In the world of climate investing, how can investors target the maximum environmental – and financial – impact? We look at how quant investing may help alpha-driven investors ensure they leave nothing on the table.

In the world of climate investing, how can investors target the maximum environmental – and financial – impact? We look at how quant investing may help alpha-driven investors ensure they leave nothing on the table.

June 2024

Key takeaways:

- Climate investing requires an approach that ties the complexities of climate change to company fundamentals, while adapting to an uncertain world

- The intersection of quantitative research and climate science is well suited to analysing the vast data volumes, and wide array of alpha sources that give a comprehensive picture of this evolving space

- Expressing climate views in a long-only framework has limitations, and long/ short solutions provide an additional lever for investors. These may help capture returns from both climate leaders and laggards

Introduction

As the physical reality of climate change increasingly becomes an economic one, companies are acknowledging its impact on their business models. That means considering how to adapt and evolve. Concurrently, investors are thinking about how to integrate climate considerations into their portfolios.

Today’s investors adopt a range of approaches to implement their views. Long-only portfolios that include carbon budgets and impact investing are some of the most popular. By contrast, neither long/short nor quantitative approaches have received as much focus to date.

In this paper, we outline why we believe a quantitative long/short approach to climate allows for a more comprehensive expression of climate principles that goes beyond traditional investment solutions. Inevitably there will be winners and losers in the climate transition, and we highlight here how we think investors can capitalise on both sides.

We begin by looking at the attributes of quantitative investing versus discretionary from a climate perspective, including quants’ ability to handle large amounts of climate-related data, before moving on to consider why a long/short approach is well-positioned to harvest responsible investment (RI) and climate-related premia. Finally, we will take a deeper look at long/short portfolio implementation.

Why we believe quant investing has the edge

For investment management to play an active part in driving companies to adapt to and try to mitigate climate-change impacts, we believe we need both discretionary and quantitative strategies. Discretionary strategies can typically handle a higher capacity and thus may offer climate-friendly solutions for large volumes of assets under management. However, we believe investors seeking climate alpha should consider quantitative strategies as a means of capturing the full premium associated with the changing climate environment across global financial markets.

An influx of climate-related data

First and foremost, high volumes of data are necessary to estimate the climate impact. Quants are well-positioned to take large, often complex climate modelling data and find systematic ways to tie the impact to fundamentals, the economy and its interaction with climate change and climate policy.

This is essential, given the shifts which are likely to occur across the world because of climate change. A warmer world will likely reshuffle supply chains, interfere with labour patterns, and ultimately reshape markets. To take just one example, we expect much of the grain-growing industry to move north from the bread basket of the US towards Canada.

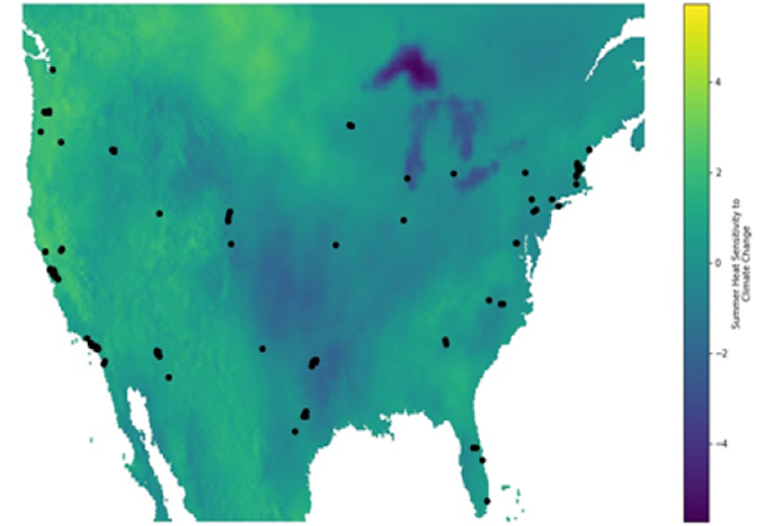

And it is not just where companies operate that will change. The dominance of certain sectors and processes is likely to evolve. Moreover, as the world gradually digests the potential impact of climate change, its market impact in different regions is likely to increase. Take semiconductors, for instance. Extreme heat poses a significant threat to their production and supply chains of these products, which are inherently sensitive to temperature fluctuations. The precision required in semiconductor manufacturing means that even slight variations in temperature can lead to substantial yield losses. The semiconductor industry is highly water-intensive, which creates another concern, when we consider the lower water availability in hotter areas. Figure 1 illustrates the location of semiconductors in the US overlayed with where we see heightened climate sensitivity. Currently, the highest heat sensitivity in the US is concentrated on the West Coast. As global temperatures rise, cooling costs surge and the risk of disruption from heatwaves increases. These effects will likely lead to a potential re-evaluation of the geopolitical landscape of semiconductor manufacturing, whereby their facilities may need to relocate to cooler climates or invest heavily in advanced cooling technologies.

Figure 1. The Californian coast is the fastest-warming part of the USA today

Source: Man Numeric data, As at May 8 2024, input data from 1980-2024.

In addition to modelling climate change and the impact on company fundamentals,1 quants are equipped to handle the mass influx in both RI and climate-related alternative data we have seen in recent years. Over the last four years, Man Group has analysed more than 65 data-sets as candidates for potential investment signals, and much more data is being generated each year

In short, we believe quants are well equipped to process large amounts of data that extend decades into the future, to link geographic climate data with company-specific data and to integrate changes and developments – such as those described above – into models in a timely manner through a unified analysis and portfolio construction process.

Why adopt a quant long/short approach?

Releasing climate investing from the index bind

Quantitative long-only funds are generally constrained to a benchmark and, as a consequence, often have a low appetite for tracking error deviation. To demonstrate how similar the available climate indexes are to the traditional global indexes, in Figure 2, we can compare the MSCI ACWI Paris Aligned Index to the MSCI ACWI Index and see that the tracking error is as little as 1.5% over the last eight years.

Problems loading this infographic? - Please click here

It is important to highlight that climate investments often have a different sector and country composition to a standard cap-weighted benchmark. As a result, the impact of climate change will not necessarily move in line with companies’ market cap. Being constrained to tracing a traditional index mitigates the ability to capture the climate premium and to make a positive impact, in our view.

By design, portfolios with lower tracking errors deviate less from the sector and country compositions in benchmark indices. For climate investing, there is a powerful argument for allocators to direct capital to the sectors where companies can make the most impact, reinforcing the fundamental concept of materiality in climate change investing.

On a peer-relative basis, the climate change transition will inevitably present winners, laggards and losers. Take, for example, the healthcare sector. Some healthcare companies may be more aligned with reducing future carbon emissions or have more diverse locations. Thus, they are more agile in terms of climate impact than others in their sector. However, these healthcare firms have minimal overall impact relative to firms in the energy sector. In other words, investing in more relevant sectors and pushing these firms to contribute to climate solutions will have a larger effect on the whole economy.

Using multiple parameters to measure impact

So, how can we go about defining the most impactful areas for climate developments? It can be done in many ways, but here we concentrate on two approaches: the European Union (EU) taxonomy and sustainable investments defined using Man Group’s internal environmental, social and governance (ESG) policies.

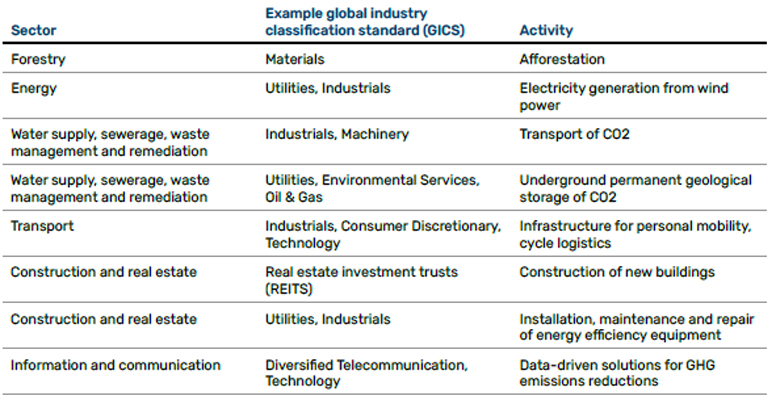

On one hand, the EU taxonomy, an official European classification system which buckets economic activities based on their impact on environment materiality, can be a valuable resource. It objectively answers the question of which economic activities contribute to the mitigation of climate change.

Figure 3. EU taxonomy: Which economic activities contribute to the mitigation of climate change?

Source: EU, 31 December 2023.

On the other hand, Man Group’s internal sustainable investment definition (SI alignment) categorises companies as sustainable based on multiple facets. It looks at the EU taxonomy together with carbon emissions, ESG scores, sustainable development goals, assesses individual companies for severe ESG controversy violations or other indications of significant harm; thereby offering a comprehensive view on sustainability.

Figure 4 compares a market capitalisation-weighted benchmark’s sector composition to a hypothetical cap-weighted benchmark of sustainable investments, as well as the weight by sector according to EU-aligned revenue. As is demonstrated, the EU taxonomy places primary focus on Real Estate and Utilities, whereas a more diverse view from SI-aligned investments focuses on Information Technology. Both views on the sectors deemed material for climate investing deviate significantly from traditional benchmark exposures.

Problems loading this infographic? - Please click here

What about ‘shorting’ in climate portfolios?

Having examined the core reasons to deviate from the benchmark in the construction of the long side of a portfolio, short selling or ‘shorting’ can also be an effective mechanism to realise a premium on those stocks whose performance is expected to deteriorate. Shorting means borrowing a security and selling it in the anticipation its price will fall, so that it can be repurchased at a lower price on a later date and returned to the lender, while the investor profits from the difference. Ultimately, we believe a long/short approach allows investors to capitalise on the full climate premium by also capturing returns which reflect a firm’s expected future negative climate impact. It is widely recognised by both regulators and practitioners that shorting can increase the cost of capital for firms; balance out the marketplace; and contribute to the total shares shorted which pushes the price to where the collective market views it to be.2 This benefit of shorting is shared by quants and discretionary investors and thus should be included in the most impactful climate portfolios.

There are, however, some key points of differentiation between quants and discretionary investors’ use of shorts. Discretionary strategies tend to focus on a smaller subset of companies to short than that in which they hold long positions, which creates a gap between long and short exposure in market-neutral funds. To fill this gap, discretionary investors often short indices for hedging purposes rather than direct alpha. This inherently leads to ‘climate-positive’ companies being shorted as well. In contrast, quants can exploit the advantage of breadth for short selling, as well as an ability to implement widespread short-alpha ideas, while balancing the risk profile. This creates flexibility for quants to construct their long/short portfolio, while avoiding shorts in sustainable companies. We have written a paper in detail on this topic which includes examples of some funds that follow this convention illustrating that discretionary long/short funds typically short-sell futures in order to hedge their market beta in the long side of their portfolios.3

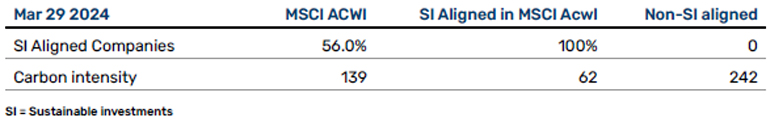

The MSCI ACWI Index has 56% SI aligned companies. If an investor were to short 50% of the MSCI ACWI Index to ensure their portfolio was market neutral, they would end up with 23% of their short weight in sustainable names.

Figure 5. A blunt instrument: shorting entire indices risks reducing sustainable names, too

Source: Trucost, Bloomberg, As at March 29 2024.

Quant alpha in climate investing

As we have already acknowledged, climate investing is a fast-evolving field and it requires multiple alpha sources and ideas to be incorporated into an investment strategy. In the same way that quants can process and integrate data more quickly, they also have another unique advantage. They can utilise alpha signals from multiple sources to predict a company’s future returns stemming from climate adaptation and balance exposures from a risk-management perspective. This is important. Some of the data utilised in the climate space might have very skewed distributions (such as carbon intensity)4 which may bring unwanted risks that quants can control for.

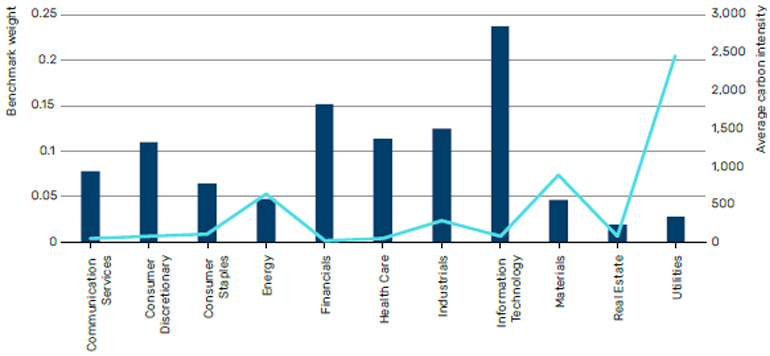

Using a limited set of metrics, for example simply focusing on carbon emissions, which has been at the forefront of climate investing to date, may lead to a skewed perception of certain companies. This is because the picture is much more nuanced; there are climate-positive firms with high emissions and those that are harming the climate with low emissions. While carbon intensity is more directly related to firms adapting to climate change, it also deviates from a truly material view. For example, when looking at the average carbon intensity score by sector for the MSCI ACWI index, Utilities and Materials rise to the top of the importance however sectors like Industrials and Real Estate are still underrepresented.

Figure 6. Carbon intensity scores alone don’t tell the whole story

Source: Man Numeric, Trucost, Bloomberg, as at 29 March 2024.

To take one example, Jinko Solar ranks in the 95th percentile for scope one, two and three emissions intensity for semiconductors because the production of polysilicon is an incredibly carbon-intensive process. However, the company is taking control of the solar industry and has been instrumental in pushing the progress of solar energy and driving down overall costs.

BP is a primary counter example. The oil and gas firm is well below the median of scope one and two emissions intensity within the Energy sector, but has historically been responsible for a large amount of global emissions and has made little effort to adapt – and even recently reversed previous emissions reduction goals.

In addition, one of the risks associated with using carbon intensity to tilt a portfolio is that it misses the mark of capturing where climate information is material and in some cases is misaligned to the most important climate data.

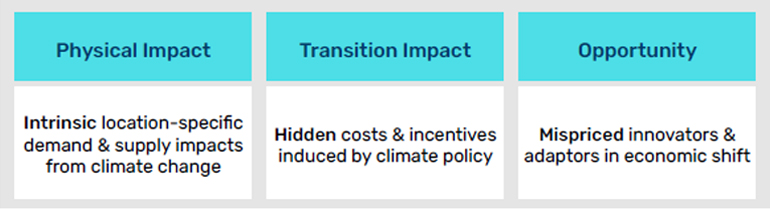

Taking a more comprehensive approach

At Man Numeric, as shown in Figure 7, we adopt a more comprehensive approach to climate change, looking across three core pillars, including the physical impact, the transition impact and the opportunity cost. In our view, breaking down climate investing into the opportunity set for new innovations and technology; costs associated with transitioning to mitigating climate change (including fines, taxes and interrupted operations); and the physical costs associated with operations in climate impacted regions, creates a holistic view of the potential impact of climate change at a company-specific level. In each area, many signals come together to complement one another and encompass the wide spectrum of views and data accessible. Some examples include: the future projections of carbon emissions relative to peers such as two-degree emissions estimated from Trucost, predicting temperature change and projecting that onto firm locations, and estimating firms’ exposure to the carbon markets and climate news. Prudent climate investing coalesces a wide range of viewpoints systematically, handling large amounts of data and integrating expertise to build accurate views on the impact of climate change on individual companies.

Figure 7: Approaching climate change across three core pillars

Source: Man Numeric, 2024.

Adopting engagement practices

Engagement is one area where a discretionary approach has some benefits over and above a quantitative one. Systematic funds typically do not interact directly with the companies that they hold long positions in whereas some discretionary managers are heavily involved in stewardship and engagement with the companies that they own. Nevertheless, we believe quants’ capabilities in both data management, an ability to manage multiple views from an alpha perspective, as already outlined, and the implementation of shorts gives quant long/short approaches the edge in the climate space. In addition, it is also possible for quants to adopt certain discretionary practices, such as engaging in firm-level stewardship that acts on behalf of systematic strategies in advancing stewardship objectives.

Boosting portfolio construction

Quantitative managers have a distinct advantage when it comes to portfolio construction. There are many ways a climate long/short fund with the defined goals of producing a strategy with the highest return, subject to capturing the climate premium, while also maintaining a strong focus on risk management, can benefit. We believe the optimal strategy combines fundamental models with climate specific models.

Traditional quant models that focus on valuation, momentum and quality have proven to be significant in explaining the returns of stocks and this is likely to continue to be the case moving forward. Thus, when building a portfolio, the fundamental principles of investing should not be forgotten. There are also special considerations to consider when combining such models, including ensuring the largest positions in the portfolio are aligned with one’s end goals. It also goes without saying that it is important from a risk perspective to ensure the amount of risk in each concept is balanced in the resulting strategy.

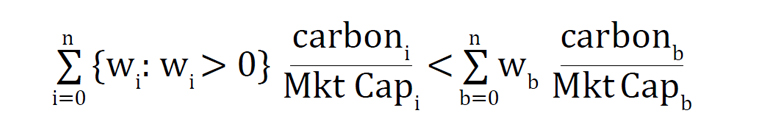

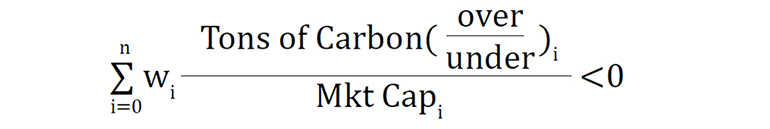

Further, when building a quant long/short portfolio with a goal such as capturing the climate risk premium while aligning with climate change moving forward, applying portfolio level constraints with materiality is vital. Carbon emissions are important when looking at the overall emissions of a portfolio in terms of its impact on the economy, as well as ensuring the strategy does not take on large exposures to carbon emissions from a risk perspective. Accounting for the carbon emissions on both long and short positions should therefore be analysed separately and on multiple metrics.

There are various metrics that can be examined to scale the carbon emitted by each firm to be more comparable between companies, including the company’s annual sales or their market capitalisation. At Man Numeric, we ensure we look at the emissions profile from multiple perspectives.

Managing the emissions profile of a portfolio

- Constrain carbon emissions at the portfolio level to ensure long-side emissions are less than short-side emissions. This ensures the portfolio is net-short carbon emissions. Long versus short constraints also allow investors to manage their risk to carbon emissions by making the constraints within a certain threshold of 0

- Constrain carbon emissions on the long side only to ensure the companies bought have low emissions. If an investor were to only use long/short constraints outlined above, if they are shorting high emitting firms, they can buy any firm on the long side. This is straightforward to achieve, as the positive outliers of carbon emitters are significant.5 Long-side constraints ensure that the total amount of carbon in the firms the investor owns is kept at a low level relative to an economically meaningful long only portfolio

- Utilise metrics that account for projected carbon emissions such as Two Degree Alignment data from Trucost. This figure is an estimate of emissions relative to an industry-adjusted projection. This projection aligns with temperature rises of no more than two degrees Celsius by 2025, as per the Paris Accord. Previous emissions from each firm were a first approximation of future emissions. However, given firms are changing their emissions profile at an unprecedented rate in a bid to contribute to climate goals, it is prudent to also view the portfolio from the lens of projected emissions. This takes into account, and aligns the portfolio with, firms on a more impactful reduction path

Conclusion: Quant approaches are well-positioned to capture complex climate alpha

Modelling climate change and capturing its associated investment risk premium is complex. The space requires subject matter expertise and, in our view, quantitative capabilities given the speed of change and the significant amount of data required to accurately model climate change and estimate where companies sit compared to their peers.

As the global economy continues to adapt to climate change, we expect a spread of returns in the space with companies on both ends of the spectrum. The full climate risk premium is captured not only by investing in companies that are driving the transition to a climate friendly world, but also by shorting companies lagging their peers or those having an adverse impact. Alpha signals should be viewed from many angles, including transition costs, climate specific opportunities and direct physical impact coalescing data from multiple sources.

We believe a quantitative long/short approach to climate should be considered as it can account for many aspects of climate investing and may offer a strong ability to adapt as the world around us changes.

1. A topic we have examined at length in a previous paper: The Impact of Climate Change and Carbon Policy on Company Earnings

2. See the UK Financial Conduct Authority and the Standards Board Alternative Investment Principles for GHG-Emission Accounting in Alternative Strategies. https://www.sbai.org/resource/principles-for-ghg-emission-accounting-in-alternative-strategies.html

3. See additional details on this in a recent paper from our colleague Jason Mitchell who provides examples of funds that engage in these practices: https://www.man.com/maninstitute/to-net-or-not-to-net

4. A topic we have examined at length in a previous paper: https://www.man.com/maninstitute/carbon-emissions-microscope

5. A topic we have examined at length in a previous paper: https://www.man.com/maninstitute/carbon-emissions-microscope

Index definitions

MSCI ACWI Climate Paris Aligned Index:

The MSCI ACWI Climate Paris Aligned Index is based on the MSCI ACWI Index, its parent index, and includes large and mid-cap securities across 23 Developed Markets (DM) and 24 Emerging Markets (EM) countries. The index is designed to support investors seeking to reduce their exposure to transition and physical climate risks and who wish to pursue opportunities arising from the transition to a lower carbon economy while aligning with the Paris Agreement requirements.

MSCI ACWI Index.

The MSCI ACWI Index, MSCI’s flagship global equity index, is designed to represent performance of the full opportunity set of large- and mid-cap stocks across 23 developed and 24 emerging markets.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.