The risk-reward is not yet favourable enough to step in and buy equities in size; and are rate hikes still the best course of action?

The risk-reward is not yet favourable enough to step in and buy equities in size; and are rate hikes still the best course of action?

15 March 2022

Buy the Dip?

If there has been one adage of investing during the last 10 years, it has been to ‘buy the dip’. Whenever markets have sold off, they have swiftly risen back towards previous levels.

So, after a turbulent few months, is now the time to buy the dip in the US? Or are we about to embark on a recession due to the stagflationary impact of higher commodity prices? As always, we are guided by our dashboard of indicators. This suggests that: (1) while risks have risen, a recession should not yet be our base case; and (2) that the risk-reward is not yet favourable enough to step in and buy equities in size.

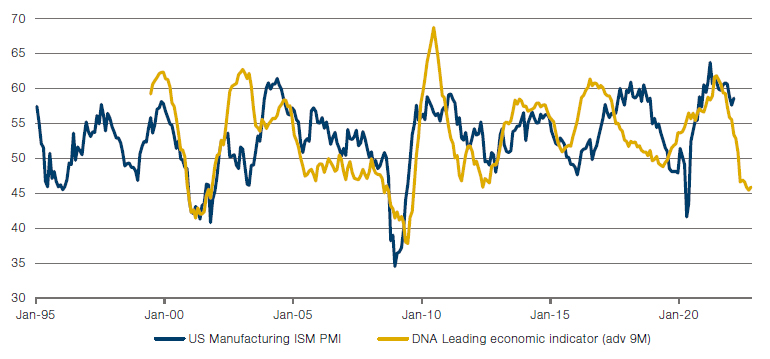

While markets have been troubled, this has yet to fully filter through to the real economy. Our leading indicator predicts the future direction of US manufacturing PMI, which is a key metric for general economic activity (Figure 1). For context, readings below 45 have historically been associated with a recession. Currently, the indicator is hovering just above 45, which implies that while we expect a slowdown, it is not signalling a full-blown recession. In short, activity still has some way to fall.

Equity prices themselves are yet to fully reset. Our combined market timing indicator – which comprises indicators of valuations, fundamentals, flows and sentiment – is not yet below the -0.5 threshold which would indicate the risk-reward of buying has significantly improved (Figure 2).

Buying a dip is not a bad strategy per se. But our analysis suggests that it may be best to patiently wait for a better entry point.

Figure 1. US Leading Indicator

Source: Man Solutions, Bloomberg; as of 3 March 2022.

Figure 2. Combined Market Timing Indicator

Source: Man Solutions; as of 3 March 2022.

Note: This analysis does not constitute a recommendation for purchase or sale and/or investment advice. For full details on how we compute the CMTI, please contact your local relationship manager.

Should We Still Get Rate Hikes?

At the start of the year, inflation was front and centre of markets. No wonder, then, that the market was expecting US rates to increase from 0.25% to 1.95% by March 2023.1 However, the market has seen some recent moves that are atypical of the hiking cycle, which may result in these expectations being tempered.

As an example, funding markets are starting to experience some stress, which started with sanctions being imposed on the Central Bank of Russia. The FRA-OIS spread, a measure of funding costs for the banking sector, has risen to its highest since the early days of the Covid-19 pandemic (Figure 3).

Additionally, real rates are heading backing towards their lows, which is very unusual given we are about to enter a hiking cycle. Figure 4 shows that the real rates tend to rise when the Fed starts to raise rates.

This does illustrate that central banks are caught on the horns of a dilemma – how far and how fast can they go? Should they rapidly raise rates, and try to fight persistent inflation? Or should they hold off and run the risk of stagflation? It is times like these when we give thanks that we are not central bankers and the decision is not ours to make!

Figure 3. US 3-Month FRA-OIS Spread

Source: Bloomberg; as of 14 March 2022.

Figure 4. Real Rates Versus US Base Rate

Source: Bloomberg; as of 14 March 2022.

With contributions from: Teun Draaisma (Man Solutions, Portfolio Manager) and Ed Cole (Man GLG, Managing Director – Discretionary Investments)

1. Bloomberg. As of 14 March 2022.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.