Why market positioning is just as important as fundamentals and valuations when investing in emerging-market debt.

Why market positioning is just as important as fundamentals and valuations when investing in emerging-market debt.

March 2022

Recorded on 28 February, 2022.

Episode Transcript

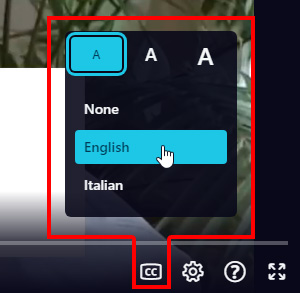

Note: This transcription was generated using a combination of speech recognition software and human transcribers and may contain errors.

00:00

Hello everyone. My name is Phil Yuhn, I'm a portfolio manager on the Emerging Markets Debt team here at Man Group. And today I'm going to talk about market positioning. Most market participants know how important fundamental and valuation analysis is when assessing markets, but I think one part that is often overlooked is market positioning. So, in the next couple of minutes I'm going to talk about why market positioning is important, how to assess market positioning and then to see how market positioning impacts market prices in certain moments of time. So, on the next slide we're going to first start with explaining why market positioning is important. On this slide you see two lines. The blue line which corresponds to the left-hand axis shows you the amount of bond inventory held by US primary dealers. So, this is in essence a measure of their ability to warehouse risk. And you can that see from the early 2000s right up until the financial crisis, their balance sheets increased exponentially.

01:00

After the financial crisis however, their balance sheets became significantly impaired to the point where today, it's less than a tenth of what it was during their peak. To make matters worse is what's been happening on the other side of the equation. When you look at the yellow line which corresponds to the right-hand axis, what we show you here is the market cap of the Bank of America Merrill Lynch, US High Yield Invest.

01:30

We use this as a proxy to show you how much of an increase we've seen in tradable assets in the bond market. And you can see in the global financial crisis period it's gone the opposite direction over the balance sheets of the broker-dealer's account. So, not only has the ability of the bank's ability to make markets become more impaired, on the other hand the number of investible assets has grown much larger. So, there's become a much larger gap in liquidity.

02:00

Now, to make matters worse, there's another trend that we see in the markets, which you can see in the next slide and that's a trend in growth of ETFs. Emerging markets that is no exception. And the way we show you this, is by looking at the Hard Currency markets where the ETFs are the largest in our space. What we're showing you here in this chart is to show you the amount of assets managed by ETFs relative to the 10 largest actively managed Hard Currency fund managers.

02:30

And you that over the last decade or so, the share managed by ETFs has more than doubled and it's almost 50% relative to these 10 largest active fund managers. Why is this important? It's because ETFs, by definition, have to invest when they get inflows in, and they have to sell when they get outflows. In other words, they cannot hold cash cushions.

03:00

Now, when you get inflows, that's less of an issue for the markets, because most market participants in our space tend to be long data, and so they benefit when flows come into ETFs when they purchase risk assets. We'll also view in the next slide just how market position is with these peers. A bigger issue, though, is when there's outflows. When there are outflows in moments of stress these types of forces sell and then that leads to a liquidity crunch.

03:30

And then in turn market participants, which as I've mentioned, tend to be long data, they then are forced to sell, because they have market losses and they sell into a very eloquent market where the ETFs have already been selling as well. And so, this is why it's been very important to keep track of this trend as well in the markets. Now, in the next slide we show you how to assess market positioning.

04:00

What we've done, is look at the largest Hard Currency fund managers, the largest Local Currency fund managers and the largest total return fund managers in our space. And what we've done is looked at their recent performance and regressed them against a set of global risk factors. So, on this slide what we show you, is the output from such regression for total return fund managers in our space. So, total return managers, meaning benchmark diagnostic absolute return fund managers.

04:30

And we picked three moments in time to show you how market price actions get impacted by these coefficients. Before we go there, I wanted to highlight risk factors that we used for this analysis. The first is the EMBIG DIV IG. That is the investment grade portion of the Hard Currency dollar-denominated government funds. Next one, EMBIG DIV High Yield, are the high yield government funds denominated US Dollars.

05:00

So, these are the frontier markets in our space. The next one below that is CEMBI Broad Diversified High Yield. Or EM High Yield corporates, so these are Chinese property developers, for example. And then finally the next two, GBI-EM Rates AND GBI-EM FX, are the Local Currency segments of our universe. And then at the very bottom, we have US Treasury 10 year. Now, starting with the first column, we show you here are the positioning of these market participants right before the COVID shutdown.

05:35

And what you can see is that the average market participant was long risk across every statement of our universe. The only exception, of course, is US Treasury 10 year, which by definition, is a risk-free asset. So, if you're long risk assets, then you'll be underweight the risk-free asset here. That's why that's negative. Now, segue to the next, middle column, this shows you the market positioning of the same market participants at the beginning of 2021.

06:00

Again, you can see that market participants are long risk across the board. However, one notable change to make note of, is with the GBI FX. You can see there, market participants have almost doubled their exposure there, leading in 2021, presumably based on a fundamental in valuation analysis. Finally, we flash forward to the beginning of this year.

06:30

Again, market participants are long, but the one notable change to make not of here, is with the first coefficient. The EMBIG DIV Investment Group. What you can see is market participants almost tripled their exposure there. Now, why am I pointing out all these changes? Just to show you how in turn have impacted price action, which we'll now show you on the next slide. The next slide here shows you the returns for three different moments in time. The upper portion of this table shows you the returns of our three main indices in our universe.

07:05

So, the EMBIG is the Hard Currency Index. The GBI-EM, GLOBAL Diversified is the Local Currency Index. And then finally the CEMBI Broad Diversified is the EM Corporate Index. And then we show you the sub-segment portions of each one. Below that, you see the returns of the 18 largest total return fund managers in our space. So, let's start first with the first column. That shows you the returns during the March 2020 sell-off where we had the COVID shutdown.

07:33

As I showed you in the earlier slide, market participants were long across every segment of our universe, and so it's not surprising that when the market starts to sell off, these fund managers had negative returns. And you can see the magnitude of those returns with the last three lines here. So, the average shows you the average return of these fund managers, the blended index shows you what the return was of the 50% Hard Currency, 50% Local Currency Index, to show you a reference point of the broader markets.

08:05

And then finally the beta, the implied beta that these investment managers were running. And keep in mind, these are total return fund managers, not data managers. What you can see during that March selloff, is what started off as a normal market selloff, deepened further. And the reason for that, is because of the ETF effect. ETFs had over three billion dollars of outflows over this relatively short time period, which exacerbated a liquidity crunch that I went into at the beginning of this presentation.

08:35

And so, fund managers who were long every single risk asset, in turn faced large market losses. Now, let's go to the middle column where we show you the returns for Cambi year 2021. If you recall on the prior slide, I'd shown you how market participants had increased their exposure in particular to the FX compartment of the global, of the GBI-EM index.

09:00

In a year, where most of our indices were in the red, it was not coincidental that the biggest underperformer was the Local Currency Index. And you can see that borne out in the returns of the fund managers, and again, their average return was similar in line to the losses that you saw on the broader markets as well. And then finally we look at the last column, which shows the returns in the first month of 2022. Again, keeping in mind the previous slide, I'd shown you that market participants and coming into 2022 had increased significantly the exposure to IG Government Bonds.

09:40

The IG sovereign Index. So, not surprisingly again, not coincidentally, that was the biggest underperformer to start off the year. That portion of our universe was down -3.6%. That in turn led to the average fund manager end quota return to have returns that were subtly worse than the Broader Universe as well.

10:00

So, this is to show you how market positioning can impact the markets as much as fundamental evaluation can, particularly in times discussed. I felt that it would be nice to conclude with a real-life recent example, which you can see on the next slide. Russia and Ukraine are obviously very timely at the moment right now. The purpose of this call is not to talk about the fundamental in evaluation around Russia and Ukraine, rather what I wanted to focus on here, is to show you the market positioning, the evolution of the market positioning of these two countries.

10:40

And the way we show you that, is by showing you the output from the regression of the Hard Currency benchmark fund managers versus these two countries' coefficients. So the way to translate the numbers that you see here, is that a positive number means Hard Currency fund managers on average are overweight relative to the benchmark. A negative number means they are underweight relative to the benchmark.

11:00

And roughly speaking, these coefficients translate to market win. So, in case of Russia, if you look at the first line, at the beginning of January 0.058 means that they were roughly 5-6% overweight in Russia, relative to the benchmark. And that's where we start with this analysis. When you look at where we were at the beginning of the year, market participants were very long Russian assets. And they were market-weight Ukraine. Now, looking at the Russia component, as the uncertainty continued as the conflict started to escalate, you can see that market participants did reduce their Russia overweight. So it went down to roughly half over the next month. However, at some point they stopped reducing, probably because of an anticipation that this conflict would be resolved without actual any warfare. And so, that's why you see the coefficient stabilize at around that 0.027 level, around 0.026.

12:00

That's where we were as of the middle of February. Ukraine showed a similar trend. The beginning of the year they were market weight, but as the market was starting to price in that this conflict will be resolved, relatively peacefully, market participants were very comfortable adding longs to Ukraine, and so you can see that coefficient increase, and so market participants were left long, both Russia and Ukraine leading into the events last week.

12:30

And while it's a very fast-moving market right now, the markets have been moving up and down. The one thing we want to point out here, was that market price is moving just beyond the fundamentals, this market positioning has had an impact as well too. There'd been days when we can come in, Russia and Ukraine assets are down meaningfully, because again of this crowded positioning, selling into markets that have lower liquidity even in the best of times, certainly has even less liquidity in stressful moments as well.

13:00

So, in conclusion what we wanted to show you here, is that, while there's always a place for fundamental valuation analysis. Another important factor that market participants need to, and should look at, in terms of analysis, is market positioning for the reasons we outlined to you before. Why it's important to date, because of the lack of liquidity. It can impact prices as much, if not more so than fundamental evaluations in times of stress. With that I'd like to conclude the web pass for today. I want to thank everyone for listening and if you have any follow-up questions, please reach out to your relationship manager. Thank you.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.