The dismissal of Naci Agbal as the governor of Turkey’s central bank after only five months has precipitated a crisis. Applying restrictive capital controls seems the only way out.

The dismissal of Naci Agbal as the governor of Turkey’s central bank after only five months has precipitated a crisis. Applying restrictive capital controls seems the only way out.

March 2021

Introduction

The recent Turkish lira selloff took the market by surprise. It seems strange to say this: after all, the country has been on a worsening economic trajectory for a considerable period of time, exacerbated by the onset of the coronavirus pandemic. Why then, was the market quite so blindsided?

The Bait

The answer lies at the door of one man: Recep Tayyip Erdogan. In November 2020, President Erdogan replaced Murat Uysal, the governor of the Central Bank of the Republic of Turkey, with Naci Agbal, a politician and a former finance minister. Over the same weekend, Erdogan’s son-in-law Berat Albayrak resigned as finance minister. This move was welcomed by foreign investors: Albayrak was considered to be the architect of recent economic policy failures, whereas the promotion of Agbal was regarded as putting a technocrat at the helm of central bank. The market believed Turkey was about to pursue an orthodox monetary and fiscal policy, just as it was approaching the point of no return, as we highlighted in October.

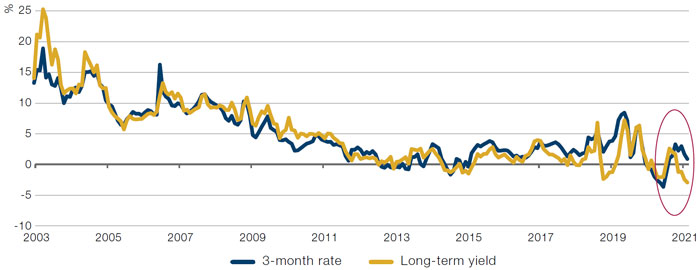

Agbal followed on his promise of pursuing a tight monetary policy to control inflation and increased interest rates by 875 basis points, from 10.25% to 19%. These hikes were enough to bring short-term real interest rates to positive territory (Figure 1).

Figure 1. Turkish Real Rates

Source: EM Advisors Group; as 24 March 2021.

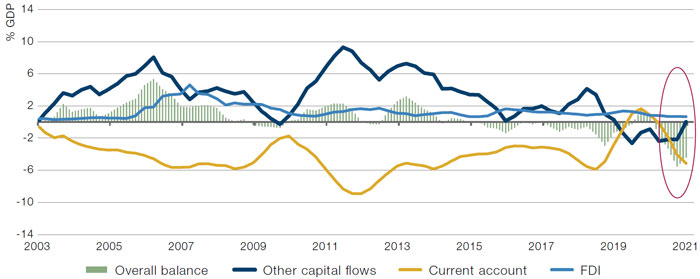

During Agbal’s short tenure, investors became optimistic about Turkish local assets, rewarding the new policies with inflows of roughly USD5 billion into local debt and equity markets and another roughly USD6 billion through FX swaps. These capital inflows, while not that large in the grand scheme of things, helped Turkey stem the deterioration of its balance of payments (Figure 2).

Figure 2. Turkish Balance of Payments

Source: EM Advisors Group; as 24 March 2021.

The Switch

This positive trajectory lasted until Saturday 20 March, when Agbal was dismissed by yet another late-night decree from President Erdogan. The Turkish lira immediately came under pressure as soon as the market opened, and at one point weakened by more than 17% from the closing level of Friday 19 March, before ending the day 8% weaker.

Restrictions on local banks when dealing with foreign entities have led to limitations for funding short liras. These limitations have created an exceptionally narrow exit door for foreign investors looking to exit the market. Even though US dollars could be bought in the spot market, it became very expensive to roll long US dollar/short lira to your forward dates: overnight implied yield on short lira reached more than 1,000% on an annualised basis. This elevated funding cost slowed outflows, but as forward points and funding costs come down, the spot lira should weaken further. Similarly, local bonds cheapened by almost 500bps the following Monday, and there has been minimal liquidity to trade. Primary dealers, local banks and local pension funds have been the main source of liquidity for local bonds as offshore investors have continued to try to sell since the weekend.

Going forward, the big question is how far the central bank is able to intervene in the market and defend the lira. Unlike 2020, when the central bank sold USD100 billion to stabilise the market, it doesn’t have the luxury of ample reserves this time around. Indeed, Goldman Sachs estimates that the central bank’s net reserves are currently negative USD60 billion (Figure 3).

Problems loading this infographic? - Please click here

Source: Goldman Sachs; as of 19 March 2021.

Where Next?

It should come to no surprise that President Erdogan is an opponent of higher interest rates. But the dismissal of Agbal after only five months in the office was not foreseen even by the most pessimistic analysts, and surprised almost everyone. The new governor Sahab Kavcioglu is a proponent of lower interest rates and has defended using central bank reserves to support the lira. There is no question that the new governor is likely to cut interest rates, but it is unclear how fast he’ll bring the rates down.

Turkey is back to where it was at the end of last summer and still facing the same challenges that we discussed in October. On the domestic front, the country is still struggling to contain coronavirus, and the pace of vaccination has been slow. The prospect for the return of tourism this year might not be as bad as last year, but it is still nowhere close to its historical averages. Furthermore, European countries have been slow to roll out vaccinations and are unlikely to have the pandemic under control before the summer, reducing the likelihood of significant tourism.

In addition, President Erdogan has to deal with a much less friendly US administration (which has applied sanctions after Turkey’s purchase of Russian S-400 missile systems), manage increasing tensions with its Mediterranean neighbours and its involvement in Syria and Libya.

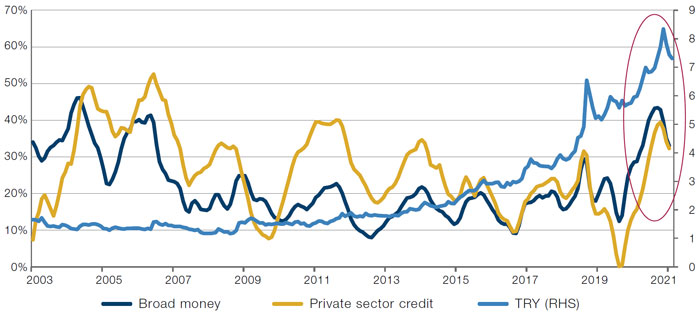

Facing pressure from home and abroad, we believe President Erdogan will call for an early election this year. In order to increase his support, we believe he will aim for higher economic growth at home, likely expanding credit creation to drive spending. Investors should keep a close eye on Turkish credit metrics: even though the pace of credit growth slowed down during the last few months, it is still at elevated levels and is already creeping up (Figure 4).

Figure 4. Turkish Money Supply

Source: EM Advisors Group; as 24 March 2021.

The Only Way Out

However, increasing credit creation does not address Turkey’s underlying issues. With an estimated current account deficit of USD24 billion, and another USD30-40 billion of private and public debt that cannot be rolled over (using a conservative rollover ratio) this year, we believe Turkey needs roughly USD50-60 billion of funding in 2021. To meet these funding requirements, applying restrictive capital controls seems the only way out.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.