What could spoil the big tech party? Also, why investors remain vigilant after yet another Turkey central bank head quits.

What could spoil the big tech party? Also, why investors remain vigilant after yet another Turkey central bank head quits.

13 February 2024

Are we peak tech? This tech driven S&P rally has drawn parallels to the bubble of 1999 with the Magnificent Seven1 driving the majority of S&P gains this year.

However, today’s landscape is different. The market is not rewarding just any unproven business models like it did during the tech bubble, this rally is driven by proven business models generating billions of additional free cash flow (FCF) dollars. With substantial capital expenditure and an acceleration in Artificial Intelligence (AI) algorithms, there is enough momentum suggesting a robust foundation for current and (possibly even future) valuations to drive real economic growth.

This is not to say that some stocks in the AI supply chain are not reflecting bubble valuation behaviour. But the tech leadership is based on real top-line growth and operational leverage.

The top ten S&P constituents now account for a staggering 33% of the S&P 500’s total earnings (Figure 1), reflecting not only their current financial impact but also their potential for future growth. Their earnings are driven by a combination of top-line growth and margin expansion, with the latter often overlooked yet vital in understanding the sustainability of their market performance.

Figure 1. Top 10 companies as share of S&P total

Problems loading this infographic? - Please click here

Source: Goldman Sachs, Factset Consensus.

A comparison of the tech bubble era against the current state reveals some clear similarities BUT also some distinct differences.

The commercialisation of the internet in the late 1990s created a swath of new profit pools, new industry winners and disrupted a number of incumbent sub-sectors. The promise of AI is no different in generating new winners and losers across the tech enabled economy. In the dotcom 'gold rush' the picks-and-shovels were companies selling networking gear (like Cisco), no different to the AI supply chain vendors of today (like Nvidia).

However, during the bubble, top companies like Cisco traded at nearly 100 times earnings, whereas today’s leaders like Microsoft, Amazon, and Nvidia exhibit more conservative multiples, accompanied by genuine operational leverage.

For instance, Meta, despite expanding topline at around 15%, operates with a workforce reduced by 22% from last year, exemplifying the type of real-time, efficiency-driven growth that bolsters confidence in the sector’s valuations.

As tech companies continue to take market share from traditional players, should there be concerns about their now more cyclical nature? Companies like Tesla and Amazon are of course more sensitive to economic shifts, yet firms such as Microsoft maintain robust growth narratives. Moreover, more than half the earnings growth from these tech giants will be driven by a combination of structural growth and operational leverage, particularly with AI’s ascendancy.

AI – the new frontier

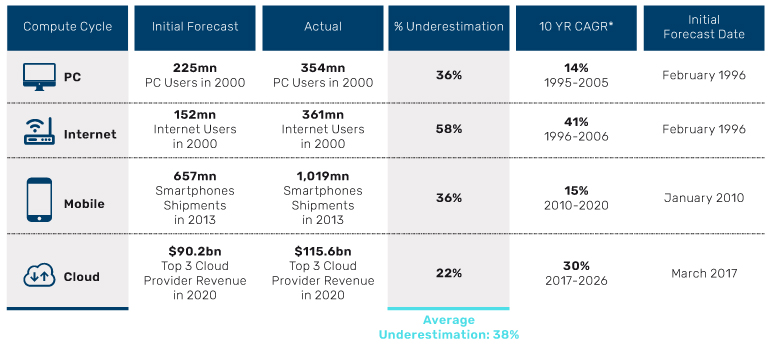

AI is the next significant fundamental core technological shift, akin to the transitions from PC to mobile and internet to cloud. Such core technological shifts happen every 10-15 years, and Wall Street has a consistent track record of underestimating the potential of such shifts 3-4 years out. The current trajectory of AI is likely no exception.

Figure 2. On average, Wall Street underestimates the size of new tech opportunity by 38%

Source: Morgan Stanley.

Similar to previous technological shifts, AI will be no different in generating new profit pools and disrupting existing ones. It should drive investment opportunities in sectors like cybersecurity, health tech, and AI-driven productivity tools, meanwhile creative advertising and outsourcing sectors could face further challenges.

However, this optimistic outlook for tech valuations is not without its potential spoilers. This year is the biggest election year in history with over half the global population going to the polls, across 65 elections. The one that matters the most for tech sectors is really the United States. The tech industry is more sensitive to shifts in international policy and trade relations than ever before, as evidenced by the US-China trade tensions during the previous Trump administration.

These elections could redefine the regulatory and trade landscapes, potentially disrupting supply chains and affecting today’s tech rally flag bearers like Nvidia and ASML, which have significant exposure to the Chinese market.

In conclusion, while the robust growth and operational leverage in the tech sector suggest that valuations are more grounded in reality rather than hype, investors should remain vigilant. The geopolitical backdrop could present challenges that were not as pronounced during past technological shifts, potentially derailing the growth trajectory and calling for a strategic reassessment of the tech investment landscape.

Investors Remain Vigilant after another Turkey Central Bank Head Leaves

The resignation of Turkey’s central bank governor Hafize Gaye Erkan in early February after less than eight months in the post has put investors on alert again over President Erdogan’s commitment to orthodox economic policy and controlling rampant inflation.

While she said she resigned for personal reasons – citing a smear campaign against her and her family – it’s not inconceivable that she must have felt renewed pressure from President Erdogan to support boosting economic growth at the expense of reining in inflation in the run-up to municipal elections in March.

Her successor Fatih Karahan, the previous deputy governor and fifth head of the central bank since 2019, is widely expected to stick with conventional measures to tame Turkey’s rampant inflation rate which accelerated to almost 65% in January. Investors will keep a beady eye on whether the officials will be given the leeway needed to bring down inflation after a volatile few years.

Before the May 2023 Presidential elections, the anticipation of a regime change spurred foreign investor optimism, which contributed to the compression of Turkey’s credit risk premiums. Five-year Credit Default Swap (CDS) rates fell from 900 basis points in mid-2022 to approximately 500 basis points during the elections, mitigating concerns over Turkey’s populist pre-election fiscal measures.2

However, market sentiment turned as Erdogan’s campaign gained momentum and CDS rates went back up to 700 basis points3 as investors tried to exit their long positions. In an unexpected move, Erdogan responded by signalling a shift towards orthodox economic policies and appointing the “dream team,” of technocrat Finance Minister Mehmet Simsek and Erkan, committed to combating inflation through tough measures such as raising interest rates and cooling credit growth even if it means slowing economic growth

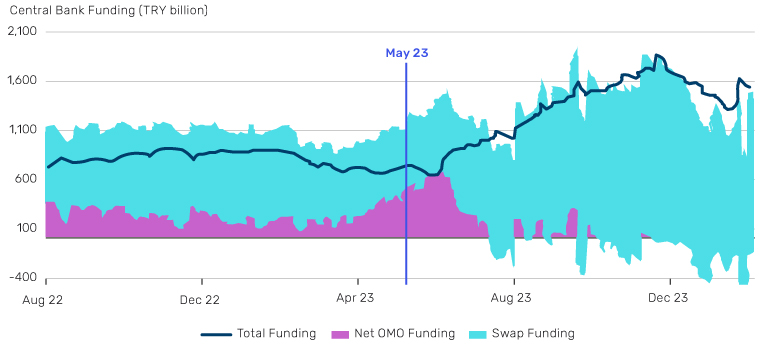

The central bank hiked interest rates from 8.5% to 45% (Figure 3, yellow line) and slowed the amount of credit being injected into the economy, from more than 100% (annualized quarterly changes) to mid-30%.

Figure 3. Real rates are significantly negative

Problems loading this infographic? - Please click here

Source: Bloomberg.

That said, even though there has been a slowdown in credit growth to 30%, monetary policy remains more expansionary compared to the tighter conditions of 2020 or 2018. Consequently, while there has been some improvement in the country's current account balance, it is still in a significant deficit of nearly $50 billion over the past 12 months. Furthermore, the extent of the current account adjustment is less than what was observed in 2019 and 2021, which followed periods of more stringent monetary policy.

Finally, the new governor still has the challenge of a massive net negative reserve of almost $50bln. Even though Turkey saw more than $12bln capital inflow after the election, it has not been able to reduce its large dollar swaps holdings with local banks.

Moreover, these swaps have also been the source of Turkish lira (TRY) funding for local banks. Even though the central bank has removed liquidity through open market operations, the TRY liquidity provided since May 2023 has more than doubled, defeating the central bank’s objectives, as inflation is still rampant. Although, this liquidity injection has been mitigated by modifying reserve requirements on different sorts of deposits for local banks from time to time, that has not been enough to control inflation.

Figure 4. There is ample TRY liquidity in the system

Source: Barclays.

Looking ahead, the success of Turkey’s economic policy will hinge on the ability of Mr. Simsek and the new governor, Mr. Karhan, to implement and maintain policies that address the dual challenges of fiscal balance and positive real interest rates. As we approach the local elections next month, we should expect more fiscal spending and pressure on Mr. Simsek to loosen his fiscal grip. We’ve already seen a minimum wage increase of 49% at the turn of this year which was far above the 36%-year end inflation target. Investors must remain vigilant, as the economic landscape in Turkey remains fraught with challenges.

With contributions from Discretionary Portfolio Managers Sumant Wahi and Ehsan Bashi.

1. Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla.

2. Source: Bloomberg.

3. Source: Bloomberg.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.