Could a Labour majority government offer a long-awaited boost to an unloved asset class? Also, demand for solar panels has driven up the price of silver. Can it outshine gold?

Could a Labour majority government offer a long-awaited boost to an unloved asset class? Also, demand for solar panels has driven up the price of silver. Can it outshine gold?

25 June 2024

The UK news agenda is currently being dominated by the upcoming general election on 4 July as political parties vie for seats in the next parliament. Opinion polls are predicting a landslide victory for the Labour Party, potentially even exceeding that which occurred in 1997.

The reliability of opinion polls has been debated ad nauseum. Crucially, even if the largest recorded swing of approximately 9% between final opinion polls and the election outcome was replicated, Labour would still achieve a working majority. What could a Labour majority mean for UK equities, an asset class which has been unloved and undervalued compared to its US and global peers?

While we can debate causation and correlation, sizeable majorities in UK Parliament have historically coincided with above average economic growth. Given the challenges the next government will face in relation to the UK’s public finances, the role of equity financing in delivering investment for growth should not be underestimated.

For UK equities in general, a working and stable majority taking a centrist and fiscally cautious stance would be welcome versus recent history and we believe this should allow the valuation of UK equities to catch up versus European peers.

Which sectors are likely to benefit most?

The Labour Party’s manifesto identifies the clearest economic multiplier – or opportunity to generate growth – as construction via reforms to the planning system. We are excited about the valuation and profit potential of several names in this area. The are no notable negatives for banks that we see, which is contrary to some commentary and distinctly different to the 2019 election. Where there are negative implications for some sectors, such as domestic energy through ongoing elevated tax rates, as well as transport given rail policy, these have been well signalled.

Our sense is that following the election, the narrative will quickly return to monetary policy and the beginning of the rate cutting cycle. We also expect M&A activity to continue, likely leading to an improvement in IPO activity. In short, we believe a Labour majority could bring a long-awaited boost to UK equities.

Can silver outshine gold?

Silver is having its moment in the sun, as demand from the solar panel industry and AI datacentres has boosted its spot price by over 20% this year compared to gold’s 13% gain.

Demand is forecast to increase and falling supplies have created the second-largest silver deficit in over 20 years, according to the Silver Institute. Does this mean silver will overshadow gold as the leading precious metal?

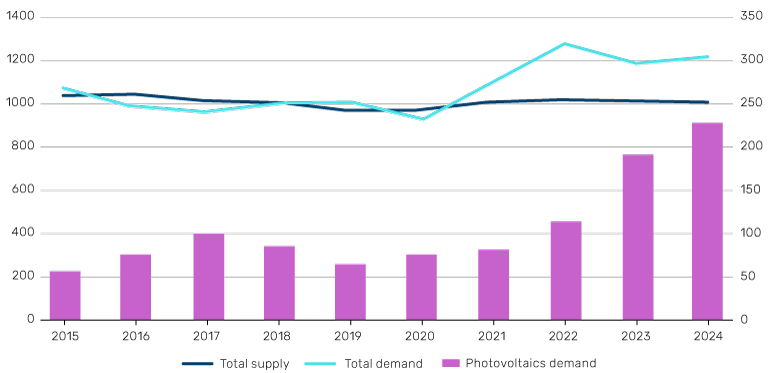

Figure 1: Solar panels drive silver demand beyond supply

Source: Silver Institute

Silver shares many attributes with gold: it has been a store of value for thousands of years, has a close relationship with real interest rates, and possesses attractive industrial properties. However, silver is far more abundant than gold, with underground silver mines having grades (concentration of the desired mineral within the ore) which are over 100 times higher than comparable gold mines. That said, it’s still rare, hence why it costs almost a million dollars a tonne.

Although silver is a recognised store of value, it is not the ‘go-to’ choice during geopolitical or economic shocks. Figure 2 illustrates that gold attracts more safe-haven flows and outperforms silver in such times. However, as conditions stabilise, investors start to look at the ‘poor man’s gold’ and silver outperforms.

Problems loading this infographic? - Please click here

Central banks favour gold because of its price density, which is almost 150 times higher than silver's. This preference has supported gold prices in recent years, a benefit that silver hasn't directly enjoyed.

Silver’s industrial glitter

While it may not be a central-bank favourite, silver’s industrial clout is growing. Silver boasts the highest electrical and thermal conductivity of all metals. That, and its relative abundance, makes it the prime metal for industrial use – 54% of silver is used in industrial applications, compared to 10% for gold. This industrial demand can drive silver prices up during periods of flat interest rates but can also depress prices during low activity periods.

Silver is at the heart of the energy transition. As we shift from hydrocarbons to electric power, the demand for circuits, switches, motors, and contacts grows, all of which use silver. This demand is expected to rise with the increase in electric vehicles and AI/datacentres.

The most significant current end use of silver is in solar panels, each needing 10 to 20 grams of silver per kilowatt. Bloomberg estimates that over 500 gigawatts of photovoltaic (PV) units will be built this year, requiring approximately 250 million ounces of silver, or 30% of global mined supply. This demand is rapidly increasing, with a 67% rise in PV installations between 2022 to 2023 alone.

Dwindling Supply and Changing Price Dynamics

The way silver prices are set is also evolving. Historically, real rates determined prices, given silver's role as a store of value. However, the supply-demand balance is becoming far more critical.

Mined silver supply peaked in 2016 and has stagnated due to a lack of investment, as low prices and stringent environmental, social and governance (ESG) requirements discouraged new mines. The Silver Institute projects a 1% decrease in total silver supply in 2024, leading to a projected market deficit of 215.3 million ounces, the second-largest in over 20 years.

This energy transition-driven deficit is silver's ‘silver lining’ against gold's superior store of value and safe-haven qualities.

All sources Bloomberg unless otherwise stated.

With contributions from Henry Dixon, Portfolio Manager, UK equities, and Albert Chu, a portfolio manager, and Angus Poland, an analyst, focusing on natural resource strategies at Man Group.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.