Markets focused on technology in Q2 - can quantitative techniques unpack the tech trends?

Markets focused on technology in Q2 - can quantitative techniques unpack the tech trends?

11 July 2023

Markets ended the second quarter on a buoyant note thanks to sentiment quickly moving on from fears of inflation and a potential systematic banking crisis, and animal spirits turning to the topic of artificial intelligence (AI). But the first week of July has featured the return of volatility on unexpectedly strong US jobs data and the related jump in Treasury yields. Have investors temporarily forgotten about the potential for interest rates to rise further, impacting markets? And although it seems a repeat of the 2008 banking bust is not playing out, could the market be reprising the hype of the DotCom years? There are ways to track the dominant concerns of markets over time. By using natural language processing (NLP) models, the prevalence of themes in financial texts such as broker reports can be gauged. Quantitative analysis of the texts in documents written by industry experts, such as broker reports, can help identify and then visualise these themes capturing the market’s attention, and track how each changes over time.

Key phrase extraction identifies the focus of the text, and when key phrases across all the document set are aggregated and compared against history, the prevailing themes become evident. Figure 1 visualises the prevalence of the themes that have been written about in recent years. The topic of interest rates is indeed one that has remained on investors’ minds so far this year, while inflation worries have been receding quickly over the past six months. The most notable and quite rapid uptick though has been the topic of AI.

Figure 1. Changes in key phrases in recent years

Problems loading this infographic? - Please click here

Source: Man Numeric, using a variety of broker reports received via Refinitiv.

The market in the past quarter has been supported by the excitement around AI and the buoyant behaviour of technology stocks, and by extension, the market indices. This strength obscures the picture under the surface. While we know that index returns have become more concentrated in recent years, the data for the end of the second quarter shows that the Herfindahl-Hirschman Index (HHI), a commonly used measure of market concentration where the higher the level the closer the market is to being entirely dominated by a single firm, has risen rapidly over the past quarter. The HHI has now spiked to a level not seen before in history, even higher than the DotCom craze around the year 2000.

Figure 2. Herfindahl-Hirschman Index for the MSCI World Index, January 1996 to June 2023

Problems loading this infographic? - Please click here

Source: Man Numeric, Bloomberg data.

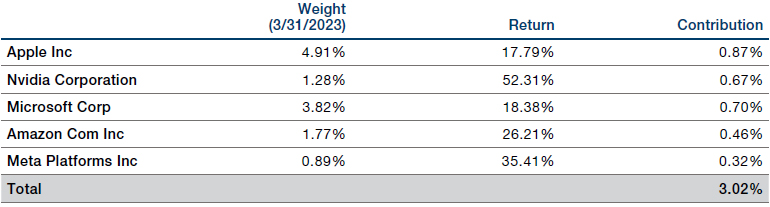

Why does this matter for equity investors? It means the market is currently dominated more than ever by just a handful of names. The sum of contribution of the Top 5 contributors to the performance of the MSCI World Index in the second quarter was 3.02%, as shown in Figure 3. This was approximately 44% of the 6.83% return for the MSCI World Index in the second quarter, or to put it simply, just five tech-related stocks of the 1,500+ names in the index were responsible for nearly half of second-quarter returns. Not owning these five names would have set an active manager back 3% relative to the index.

Figure 3. Top Contributors to MSCI World Index, Q2 2023

Source: Man Numeric, Bloomberg. The organisations mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

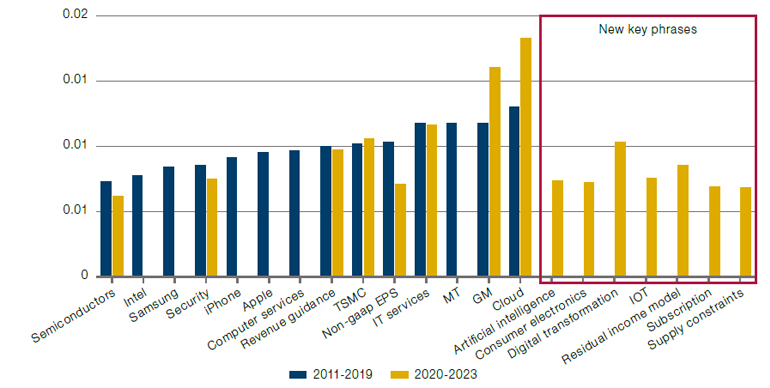

Again, does the dominance of such a small handful of stocks in driving overall market returns echo the tech hype around the year 2000? NLP analysis shows that the excitement looks a little different this time, and there has been a new set of themes arising within the technology sector in the past few months that seems more varied and perhaps more nuanced than before. While there is still interest in longer-running themes such as semiconductors, our research shows the term “cloud” is gaining popularity over “computer services”, and a set of new topical themes such as “AI”, “digital transformation”, “IOT” (internet of things) is now featuring strongly. Our comparison of IT sector representative key phrases using reports from early history (2011-2019) vs recent history (2020-2023) is shown in Figure 4, with the set of entirely new recent themes highlighted. The emphasis is not about simply buying anything within the technology sector; it is now more nuanced. The market is no longer so focused on whether it’s better to buy certain names like Apple or Samsung, and appears to be moving on to exploring technology themes such as cloud, AI and consumer electronics. More fresh key phrases will arise as technology investors' attention shifts to new areas of innovation. NLP techniques give investors a way of seeing how these themes are evolving and making sense of the hype around the sector.

Figure 4. New (post 2020) versus old (2011-2019) old key phrases within technology

Source: Man Numeric, using a variety of broker reports received via Refinitiv. The organisations mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale.

With contributions from Nina Gnedin, Portfolio Manager at Man Numeric, and Yang Zhou, Associate Quantitative Researcher, Man Numeric.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.