How can investors defend against rising inflation? And will the crisis in Ukraine prompt an accelerated renewable transition?

How can investors defend against rising inflation? And will the crisis in Ukraine prompt an accelerated renewable transition?

May 2022

This article was initially published in Forbes on 19 April 2022.

War on the European mainland. Inflation at 40-year highs. The present seems to have arrived as if from a different age.

Lawmakers and many economists, past and present, certainly seem to think so. The European Central Bank’s first chief economist and former Bundesbank official Otmar Issing has warned of a return to the stagflationary years of the 1970s.

Those same years occupy the minds of Britain’s politicians too. It was recently reported that Rishi Sunak, the UK’s Chancellor, organised a university-style

seminar with the government’s chief economist to learn the lessons of the Opec crisis of 1973.

The historical parallel is rich. In 1973, war precipitated a shock. On that occasion, the Yom Kippur war led the Opec nations to shut off the taps and oil prices soared. Today, war is again playing havoc. In fact, 2022 has given us the highest commodity price shock since Yom Kippur.

You might have thought that the world could absorb the costs of economic sanctions directed at the world’s eleventh-largest economy with ease. But that number disguises how much the world has come to rely on Russia for the energy that powers it. Russia is the world’s top exporter of gas, second for oil, and third for coal. Europe, in particular, is heavily reliant on Russia.

Figure 1. Share of Russian Oil and Petroleum Products Imported (EU27)

Problems loading this infographic? - Please click here

Source: Eurostat; as of 2020.

Now, the prices of all are soaring. Despite the recent fall following President Biden’s announced release of US strategic reserves, Brent crude closed the month above $100 a barrel and hit a recent peak of over $130. A year ago, it was $69. In early March, gas prices rocketed to 18-times their value a year before. Coal meanwhile has hit a 200-year high.

The world is also discovering, to its cost, the other areas of the economy where it is exposed to Russia. The large run-up in nickel prices in early March was likely driven by a short squeeze on the world’s largest nickel and stainless-steel producer, Tsingshan Holding Company. The increase was so dramatic (as you can see in the chart below) that nickel trading on the LME was halted for six trading days in early March.

Figure 2. Nickel’s Wild Ride

Problems loading this infographic? - Please click here

Source: Bloomberg; as of 1 April 2022.

It’s not just investors who will suffer, however. Price rises will be felt by all. This is in part a consequence of the world’s largest wheat exporter invading the fifth-largest, a nation popularly known as the “breadbasket of Europe”, putting nearly a quarter of the world’s wheat supply at risk. The Resolution Foundation, a UK think tank, expects a 10% increase in the cost of living for Britain’s poorest as heat, fuel and food prices all rise.

Figure 3. World’s Largest Wheat Exporters

Problems loading this infographic? - Please click here

Source: UN Comtrade Database, HS Code 1001; as of 2020.

Trying to figure out the impact of all this, I turned to friend and colleague, Teun Draaisma. Teun, along with his team, happens to be the Man Group resident expert on all things inflation. They recently co-authored a 100-year study of inflationary periods in the US, UK and Japan. Unsurprisingly, Teun set today’s events in a longer view.

“We appear to be at the end of a forty-year low-inflationary regime,” Teun said. The world that we have grown used to – with high debt, zero rates and huge inequality – has led us to a series of policy reactions. Teun reeled off a list: “fiscal not monetary policy, average inflation targeting, high spending to address inequality and reduce climate change.” “All,” he noted ominously, “are inflationary.”

While the war in Ukraine isn’t the sole cause of this new inflationary regime, it exacerbates it. Throughout history, periods of persistently high inflation have begun Back to the Future: Are we heading back to the 1970s? | 4 with specific events that lead to a generalised trend. Inflation, after all, has a habit of causing itself, as the expectation of inflation increases and workers demand higher wages to account for it.

Teun dismissed a common argument that these higher wages only emerge in eras with “strong unions” and “wage indexation”, neither of which are true of the world today. Wage growth simply needs “a tight labour market”, “underinvestment in commodities”, and “a shortage of housing” he explained. Sadly, that’s a pretty good description of the world today.

At a moment like this, where should an investor turn?

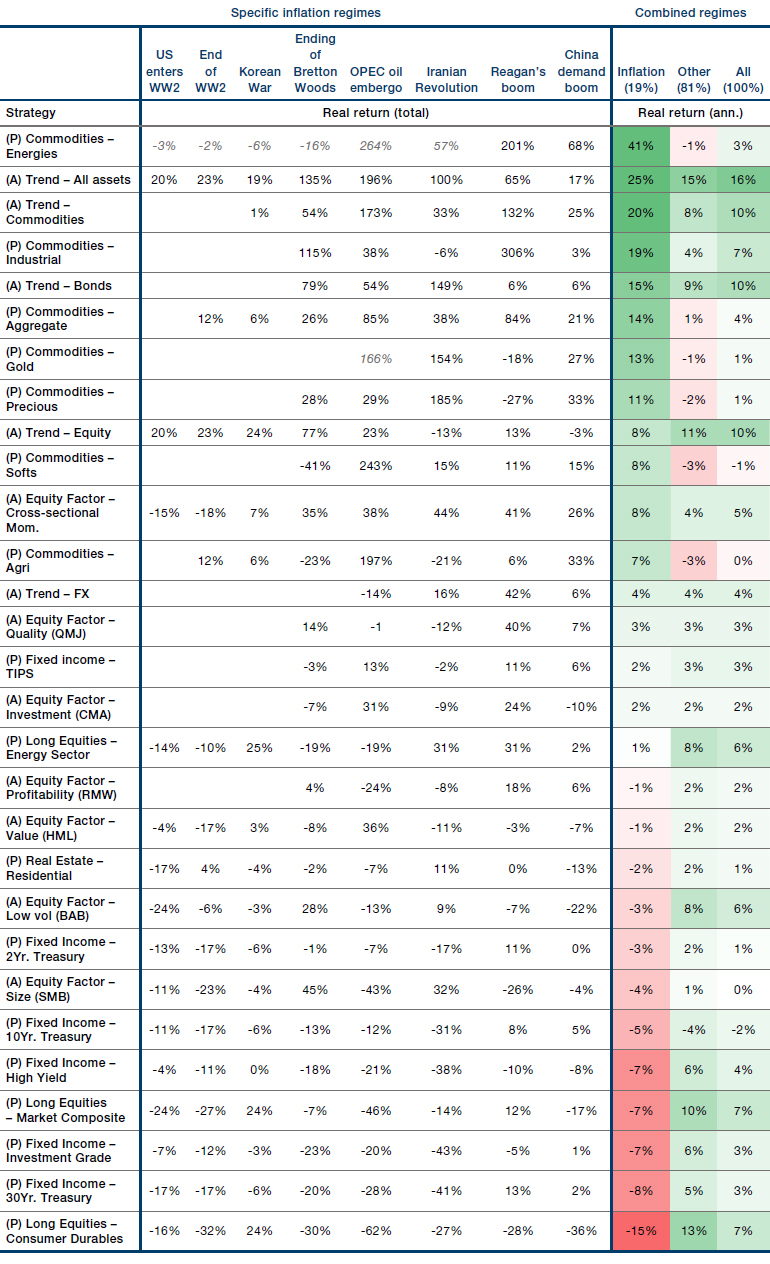

Teun’s research, conducted I should note before the Ukraine crisis took hold, provides some excellent guidance. As I wrote here last month, commodities have historically proved a hedge against inflation. So the research shows. On aggregate, commodities deliver an average annualised return of 14% in years of high inflation. Equities, on the other hand, perform poorly, as do bonds. The classic 60-40 equity-bond portfolio delivered a -6% annual return in periods of high inflation.

Figure 4. Summary Performance of Assets in US Inflation Regimes

Source: Man Group, National Bureau of Economic Research; as of 1926-2020.

Note: A summary table of real total returns to assets analysed across this paper, through the eight US inflationary regimes shown in Exhibit 1, as well as the annualised return during inflationary, other, and all periods. In the first column, the strategy is denoted as active or passive by ‘(A)’ or ‘(P)’, respectively. Returns for energies and gold in grey italics are spot returns where we do not have futures data. These are not included in the combined regime calculation.

While history can teach us some lessons, however, there are always questions that are unique to their time and place. How, for instance, should a responsible investor respond to the Ukraine crisis and its repercussions?

This is a moment, after all, when on March 31, 2022, President Biden announced that his administration would release 1 million barrels of oil per day from the reserve for the next 180 days. The highly-esteemed energy economist Philip Verleger predicts an energy investment boom, believing that Putin’s actions are hastening the end of fossil fuels and accelerating their replacement by renewables, starting in Europe.

While these two actions might sound contradictory, both can be right. It is simply a question of your time horizon. A short-term increase in production of fossil fuels is likely to be required to detach Europe, and the wider world, from dependence on Russia. In the long-term, however, responsible investors have an opportunity: to invest in a world where Russia’s strength in oil, gas and coal no longer looks so meaningful. In this sense, responsible investing has never been so important, nor the opportunities greater.

In some ways, we have much to learn from what came before us. A period of high inflation is upon us, for reasons that have clear historical parallels. The commodities booms of yesteryear are likely to provide a safe harbour again today. But the crisis in Ukraine is also an opportunity to escape at least one of the shackles of our past: our dependence on fossil fuel producers. In this, at least, our future can be different.

You are now exiting our website

Please be aware that you are now exiting the Man Institute | Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Institute | Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Institute | Man Group related information or content of such sites and makes no warranties as to their content. Man Institute | Man Group assumes no liability for non Man Institute | Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Institute | Man Group.