Volatility curves seem remarkably calm given the uncertain environment. How long can this disconnect last?

Volatility curves seem remarkably calm given the uncertain environment. How long can this disconnect last?

8 August 2023

After all the worrying, has the economy arrived at a soft landing? The equity market certainly seems to think so. In the first half of the year, US equities have had their best performance for over 25 years. Does this indicate the economy is out of the woods? At the July FOMC meeting, US Federal Reserve (Fed) Chair Jay Powell said that the central bank was no longer forecasting a recession. The US public certainly seems to agree, as Figure 1 shows: Google Trends’ search interest in the US in the term “soft landing” reached peak popularity in July.

Figure 1. US search trends for ‘soft landing’

Problems loading this infographic? - Please click here

Source: Google Trends, from Jan 2008 to end July 2023, United States data. Google Trends’ numbers represent relative search interest for a given region and time. A value of 100 represents the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term to show in the results.

Markets similarly seem to have latched onto the soft-landing scenario, with confidence in a benign outlook being illustrated by the cost of market protection in the form of puts now trading at the cheapest levels since their data began in 2008, as reported by Bloomberg.1 Equity market participants in aggregate currently appear to have little interest in seeking insurance against market downside.

Meanwhile, rates stand at multi-decade highs and further hikes by central banks cannot be ruled out: despite inflation having eased recently, it remains at high levels in many economies around the world. The speed of rate moves has proven challenging for some businesses. In fact, the Fed has only hiked interest rates at a faster pace in just one period in history, and that was in 1980.2 The new high inflation, high interest rate operating environment has sparked a number of business failures, just the latest of which is UK household and garden products retailer Wilko, which has given notice that it may enter administration unless a buyer is found.

Remarkable calm in markets

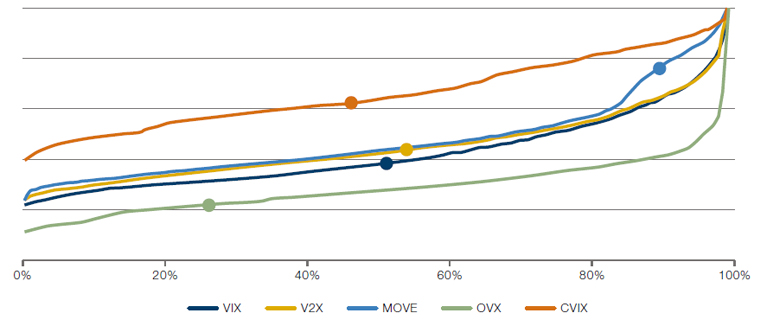

Add to this mix the geopolitical tension that is escalating and investors would be forgiven for worrying what the future holds, given how uncertain the macro environment is. And yet markets appear essentially unperturbed, with volatility prints languishing around average or even the bottom end of their historical ranges for some markets, as shown in Figure 2. Volatility curves for indices, such as the ‘fear gauge’ VIX, are remarkably low and flat. So, not only is current spot volatility muted but forward volatility expectations are also low.

Figure 2. Volatility indices for various assets by quantile, over past 10 years

Source: Man AHL, using data from Bloomberg, as at 30 June 2023. The VIX is the Chicago Board Options Exchange’s Volatility Index, V2X measures volatility in the Eurostoxx 50, MOVE (Merrill Lynch Option Volatility Estimate) measures the market’s expectation of implied volatility of the US bond market, OVX is oil’s implied volatility and CVIX measures currency market volatility. Dots indicate current levels.

With the exception perhaps of the MOVE Index, which is at the upper level of its 10- year history, volatility across markets is muted, with US and European equities around the 50th percentile and oil and currency volatility even more relaxed relative to history. While bond investors seem to be more concerned about the uncertain environment, equity market investors don’t seem to be particularly worried at the moment.

Without attempting to forecast the future, the current volatility prints feel odd, sitting at such low levels, given the global macro uncertainty and geopolitical tension. What will it take to spur them to move higher? While vol curves seem to be calmly enjoying the summer, the disconnect between volatility and the wider macro environment will not last forever.

(With contributions from Tarek Abou Zeid, Partner and Senior Client Portfolio Manager, Man AHL).

1. Stocks Are Doing So Well That It May Be Time to Start Worrying - Bloomberg

2. Source: Refinitiv: Lipper Mid-Year Investment Outlook 2023 (refinitiv.com)

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.