Tech is profiting from AI but could ultimately disrupt itself; the potential liquidity crunch if the debt ceiling rises; and earnings revisions are encouraging – with a notable exception.

Tech is profiting from AI but could ultimately disrupt itself; the potential liquidity crunch if the debt ceiling rises; and earnings revisions are encouraging – with a notable exception.

30 May 2023

After the AI Boom

If there were any doubts about the market’s infatuation with all things AI, NVIDIA surely blew them away last week. In its first-quarter results, the ‘AI arms dealer’ – provider of the processors able to handle high-level AI training – relayed that it expected its revenue next quarter to reach $11 billion, 50% more than consensus expectations of $7 billion (Figure 1). Including an immediate 23% spike in its share price, NVIDIA has now gained over 160% so far in 2023 and is approaching a $1 trillion market capitalisation.1

At present, it seems the tide of enthusiasm for AI is lifting all boats near it. Such a disruptive force will inevitably create winners and losers over the coming years, but in our view it is too early to fight the optimism and try to identify the longer-term short candidates within the theme (outside a few names that have already sold off heavily, such as educational technology, and/or already faced deteriorating fundamentals).

In time, though, technology companies may themselves become victims of the AI revolution through the productivity improvements they deliver. Many have significant enterprise businesses whose revenues depend on the number of user licences taken by their subscription clients. If AI applications create a white-collar job recession, which would be highly deflationary due to lower demand for high wage labour, these clients simply won’t need so many licences.

It’s too soon to say whether AI is a truly transformative technology, an equity bubble, or some combination of both. We believe that looking at companies that will disrupt or be disrupted needs to be a part of the investment process, but not the only criteria; fundamentals still matter too, especially where weakness could cause multiple compression. For some tech names, the positive effects of AI (from new business lines, efficiencies and/or market leadership) will outweigh any negative impacts. For others, the disaggregation of AI victors and vanquished currently bundled in some AI indices or strategies – while still likely some way off – may not leave much of a future.

Figure 1. NVIDIA Revenue

Problems loading this infographic? - Please click here

Source: NVIDIA; as of 24 May 2023. The organisations and/or financial instruments mentioned are for reference purposes only. The content of this material should not be construed as a recommendation for their purchase or sale. Projections are subject to change and are for illustrative purposes only. Projections should not be relied upon when making investment decisions.

After the Storm, the Deluge?

Anything written about the US debt ceiling is at risk of becoming instantly obsolete as negotiations proceed. However, with the deal struck over the weekend coming before Congress this week, we can look ahead to what may follow any resolution.

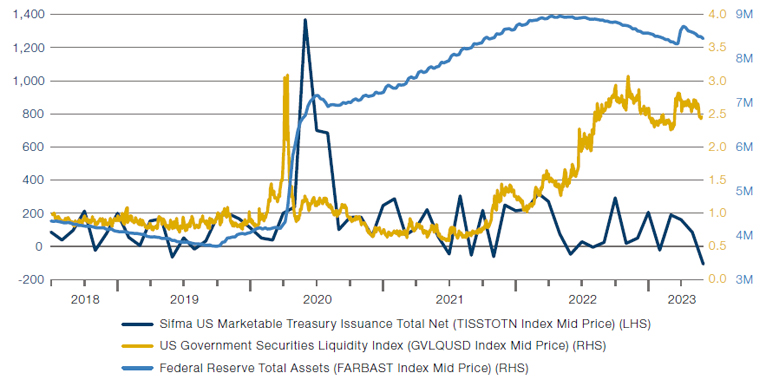

Beyond the immediate market implications we discussed last week, we note the potential impact of a return to something like normality for sales of US Treasuries. In Figure 2, we see that US Treasury liquidity (the orange line, represented by the average yield deviation relative to a fair value yield curve for these bonds as calculated by Bloomberg – a greater deviation from the expected yield implies less-liquid conditions) worsens in periods of high issuance (the dark-blue line). This orange line has remained elevated as the Federal Reserve continues to reduce its balance sheet (the light-blue line), with the sole blip being the US central bank taking regional banks’ assets into receivership.

To replenish the Treasury General Account if the ceiling is lifted would require an additional $700 billion to $1.2 trillion, according to consensus estimates, in a relatively short period of time. We would expect such a glut of issuance to worsen US Treasury liquidity and, as an extension to that, asset liquidity in general.

Figure 2. US Treasury Liquidity Versus Issuance and the Federal Reserve Balance Sheet

Source: Bloomberg; as of 23 May 2023.

An Earnings Inflection – Everywhere Except EM

The beginning of May often feels like the start of a new season. But this year, it isn’t just temperatures in the Northern Hemisphere that are heating up now summer is upon us; corporate earnings also appear to be warming.

Figure 3 shows a simple count of earnings revisions up versus earnings revisions down across various equity markets. What becomes immediately apparent is the inflection point in late April and early May as the number of positive revisions has increased dramatically and the number of negative revisions has decreased dramatically. This can be seen in US stocks, global large-caps and (to a smaller degree) global small-caps.

The exceptions, however, are emerging markets – although upwards revisions are at least now trending higher. Should emerging markets arrive with a lag at a similar inflection point to developed equities, we would expect the attributes of emerging small-caps we outlined at the start of the year to become even more emphatic.

Figure 3. Earnings Revisions Across Equity Markets

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Problems loading this infographic? - Please click here

Source: Man Numeric; as of 23 May 2023.

1. Source: Bloomberg; as of 25 May 2023.

With contribution from: Ryan Allison (Analyst, Man GLG); Jonathan Daffron (Deputy Head of Investment Risk, Man FRM); and Nina Gnedin (Portfolio Manager, Man Numeric).

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.