Will rising inflation and tapering help Japan Value?

Will rising inflation and tapering help Japan Value?

October 2021

Introduction

Heaven helps those who help themselves.1 But it doesn’t hurt to have the Federal Reserve on your side as well.

Consistently high US inflation prints and an improving employment situation are pushing the Fed towards tapering, which will have a knock-on effect in the rest of the world. In our view, if loose monetary policy boosted Growth, it seems reasonable to expect that tightening will be supportive of Value – and, in particular, Japanese Value. Likewise, a renewal of the global reflation will have an outsized positive effect on the factor more generally. In addition to this outside help, as improved corporate governance encourages a renewed focus on profitability, Japanese earnings have shown a consistent positive trend.

After falling back following a strong 2021 first quarter, now is the moment to revisit Japanese Value stocks, in our view. Heaven might just be smiling on those who are busy helping themselves.

A Little Help From the Fed

For a decade, we’ve watched the effect of low interest rates and quantitative easing on the world’s stock markets. With no yield available in developed market government bonds and crowded out by central bank purchasing, investors have been forced to look elsewhere in a desperate search for returns. In this atmosphere, stocks whose valuations are reliant on padding hypothetical future earnings with a low discount rate have flourished. Conversely, without that great equaliser – an actual cost of capital – Value stocks have struggled. This has been as true in Japan as the rest of the world: the performance of Value in Japan closely tracks the rate of the US 10-year yield (Figure 1).

Problems loading this infographic? - Please click here

Source: Refinitiv Datastream, Man GLG; between 12 March 2009 and 30 September 2021.

Note: Russell/Nomura Total Value Index (for Japan) divided by Russell/Nomura Total Growth Index (for Japan), both total return.

*07 Jul 16 was the date on which Russell/Nomura Total Value Index (for Japan) started outperforming Russell/Nomura Total Growth Index (for Japan) after underperforming in the first half of 2016.

Japanese Value has been relatively resilient compared with Value elsewhere.

Despite such headwinds, Japanese Value has been relatively resilient compared with Value elsewhere (Figure 2). Indeed, conditions for more consistent outperformance may be returning. While economic data has recently been soft around the world, we believe it is more reflective of the supply constraints imposed by the delta variant, rather than a fall in demand. Fortunately for Japan, the rate of growth of delta variant cases has fallen to almost zero, and over 50% of the country is double-jabbed (Figures 3-4). In the labour market, employment is rising and job offers are increasing. Industrial production has been held back by the aforementioned supply issues. This has especially affected the auto industry, which represents some 9% of the Topix Index’s market cap. However, on the flip side, this should create some pent-up demand for the economy going into 2022. As the global vaccination rate also improves, we may well see an easing of supply disruption and a resumption of the reflationary momentum that we experienced earlier in the year. This would be good for both the Topix as a whole (which contains a high number of manufacturers and cyclicals) and for Value as a factor.

Problems loading this infographic? - Please click here

Source: Bloomberg, MSCI, Man GLG; between 31 December 1999 to 8 October 2021.

*MSCI Japan Value Index divided by MSCI Japan Growth, MSCI Europe Value Index divided by MSCI Europe Growth, MSCI Emerging Markets Value Index divided by MSCI Emerging Markets Growth, MSCI US Value Index divided by MSCI US Growth.

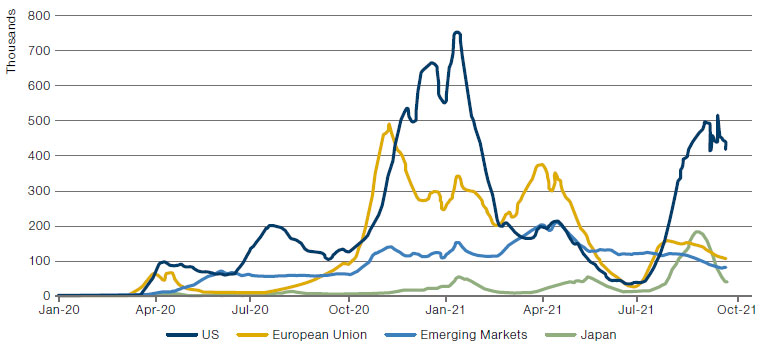

Figure 3. Daily New Covid Cases

Source: WHO; as of 20 September 2021.

Figure 4. Vaccination – Percentage of the Population

Source: WHO; as of 20 September 2021.

The easing cycle of 2019-21 has proved very beneficial to technology and Growth stocks. We feel it is reasonable to expect a reversal of this, and a rotation back to Value stocks, if the global economy gathers momentum again.

However, surging reflation has implications for monetary policy. Year-on-year US CPI has run above 5% for four consecutive months.2 As a consequence, consensus is already expecting the Federal Reserve to begin tapering sometime in the fourth quarter. This may eventually turn into outright tightening for the first time since 2018. The easing cycle of 2019-21 has proved very beneficial to technology and Growth stocks. We feel it is reasonable to expect a reversal of this, and a rotation back to Value stocks, if the global economy gathers momentum again. By the end of 2021, the Fed may therefore begin to help Value, which will in turn filter through to Japan.

Self-Help

Japanese Value stands to benefit from more than simply monetary policy. As we have previously written, there is a corporate governance revolution taking place in Japan. Since 2016, corporates have been directed to aim for an 8% return on equity (‘ROE’) ratio, with shareholders encouraged to vote against the reinstatement of boards which fail to reach this target three years in a row. The pressure to lift financial performance, especially ROE, is now intense and activist investors are increasing their presence. This ought to benefit that segment of the market where returns are lowest and most easily improved through self-help, which are typically Value stocks. This could be a medium-to long-term driver of Value outperformance, in our opinion.

Possibly as consequence, the corporate sector continues to enjoy strong profit momentum. Sales and profits in the latest quarter were 6% and 17% ahead, respectively, of the levels of the same quarter in 2019 (2020’s figures were hit by Covid-19) and profit margins pushing towards all-time highs (Figure 5). Dividend payments are rising and share buybacks resuming as life returns to normal for most companies.

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 17 September 2021.

Conclusion

As inflationary pressures build around the world, Japan Value is in a relatively strong position. In our view, it is likely that the Fed’s mooted tapering will occur and that it will be supportive of Value stocks. However, independent from monetary policy, Japanese Value stocks have growing momentum with improved profitability and margins. It may well be a case that heaven, or at least the Fed, really does help those who help themselves.

1. At least according to Samuel Smiles, the author of 1859 bestseller ‘Self-Help’.

2. At the time of writing, which was early October.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.