After suffering the worst start to a year since the inception of IG indices, we are starting find better value within investment-grade markets. Valuations look more attractive and all-in yields have improved, which has created significant opportunities for active managers.

After suffering the worst start to a year since the inception of IG indices, we are starting find better value within investment-grade markets. Valuations look more attractive and all-in yields have improved, which has created significant opportunities for active managers.

July 2022

Recorded on 06 July 2022.

Episode Transcript

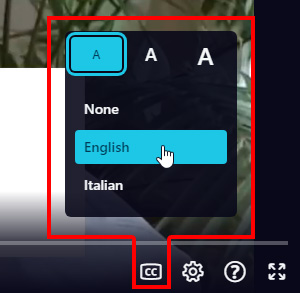

Note: This transcription was generated using a combination of speech recognition software and human transcribers and may contain errors. As a part of this process, this transcript has also been edited for clarity.

Sriram Reddy (00:03):

Hello, everyone. My name is Sriram Reddy, and I'm joined by Jonathan Golan. Today, we wanted to review some opportunities and what we're seeing within the investment-grade markets, after a very challenging timeframe for investment-grade returns. When we look at returns, looking at just returns from Bloomberg, we can see that investment-grade markets have suffered their worst total returns since the inception of many indices, getting back to late 1990s. So again, from my perspective, this perhaps offers opportunities for investors, particularly contrarian investors. But I wanted to speak with Jonathan to understand his views on the market and where he potentially sees opportunities. So, Jonathan, from your perspective what are the fundamentals? What is kind of the backdrop for the market, both from evaluation perspective and from the macro perspective?

Jonathan Golan (00:56):

So I would start by saying that a large drawdown on its own doesn't necessarily imply that an asset class is attractive. So always when I think about an investment proposition, be it in stocks, bonds, even property, I will always think about the fundamentals relative to the pricing. So what is the risk you're taking relative to the expected returns? So I suggest that we start by talking about the fundamentals in the market.

Jonathan Golan (01:29):

So when we look at the fundamentals, we're seeing substantial degradation in the fundamentals that companies are facing. And that is mostly to do with inflation, which is hurting consumers in terms of their purchasing power and is hurting some corporates that are unable to pass through some of the increasing costs of raw materials. And this is compounded by central banks that are now moving into reverse after 10, 15 years of very aggressive quantitative easing and interest rate cuts. We're moving the other way with interest rate swaps pricing in substantial rate hiking cycle across the globe. And that hurts the consumers who are looking to remortgage or are borrowing through credit cards, et cetera. And obviously it hurts corporates as well as the cost of capital is increasing.

Jonathan Golan (02:30):

What I'm seeing recently is many people are saying, well, if inflation is the problem, central banks only need to increase interest rates, price of goods falls, and then everything is fine. We can organize the soft lending. I think that is rather naïve, not really understanding how central banks actually reduce inflation. They reduce inflation by hurting demand. What does that mean? It means that the economy grows more slowly and, in fact, can go into a recession, which is my view that we're very, very likely to go into a recession. I think if you think that central banks can increase interest rates aggressively without entering a recession, it's like saying, I want to lose weight by buying a tighter belt. I think you also need to diet and that's sort of what we think is going to come next, the dieting part of the economy.

Jonathan Golan (03:19):

Now let's talk about valuations. So valuations in the market have responded, as you've alluded to. And in fact, when we look at the Global Investment Grade Index, what you can see is that spreads now are in the top quartile of valuations, going back to the late 1990s, which is normally where we would say a recession is priced in. But one facet that I think investors should think about is also how the index has changed since the late 1990s. So we've seen a huge degradation in the quality of the index, and that is evidenced by credit ratings of companies that compose the index. So historically we've had lots of triple As, double As and single As. But today the index is predominantly composed of triple B-rated securities. So the lowest rated in the investment grade spectrum.

Jonathan Golan (04:19):

And therefore, one of the things that we monitor is how triple Bs in a constant maturity have done. That gives you a better idea of valuation in a historical perspective on a like-for-like basis. So when you look at that, you see that the markets are pricing in mid to late cycles. So we're just touching the fourth quartile, but certainly is not a once in a cycle situation or the market pricing in a deep recession. So there might be more to come.

Sriram Reddy (04:54):

Great. Thanks, Jonathan. For my takeaway, you're not saying that the market is screamingly cheap at this point in time, but what's surprising for me is when I look at the market and look at some bonds, we're looking at yields in the investment-grade market of 6, 7, 8, even double digits. Is it a broad market opportunity or is it sector specific in terms of where there's value?

Jonathan Golan (05:17):

My view is that what we've seen in the market is an increase in dispersion. So more and more bonds trading wide relative to the average and more and more bonds trading tighter relative to the average. So there's certainly some bonds that are pricing in considerable credit stress, which may not actually transpire. And that's where we think investors can look for opportunities.

Jonathan Golan (05:44):

So when we look at the market today relative to the peak of the credit market, which was September 2021, that is in this cycle, we can see that the number of bonds that yield more than 5% has increased 90 fold. So nine months ago we only had 50 bonds or so that had more than 5% yield. And now it's a considerable part, more than a quarter of the market that yields more than 5%. And that's not driven only by the increase in base rates or government bond rates, but actually by credit spreads increasing. That means that the market is pricing in a much higher risk premium for defaults. And this is what allows active credit investors to distinguish their performance from the benchmark on a look-forward basis because there is this dispersion and there is an opportunity to capture high credit spreads that may not turn out to be actual defaults or downgrades to high-yield ratings. And it's up to the active manager to decipher which ones are good investments, where the market is overshot and which ones the market has actually been accurate.

Sriram Reddy (06:58):

Great. I think dispersion is a very important part of what you just said, and maybe you can walk us through a sector or something that you think is particularly dislocated or creating an opportunity for investors at this point in time.

Jonathan Golan (07:14):

So we're seeing several areas in the market that have underperformed noticeably and are trading outside historical levels, which, to me, implies that there are opportunities for active investors. Mostly we think opportunities are in Europe, we're following the Russian-Ukraine war. Investors have become quite bearish on this continent. And particularly one sector that we see opportunities is the real estate sector where spreads in this market are trading outside where they were during the coronavirus pandemic or, in fact, any point in time that we date these indices going back to inception with a considerable discount to the broader market. And that's really where there's opportunities that I would say are once in a cycle opportunities.

Sriram Reddy (08:09):

Well, thanks very much for that summary, Jonathan. This brings us to a close to our session today, but if you had any other questions about our strategies, feel free to reach out to your Man representative, and we'd be happy to engage in a further discussion on the markets or the funds that we manage. Thanks very much.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.