The best risk managers don’t just react to events; they seek to anticipate them and help make portfolios more resilient. In current market conditions, this skill has never been more important for multi-strategy managers.

The best risk managers don’t just react to events; they seek to anticipate them and help make portfolios more resilient. In current market conditions, this skill has never been more important for multi-strategy managers.

January 2023

The world currently faces dramatically increased economic uncertainty, and we have accordingly seen dramatic moves across many different markets since investors began to price a new inflation, monetary and growth regime (Figure 1).

Figure 1. Performance of Major Asset Classes in 2022

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 31 December 2022. Assets represented by FTSE World Government Bond Index - Developed Markets Index, MSCI Emerging Markets Index, MSCI World Index, Bloomberg US Large Cap/Bloomberg US Agg Index, and LBMA Gold Price.

While these moves and uncertainty create investment challenges, they can also create opportunities for actively managed funds – especially the best multi-strategy funds.

While these moves and uncertainty create investment challenges, they can also create opportunities for actively managed funds – especially the best multi-strategy funds that can actively tilt their exposures according to market conditions. Keeping track of all these moves, volatility changes and reallocations is a hugely challenging process. In our previous paper, we looked at this from the perspective of the portfolio managers. But what about their colleagues, the risk managers?

Through this paper, we aim to illustrate the importance of risk management and why it is not just a policing function. We also aim to illustrate the wide range of skills that excellence in risk management requires and why it is such a fundamentally important capability in multi-strategy funds. We find that the best multi-strategy managers have risk deeply embedded into their processes and, by being able to act as an independent voice, risk managers can act as a value-add source of alpha.

So why is risk management important and what does it take to deliver excellence in this vital field?

The Risk Manager’s Many Hats

With so many moving parts in a multi-strategy fund, it should not be surprising that a disciplined and organised risk-management process is required. You could view understanding all these moving parts as the job of the portfolio manager but, with so many things to look at, having a second expert pair of eyes on the portfolio can add real value.

It’s Not Just Policing

In our view, there are two core skills a risk manager needs to add this value:

- Discipline – On the one hand, the risk team needs to be disciplined. For example, the risk team must be responsible for monitoring each portfolio manager’s performance, the enforcement of stop-loss limits, exposure limits, etc. Discipline in enforcing these policies is important in ensuring the portfolio remains true to its mandate.

- Curiosity – On the other hand, the risk team should not just dogmatically follow a set of policies and procedures. The risk team needs to be aware of potential changes in market conditions and proactively consider how these could impact the portfolio.

Only by independence of voice can the risk team both police where required, and also ensure they have a sufficiently powerful voice to allow other concerns and insights to be heard.

In the following sections, we outline the role risk management can play, the differing skills we believe an excellent risk manager needs, and why this balance between discipline and curiosity is important. We start at the highest level, but then drill down to underlying strategies, financing, stress testing, liquidity, and finally diversification.

Why Independence Matters

To be able to act effectively, it is important that the risk team remains independent of the portfolio-management team. Only by independence of voice can the risk team both police where required, and also ensure they have a sufficiently powerful voice to allow other concerns and insights to be heard.

Hat 1: Portfolio-level Risk

The first step is to look at overall portfolio risk. By doing this, the risk manager is trying to ensure that the overall portfolio stays true to its mandate. For example, the risk manager may look at the following:

- Overall portfolio risk – The risk manager may look at Value at Risk (‘VaR’) to measure the portfolio’s overall level of riskiness. If the overall portfolio is too risky, then it may deliver losses that are not within the mandate.

- Sensitivities – Investors are typically looking for low sensitivities to traditional factors such as equities or rates. If these are too high, the portfolio may be susceptible to delivering outsized losses in the event of a large move in one of these factors, which is not what an investor would want.

- Diversification and allocations – Are all the strategies within their anticipated guidelines? If they are not, the portfolio may be overexposed to types of strategies that can lead to losses if these strategies underperform or lose money.

This first step is very much about understanding whether the portfolio remains true to the overall mandate. In many ways, this is the simplest part of the process. However, as we explain in the next sections, it is incredibly important to drill down through the portfolio.

Hat 2: Individual-strategy Risk

As we have explained in previous papers, it is important that multi-strategy portfolios are built with a wide range of diverse strategies. When selecting these strategies, the overall portfolio manager will have expected certain characteristics to be displayed in their returns (for example, the types of exposures they take or levels of risk). Unsurprisingly, if the strategies do not display their expected characteristics, they may not behave as expected, leading to a suboptimal portfolio. The question arises: how do you understand if each strategy is behaving as expected?

At the simplest level, the risk-management team will typically agree a set of limits or constraints on what each portfolio manager is allowed to do. These limits are tailored to each portfolio manager, based on their overall experience, what they have previously traded, their track record, and how well known they are to the fund. The portfolio manager is required to stay within these limits; if they move outside them, the risk team will either need to authorise this breach or force them to come back inside the limit.

Examples of these limits include what they can and cannot trade, how much risk they can take, how much leverage they can take, and importantly the level of loss they can make before they are closed out (‘stop-loss’ limits).

Excellent risk managers need to go a lot further, however. They must look at potential changes in markets, conditions, strategy outlook, and in general proactively analyse outcomes. For example, if liquidity is reducing in credit markets, that may have an impact on how credit strategies can perform. The risk manager may wish to try proactively to understand these impacts on strategies – before limits are breached.

Case Study

In October 2022, a fiscal event in the UK precipitated large-scale sales of gilts by liability-driven investment (LDI) strategies. The root cause of the challenges faced was the use of leverage, leading to unexpected loss sizes and then substantial liquidations of liquid assets by pension funds. This illustrates the importance of understanding leverage, liquidity and selling; it is an important skill for the risk manager.

Given the range of items that the risk team needs to consider, it is important they possess expertise in a wide range of strategies.

You Need a Wide Range of Expertise

Given the range of items that the risk team needs to consider, it is important they possess expertise in a wide range of strategies. For example, in an equity long/short strategy the portfolio manager may be constrained on their net and gross exposure; in event arb, they may have limits of “break risk”; in managed futures, limits on factor exposures; credit strategies require knowledge of credit instruments and liquidity.

Hat 3: Margin, Stress Testing and Liquidity

As explained in our previous paper, multi-strategy portfolios often trade on leverage. That is only a small proportion of the capital posted with a broker to trade the strategy. For example, for an equity long/short manager running a long book of $100 and a short book of $100, only $20 of capital may be needed. So in theory, $100 of capital could allow you to run five strategies. This is a simple example of what is known as “leverage”.1

In the case of a multi-strategy portfolio, being able to use leverage is tremendously important as strategies are selected to be very diversifying. This diversification can lead to low levels of realised risk so, to meet target levels of risk, leverage is an important tool.

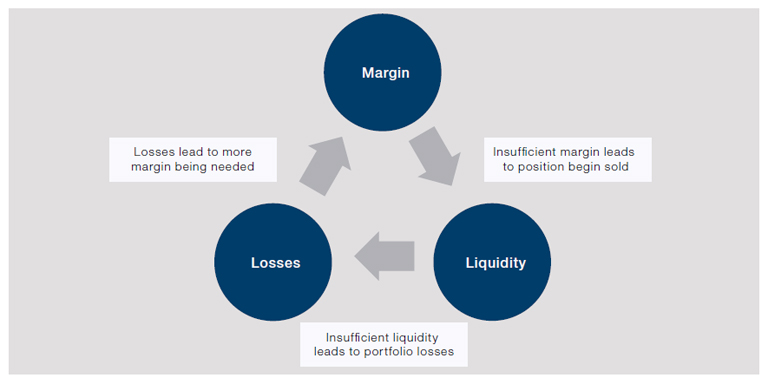

Problems can arise when losses occur in a strategy. In such cases, additional margin needs to be posted with the broker to cover these losses. Normally an amount of capital is kept back (known as “unencumbered cash”) but, if all this is used, it can create a potentially vicious cycle:

- Margin – If you do not have enough unencumbered cash, you may need to sell positions.

- Liquidity – If you do not have enough liquidity in the portfolio, you may need to sell positions at fire-sale prices.

- Portfolio Stress – If positions are being sold cheaply, that leads to more losses – which leads to more margin being requested.

Figure 2. Illustrative Cycle of Losses Leading to Margin Calls and Liquidity Challenges

Source: Man Group. For illustrative purposes only.

Understanding and controlling this cycle is possibly the most essential element of risk management in a multi-strategy. Again, while there are elements of it that are more clearly in the ‘discipline’ or ‘policing’ camp of a risk manager’s role, there are elements that rely upon deep curiosity, experience and expertise.

Managing This Cycle

Margin

The first defence for a risk manager is making sure there is sufficient unencumbered cash held back to meet “day by day” calls. Clearly if this amount is too high, then risk levels at the portfolio level may not be met. But if it is kept too low, you may need to start liquidating positions too soon.2

Liquidity

Understanding illiquidity in the portfolio is a real skill, and not an easy one to master:

- Too little – Illiquidity can present opportunities others may not be able to fund, and hence offer an excess return (“the illiquidity premium”). Not participating in illiquid opportunities can therefore damage portfolio returns.

- Too much – If the portfolio is too illiquid, on the other hand, if these positions ever need to be sold to raise cash, it may lead to forced selling at fire-sale prices.

For some instruments, such as equities that trade on exchanges, it is easier to judge their liquidity. Others, such as credit instruments where there is no such exchange, can be a lot harder to assess and proxies need to be developed.

Finally, note this process needs to be very dynamic. Market liquidity changes all the time: sometimes markets that were liquid become illiquid.

Case Study

In 2021, an investment office accumulated large positions in a small number of equities on margin. The purchase of these stakes had helped to drive up their prices but, when they began to decline, the lending banks issued margin calls. The calls were not met, so the banks liquidated the positions which further depressed their prices. Risk managers inside the investment office could have served their policing role more firmly, limiting the increase in leverage and ensuring sufficient cash provisions to meet the margin calls. But external risk managers may also have added value by exhibiting curiosity about the potential impact of such concentrated portfolios being suddenly unwound. Trying to identify crowded positions and the impact of unwinds on portfolios is an important role of the risk manager.

A core tool at the risk manager’s disposal in understanding all these levers is the use of hypothetical stress tests.

Understanding Portfolio Stress

A core tool at the risk manager’s disposal in understanding all these levers is the use of hypothetical stress tests. These apply a series of hypothetical market moves to the portfolio to understand how the portfolio behaves in differing scenarios. These may be replays of historical events, hypothetical scenarios based upon concerns the risk manager may have (e.g. how the portfolio could behave around a Brexit-like scenario), liquidity stresses, or shocks to single or groups of factors. The risk manager can use these proactively to try to identify weaknesses in the portfolio.

By looking at the impact of these stress tests, the risk manager can judge how the portfolio will respond in the event of large market moves, identify any weaknesses, and then – most importantly – create action plans on how to respond if that stress does occur. Just as an airline pilot will have repeatedly rehearsed potential dangers ahead of time, it is important that a risk manager rehearses how they may respond to portfolio challenges well in advance.3

This is a tremendously important skill to master. It is not just about looking at top-level data, which can lull people into a false sense of security. The risk manager needs to drill down to individual or groups of positions and see how they would perform in each scenario and identify any groups that are particularly exposed to the stress. They need to consider if positions that normally offset each other are likely to align in performances. If they are assuming positions will offset each other in terms of performance, how confident are they in these assumptions? They also need to go further and consider that if their action was to “de-lever” (sell positions), how similar is their book to the rest of the street – and if they do this, what would the impact of this group’s action be. This is a place where the excellent risk manager’s curiosity comes into play. They need to ask questions, analyse and question results, and constantly challenge assumptions to seek to ensure the portfolio remains safe.

Hat 4: Crowding and Diversification

The final element to consider is diversification. The assumption in building a portfolio is that there is a lot of diversification across strategies. It is this diversification that helps deliver the “all weather” returns investors seek. However, there are times when this diversification may break down:

- Strategies that are thought to be diversifying may end up being less diverse than thought. In such a case, the risk manager may need to suggest a reallocation to adjust the overall portfolio balance.

- Each strategy may diversifying, but have small exposures to a given factor. When this happens across lots of strategies, you can end up with a large exposure at the portfolio level.

Risk managers need a thorough and engaged understanding of the overall portfolio and how it behaves, seeking out elements where diversification could break down.

- Similarly, a portfolio may have only a smallish aggregate exposure to a crowded name – a stock or bond that a lot of other managers hold in their portfolios. If these positions are closed rapidly by others, it can cause large swings in the price – leading to outsize losses at the portfolio level.

- In times of market stress, diversifying strategies may suddenly become highly correlated; even hedges may become correlated with the rest of the portfolio. In short, you end up with a single-bet portfolio.

Given all these possibilities, risk managers need a thorough and engaged understanding of the overall portfolio and how it behaves, seeking out elements where diversification could break down and seeking out positions that may be crowded across the wider markets. Again, the curiosity of a good risk manager can add tremendous value.

Case Study

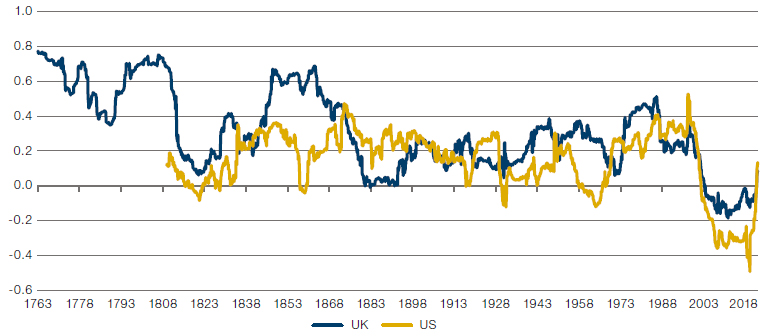

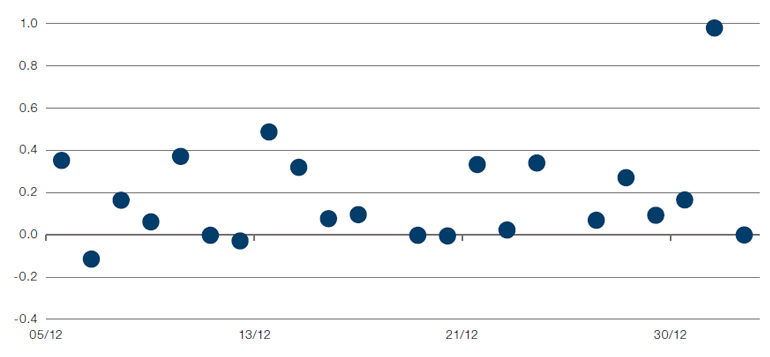

Since the turn of the millennium, equities and bonds have been negatively correlated for the majority of the time. For some investors, this became an embedded element of portfolio theory – it was supposed that bonds would hedge against equity losses because the two asset classes had for several years tended to move in opposite directions. The past few months, however, have made clear that this is not a codified market rule; the stock/bond correlation has turned positive as central banks fight inflation. A curious risk manager would be aware that this was not just a possibility in a prolonged hiking cycle, but in many ways a return to the longer-term pattern (Figures 3 and 4). Genuine diversification must mean more than extrapolating indefinitely from recent history: the risk manager must be constantly looking forward to the risks that may develop in the future.

Figure 3. Stock-Bond Correlation (Trailing 10Y, Monthly Periodicity)

Sources: Bank of England, Global Financial Data, Bloomberg and Man DNA; as of 31 December 2022. US stocks represented by MSCI USA Index, US bonds by Bloomberg US Aggregate Index, UK stocks by MSCI United Kingdom Index, and UK bonds by Bloomberg Sterling Aggregate Index.

Figure 4. Discrete Calendar Day Stock-Bond Correlations in December 2022 (10 Minute Periodicity)

Sources: Bank of England, Global Financial Data, Bloomberg and Man DNA; as of 31 December 2022. US stocks represented by MSCI USA Index, US bonds by Bloomberg US Aggregate Index, UK stocks by MSCI United Kingdom Index, and UK bonds by Bloomberg Sterling Aggregate Index.

What To Do? It’s Not Just Position Cutting

In an ideal world, the risk manager would not look to intervene: it is the portfolio manager’s job to generate alpha and they are best left alone to do this. However, sometimes the portfolio is not behaving as you would expect, or it is at risk of not fulfilling its investment mandate. At such times, the portfolio manager may be heavily incentivised to maintain risk levels (e.g. they have a vested interest in certain positions). This is a point where the risk manager needs to be able to act independently if required:

- They could request overall risk levels/leverage in the portfolio are reduced

- They could request certain strategies are reduced in allocation size

- They could reduce limits on certain strategies to make them more concentrated

- They could execute portfolio-level hedges to reduce the exposure to certain factors

However, perhaps the most valuable tool for a risk manager is ongoing dialogue. The risk team brings a multitude of skills and insights to the process. They need to be aware of many differing facets of the portfolio, strategies, and the strategy portfolio managers. So the risk team does bring a crucial element of independence, but they can also bring a lot of broader value add and insight on a day-to-day basis.

In a sense, risk managers should act as the eyes and ears of clients.

In a sense, risk managers should act as the eyes and ears of clients. This makes it important for them to develop close but vigilant relationships with portfolio managers. Risk managers want to be the portfolio manager’s first call if something goes awry; this can only happen if there’s an open line of communication, which only happens if there’s a pre-existing relationship. Ideally this relationship is built when times are good, so that if markets or performance deteriorate the conversations aren’t strained.

Conclusion

As described in this paper, there are many areas for risk managers to consider when looking at multi-strategy portfolios. In such complicated portfolios, there are many ways that things could go wrong. Having the right balance, whereby a risk manager can effectively police the portfolio via limits and restrictions, is an important part of the process. However, as we have aimed to explain, there is also so much more a risk manager can deliver to the overall process by being curious, engaged and proactive.

1. There are many other ways in which leverage can be generated. We choose not to explore these in this paper.

2. There are other elements to consider such as financing terms. This is beyond the scope of this paper.

3. In fact a good risk manager should alert the PM team if insufficient risk is being taken anywhere. After all everyone is in the game of making money.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.