With higher interest rates poised to stay for now, changes in yields could unsettle some momentum strategies.

With higher interest rates poised to stay for now, changes in yields could unsettle some momentum strategies.

19 September 2023

All Eyes on Yields

As the European Central Bank showed when it raised rates again this week, elevated interest rates are still very much with us. As investors, if we hold a static portfolio that contains some bonds – it is easy enough to get our heads round the impact of changes in yields. However, what if our sensitivity to yields is more dynamic, and perhaps less direct? For hedge fund investors, what is the current relationship between interest rates, and momentum (both time-series momentum and cross-sectional momentum)?

We have previously discussed these differing momentum strategies and noted that yield movements can affect them differently.1 Time-series momentum is directional and goes long assets that are appreciating and short those that are depreciating and appears in trend-following strategies. Cross-sectional momentum is market neutral, taking longs and shorts within an asset class, and typically appears in statistical arbitrage and equity long-short strategies. Both types of momentum are chameleon-like.

Time-series Momentum and Yields

US 10-year Treasury yields have continued to rise: they were 0.7% 3 years ago, 1.3% 2 years ago, 3.4% a year ago, and recently hit 4.3%. It is therefore no surprise that short bond positioning has been one of the strongest momentum signals of recent years. Therefore, trend-following strategies are currently short rates, as they have been for much of the past couple of years, and in some size in aggregate.

A visual example of the relationship of time-series momentum to yields can be seen in the Soc Gen CTA Index (which is mainly trend-following strategies), where there is a positive correlation (Figure 1).

Figure 1a. Trend approaches following yields higher

Problems loading this infographic? - Please click here

Source: Bloomberg.

Figure 1b. Trend now positively correlated with yields

Problems loading this infographic? - Please click here

Source: Bloomberg.

This implies that for strategies taking time-series momentum, they potentially risk losses if bond yields were to fall. This was a large driver of the pain experienced in these strategies in March 2023.

Cross-sectional Momentum and Yields

Cross-sectional momentum involves a market-neutral style that goes long stocks that are expected to appreciate and shorts those that are expected to decline. This year, the stand-out positive performers on the long side have been technology stocks.

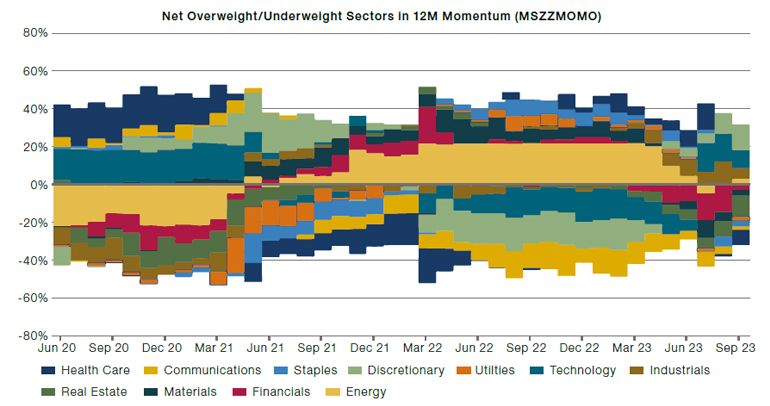

Therefore, it is no surprise that when we look at a sector-wise breakout of the Morgan Stanley 12-month US momentum basket, the largest long-exposure is technology:

Figure 2. Technology the largest long exposure in momentum basket

Source: MS Custom Baskets.

Conventional wisdom tells us that higher interest rates are bad for valuations of companies that have most of their expected earnings far in the future such as some technology stocks (particularly unprofitable ones).

Indeed, if we look at the correlation of the Morgan Stanley 12-month US momentum basket to 10-year US yields, it currently shows a negative correlation:

Figure 3. MS momentum vs US 10-year yields has flipped negative

Source: MS Custom Basket/Bloomberg.

That means for strategies taking US cross-sectional momentum, similar in construction to the MS basket we look at here, the data suggests they face losses if bond yields were to rise.

Conclusion

We now know that if yields were to rise further from here we would expect time-series momentum (i.e. trend followers) to be profitable, whilst the opposite would be true for cross-sectional momentum. The latter point is particularly useful to know. Whilst we’d be able to directly measure interest rate duration of a trend follower, the interest-rate sensitivity of a strategy running cross sectional momentum is more hidden. All eyes are now on bond yields.

With contributions from Faisal Javaid, Head of Investment Risk, Man FRM.

1. Mo’ Momentum, Mo’ Problems? | Man Institute | Man Group

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.