AHL TargetRisk

- Targeting balanced risk within a multi-asset, long-only strategy

- Uses systematic techniques to actively manage risk exposures

- Invests in futures (equity indices and government bonds), inflation linked bonds, and swaps on indices (credit and commodities)

- Aims to deliver excess returns with a stable level of volatility, regardless of market conditions

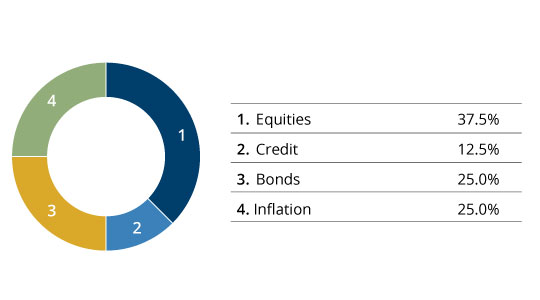

Risk allocation by asset class+

Approach

The AHL TargetRisk Programme follows a dynamic long-only approach seeking to achieve capital growth through exposure to futures (equity indices and government bonds), inflation-linked bonds, and swaps on indices (credit and commodities).

Investment exposure is diversified across asset classes and regions, targeting balanced risk allocations to instruments which tend to perform well at different times, and in different economic cycles.

The programme trades on a daily basis seeking to achieve its investment objective of maximising returns whilst controlling downside risks.

Systematic techniques, which are featured in other AHL products, are used to actively adapt risk exposures as appropriate for the market environment and to preserve capital during market sell-offs.

| Style | Multi-strategy systematic |

| Investment Approach | Balanced allocation |

| Volatility Target+ | 10% |

Performance

8.7%

1.8%

15.6%

10.8%

33.8%

111.1%

Performance by calendar years

14.1%

-16.7%

14.4%

5.7%

28.4%

-1.9%

Past performance is not indicative of future results. Returns may increase or decrease as a result of currency fluctuations.

Please note that the performance data is not intended to represent actual past or simulated past performance of an investment product. The data is calculated in USD and is based on a representative investment product or products that follow the programme. An example fee load of 0.75% has been applied.

Related content

Investment Solutions

Man offers a comprehensive suite of investment solutions and formats that can be tailored and optimised to meet specific client needs.

Our investment solutions offer optionality including: liquidity, control, investment restrictions, investor customisations and transparency.

Access to investment products and mandate solutions are subject applicable laws and regulations including selling restrictions and licensing requirements. Investment solutions listed above may not be compatible for all investment strategies and may be subject to minimum subscription requirements. Regional Funds: In additions to UCITS and AIFs registered across the EEA, a number of investment strategies are available in vehicles registered in Chile, Netherlands, Hong Kong, Japan, Singapore, South Korea and Switzerland.

Important Information

Considerations

One should carefully consider the risks associated with investing, whether the strategy suits your investment requirements and whether you have sufficient resources to bear any losses which may result from an investment:

Investment Objective Risk - There is no guarantee that the Strategy will achieve its investment objective.

Market Risk - The Strategy is subject to normal market fluctuations and the risks associated with investing in international securities markets and therefore the value of your investment and the income from it may rise as well as fall and you may not get back the amount originally invested.

Counterparty Risk - The Strategy will be exposed to credit risk on counterparties with which it trades in relation to on-exchange traded instruments such as futures and options and where applicable, ‘over-the- counter’("OTC","non-exchange") transactions. OTC instruments may also be less liquid and are not afforded the same protections that may apply to participants trading instruments on an organised exchange.

Currency Risk - The value of investments designated in another currency may rise and fall due to exchange rate fluctuations. Adverse movements in currency exchange rates may result in a decrease in return and a loss of capital. It may not be possible or practicable to successfully hedge against the currency risk exposure in all circumstances.

Liquidity Risk - The Strategy may make investments or hold trading positions in markets that are volatile and which may become illiquid. Timely and cost efficient sale of trading positions can be impaired by decreased trading volume and/or increased price volatility..

Financial Derivatives - The Strategy will invest financial derivative instruments ("FDI") (instruments whose prices are dependent on one or more underlying asset) to achieve its investment objective. The use of FDI involves additional risks such as high sensitivity to price movements of the asset on which it is based. The extensive use of FDI may significantly multiply the gains or losses.

Leverage - The Strategy's use of FDI may result in increased leverage which may lead to significant losses.

Model and Data Risk - The Investment Manager relies on quantitative trading models and data supplied by third parties. If models or data prove to be incorrect or incomplete, the Strategy may be exposed to potential losses. Models can be affected by unforeseen market disruptions and/or government or regulatory intervention, leading to potential losses.

You are now exiting our website

Please be aware that you are now exiting the Man Group website. Links to our social media pages are provided only as a reference and courtesy to our users. Man Group has no control over such pages, does not recommend or endorse any opinions or non-Man Group related information or content of such sites and makes no warranties as to their content. Man Group assumes no liability for non Man Group related information contained in social media pages. Please note that the social media sites may have different terms of use, privacy and/or security policy from Man Group.