group. RWA refers to risk-weighted assets.

The benefits of CRS for investors on the other side of the CLN trade can include:

- Access to highly income generative floating-rate instruments, potentially providing coupons from high single to double digits

- Exposure to a diversified set of corporate and consumer loans originated by banks that are typically unavailable in public markets

- Lower observed levels of volatility given the private nature of the assets, consistent income generation and the medium- to long-term nature of the institutional investor base

CRS has existed for over two decades, predominantly among European banking institutions, but US peers are coming into their own of late.

Is the Basel III endgame a new beginning for CRS?

CRS has existed for over two decades, predominantly among European banking institutions, but US peers are coming into their own of late, namely because of clarification from the Federal Reserve, which has led to greater interest from US banks. We are also rapidly approaching the implementation of new capital rules which will begin to come into effect next year. Following the US regional banking crisis of early 2023, US regulators have proposed a tighter set of restrictions which could significantly increase the amount of riskweighted assets a bank would have to hold. Therefore, the CRS market appears poised to broaden in terms of size and the number of issuers as banks look to tap into this asset class as a means of capital relief.

Problems loading this infographic? - Please click here

An expanding universe of high-quality and heterogeneous credit exists just beyond the reach of traditional credit markets.

In short, an expanding universe of high-quality and heterogeneous credit exists just beyond the reach of traditional credit markets. While we believe banks can substantially improve allocated capital efficiency and increase asset velocity while retaining important client relationships and their attendant fee income streams, buyers have the potential to receive low-beta, high-quality and predictable cash flows tied to contractual obligations not otherwise available or replicable in the capital markets.

Section III: Broader than banking: Other opportunities across the financial sector

So far, we have focused solely on the banking sector, but opportunities in financials are not just limited to banks. Indeed, there are several institutions which have different characteristics to banks and are currently trading at attractive valuations.

The insurance sector bounces back

Turning first to the insurance sector, many P&C (property-casualty) insurance companies experienced fairly challenging losses after Covid, as a result of both claims inflation and higher catastrophe event volumes. They responded to that by significantly repricing policy premiums which led to a marked improvement in underwriting profitability in 2023 and which we expect to continue during 2024. An example of this repricing is clearly visible in automobile insurance where policies have experienced double digit inflation for almost two years, as shown in Figure 10.

Problems loading this infographic? - Please click here

Like banks, insurers have taken advantage of rising interest rates. During the low-interest rate environment of the last 10 years, the income generated from short-dated investment portfolios, particularly in the non-life space, was relatively muted. As rates have risen, however, insurers have been able to reinvest proceeds of maturing bonds into higher yielding securities, rapidly improving their investment income.

Business development companies: pockets of weakness more than offset by higher interest income

In the US, we have seen wide spreads on business development companies (BDCs), firms which make loans to middle market companies and are regulated entities but have a different structure to banks. The sector has been growing in scale since the GFC as tighter regulatory requirements for banks, which we have already discussed, caused them to retrench from lending to small and middle-market companies – and BDCs stepped in to fill the financing gap.

BDCs’ leverage (based on assets/equity) is capped at 2x or 3x depending on their regulatory approvals. This provides bond investors with a significantly greater equity cushion than they have when investing in US banks. By comparison and despite tighter regulatory requirements, the latter have leverage on middle market loans (based on loans/equity) of approximately 8-10x.

Crucially, defaults have been more than offset by higher interest income as a result of higher rates.

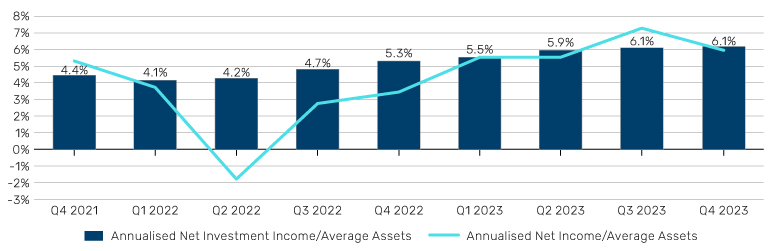

Given many of the loans BDCs make are floating rate, they experienced some selling pressure towards the end of 2023 owing to worries about the rising interest burden on borrowers and about a subsequent pick-up in defaults. Although we have seen a small increase in the proportion of BDCs’ loans which are effectively in default, such as in the healthcare sector, the extent of this has been relatively muted. Crucially, defaults have been more than offset by higher interest income as a result of higher rates. Further, the sector’s operating profitability (based on net investment income/average assets) is close to all-time highs, contrasting with its spread underperformance versus the corporate index.

Figure 11. Operating profitability close to all-time highs

Rated BDCs: annualised net investment income quarterly earnings breakdown and corresponding return on assets

Source: Moody’s Ratings, as at 31 December 2023.

Conclusion: a bright future for European financials

The European banking sector has undergone a transformation since the GFC and has thereby avoided many of the issues US banks continue to face today. We consequently believe opportunities in credit are significantly skewed to Europe, as well as a growing SRT market, which offers benefits to both banks and buyers. As evidenced, there are also opportunities for astute investors across the financial sector, in our view, but as ever, selectivity and deep research remain key in order to capitalise on the most attractive opportunities and to avoid potential pitfalls.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.