The portents are as encouraging as they could reasonably be for Japanese Value stocks. However, instead of blindly buying the Value factor, investors need to focus on those with stronger earnings, competitive business models and shareholder-focused governance.

The portents are as encouraging as they could reasonably be for Japanese Value stocks. However, instead of blindly buying the Value factor, investors need to focus on those with stronger earnings, competitive business models and shareholder-focused governance.

April 2022

“There are Dinner jackets, and Dinner jackets. This is the latter.”

– Vesper Lynd, in Casino Royale

Introduction

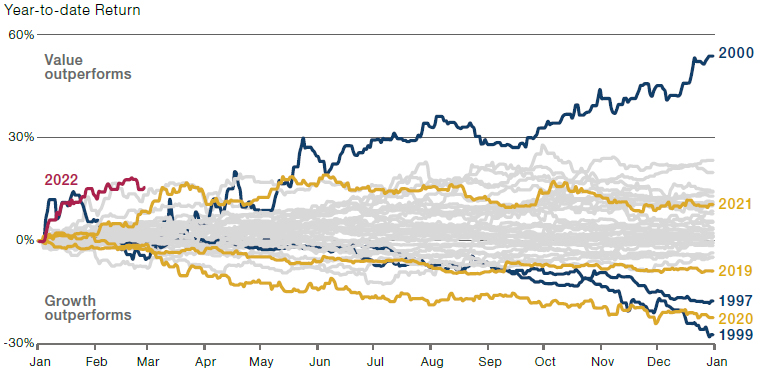

Japanese Value stocks have had a powerful start to the year, with January representing the best relative performance of the factor versus Growth since May 2000 – almost 22 years (Figure 1)!

But this does not mean that investors should simply buy the factor and sit back. Indeed, it is important – now more than ever – to remain discerning. Just as we eschew stocks with stratospheric multiples, a rising-rate environment can spell curtains for the very weakest stocks – ‘value traps’ whose businesses are on life support.

To steal Vesper Lynd’s phrase: there are Value stocks and Value stocks. We know where we’d rather be.

Figure 1. Russell Nomura Value Versus Growth

Source: Bloomberg; as of 28 February 2022.

Value stocks in Japan still trade at low multiples relative to Growth stocks.

Valuation of Value Versus Growth

2021 was generally strong for large-cap Value stocks. Performance was front-loaded, with markets in the first part of 2021 focused on the ‘Great Reflation’, rising interest rates and economic recovery from Covid-19. As the reflation trade petered out, so did the Value recovery, with big tech re-emerging later in the year.

Consequently, Value stocks in Japan still trade at low multiples relative to Growth stocks. After a long period where it seemed not to matter to investors, price is once again becoming a central part of the investment equation. For years, investors were willing to buy high-quality stocks without regard to valuation, adopting a ‘best-of-breed’ buy-and-hold investment style. We believe this trade may be over.

In the recent era where monetary policy was dominated by super low interest rates, Growth companies enjoyed a major re-rating. While they have recently corrected as a result of the rotation to Value, they remain elevated, as illustrated by the price-to-book (‘P/B’) ratio (Figure 2). This is also applicable to price-to-sales (‘P/S’) ratio. Both the P/B and P/S ratios should be regarded as long-term valuation guides, in our view.

By contrast, the valuation of Value companies remains historically low. They have had no re-rating whatsoever since the lows of 2008/09 lows, as illustrated by the P/B ratio (Figure 2). Indeed, Japanese Value stocks remain very depressed compared with the Growth companies. This leaves considerable room for Value stocks to re-rate further, in our view, especially given favourable macro conditions.

Figure 2. Price-to-Book Ratio of MSCI Japan Growth Index and MSCI Japan Value Index

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 18 March 2022.

US Bond Yields Remain Key

Perhaps the key tailwind for Value is the general economic environment, especially the potential for US bond yields to rise. The ratio of Japanese Value/Growth has shown a positive correlation with US 10-year Treasury yields ever since quantitative easing was introduced by the Federal Reserve more than a decade ago (Figure 3).

Figure 3. Japanese Value/Growth Is Positively Correlated to US 10-Year Treasury Yields

Problems loading this infographic? - Please click here

Source: Refinitiv Datastream; as of 28 February 2022.

*Indexed to 100 as of 12 March 2009.

The ultimate driver of yields is, of course, inflation. US inflation continues to run hot, at 7.9% year-on-year in February. In the short term, there is no clear path to lower inflation unless energy prices crater, in our view. With this additional momentum, and since US 10-year bond yields are still relatively low, there is still a lot of potential for Value to move higher.

While a rising-rate environment is a positive for the factor as a whole, not all Value stocks are alike.

Value Versus Value

So, the macro picture therefore remains broadly supportive for all Japanese Value stocks.

But while a rising-rate environment is a positive for the factor as a whole, it is crucial to keep in mind that not all Value stocks are alike. The factor includes both ‘deep’ Value stocks (i.e., the cheapest part of the market, which is often vulnerable to structural problems) and ‘quality’ Value (i.e., stocks with stronger earnings and resilient business models). Returns for each type of Value stock can be very different: while rising rates tend to reduce multiples such as price-to-earnings and price-to-book ratios (therefore making quality Value stocks more attractive on a relative basis), they raise the cost of capital. This can sound the death knell for some ‘deep’ Value stocks, which are often reliant on cheap debt to continue operating.

We are very mindful of this dichotomy and believe that investors should seek to avoid potential value traps in favour of companies which can provide a steadier stream of earnings.

Value stocks with quality aspects usually have a distinct competitive advantage which can be identified by investors. In Japan, these are often manufacturing stocks, in particular car makers. In our view, the country boasts the two world-leading hybrid-vehicle manufacturers. As the world transitions to electric vehicles, the quality aspect of Japanese auto manufacturers becomes apparent.

Likewise, an important facet of ‘quality’ Value stocks is governance. For some time now, we have been enthusing about the corporate governance reforms in Japan that are having a profound impact on the market. Increasing numbers of activist investors are targeting Japanese companies that are perceived as laggards in terms of governance and share price performance. Retail company Seven & i Holdings, for example, now has three activist investors seeking to force action to improve its share price, arguing management has been too slow to reform the company’s operations.1 After a strategic review in 2021, Toshiba is likely to break itself up as a result of the findings.2 These are both high-profile examples of how the activists have very much arrived in Japan – a development that can only be good for Value as boards are finally forced to engage in more shareholder-friendly activities.

Conclusion

The portents are as encouraging as they could reasonably be for Japanese Value stocks: low valuation and rising US yields. However, that is not to say that all Value stocks will prosper. Instead, investors need to focus on those with stronger earnings, competitive business models and shareholder-focused governance – in short, to pick higher-quality companies, rather than blindly buying the Value factor. In Japan, there are Value stocks – and then there are Value stocks.

1. Source: Financial Times.

2. Source: Reuters.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.